Region:Europe

Author(s):Shubham

Product Code:KRAB4391

Pages:94

Published On:October 2025

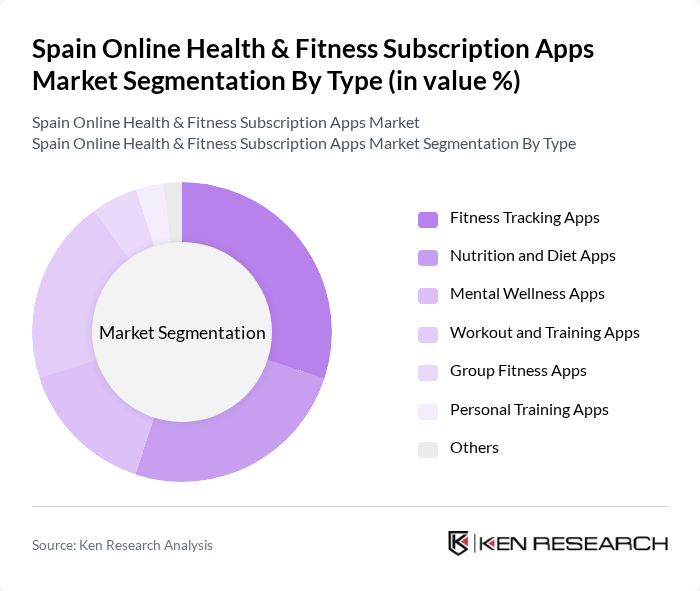

By Type:The market is segmented into various types of applications that cater to different aspects of health and fitness. The primary subsegments include Fitness Tracking Apps, Nutrition and Diet Apps, Mental Wellness Apps, Workout and Training Apps, Group Fitness Apps, Personal Training Apps, and Others. Each of these subsegments serves unique consumer needs, contributing to the overall market growth.

The Fitness Tracking Apps subsegment is currently dominating the market due to the increasing consumer focus on health metrics and performance tracking. These apps provide users with real-time data on their physical activities, which enhances user engagement and motivation. The trend towards personalized fitness experiences and the integration of social features further bolster the popularity of fitness tracking applications, making them a preferred choice among users.

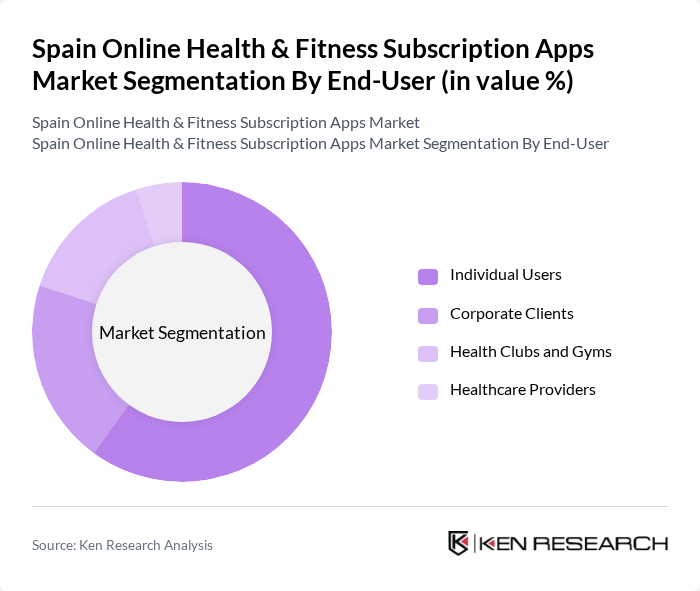

By End-User:The market is segmented based on the end-users of the applications, which include Individual Users, Corporate Clients, Health Clubs and Gyms, and Healthcare Providers. Each segment has distinct requirements and preferences, influencing the types of apps that are developed and marketed.

Individual Users represent the largest segment in the market, driven by the growing trend of personal health management and fitness awareness. The convenience of accessing fitness resources and tracking health metrics through mobile applications appeals to a wide demographic, making this segment a key driver of market growth. Corporate Clients are also increasingly adopting these apps to promote employee wellness programs, further expanding the user base.

The Spain Online Health & Fitness Subscription Apps Market is characterized by a dynamic mix of regional and international players. Leading participants such as MyFitnessPal, Fitbit, Strava, Noom, Headspace, Calm, Peloton, Freeletics, Nike Training Club, 8fit, JEFIT, Sworkit, Aaptiv, Fitbod, Gymshark contribute to innovation, geographic expansion, and service delivery in this space.

The future of the online health and fitness subscription apps market in Spain appears promising, driven by technological advancements and evolving consumer preferences. As more individuals seek personalized health solutions, the integration of artificial intelligence and machine learning into fitness apps is expected to enhance user experience significantly. Additionally, the focus on mental health and wellness will likely lead to the development of comprehensive platforms that address both physical and psychological well-being, further expanding the market's reach and appeal.

| Segment | Sub-Segments |

|---|---|

| By Type | Fitness Tracking Apps Nutrition and Diet Apps Mental Wellness Apps Workout and Training Apps Group Fitness Apps Personal Training Apps Others |

| By End-User | Individual Users Corporate Clients Health Clubs and Gyms Healthcare Providers |

| By Subscription Model | Monthly Subscription Annual Subscription Freemium Model Pay-Per-Use |

| By User Demographics | Age Group (18-24) Age Group (25-34) Age Group (35-44) Age Group (45+) |

| By Device Type | Mobile Apps Web-Based Platforms Wearable Devices |

| By Payment Method | Credit/Debit Cards Mobile Wallets Direct Bank Transfers |

| By Geographic Reach | National Regional Local Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Current Users of Fitness Apps | 150 | Fitness Enthusiasts, Regular App Users |

| Potential Users of Health Apps | 100 | Individuals Interested in Fitness, Non-Users |

| Fitness Trainers and Coaches | 80 | Personal Trainers, Group Fitness Instructors |

| Health and Wellness Influencers | 60 | Social Media Influencers, Bloggers |

| Health Professionals | 70 | Nutritionists, Dietitians, Health Coaches |

The Spain Online Health & Fitness Subscription Apps Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by increased health consciousness, digital health solutions, and the widespread use of smartphones and wearable devices.