Spain Used Vehicle and Finance Market Overview

- The Spain Used Vehicle and Finance Market is valued at approximately EUR 45 billion, based on a five-year historical analysis. This growth is primarily driven by increasing consumer demand for affordable transportation options, the rising cost of new vehicles, and the expansion of digital marketplaces that streamline the purchasing process. Advancements in vehicle technology and stricter emission regulations have also increased the supply of well-maintained used cars, further fueling market activity.

- Key cities such as Madrid and Barcelona dominate the market due to their large populations, urbanization, and robust infrastructure, which create high demand for personal vehicles. These cities also benefit from a wide variety of financing options and the presence of established dealerships and online platforms, making it easier for consumers to purchase used vehicles.

- In 2023, the Spanish government implemented the "Plan Moves III," which includes incentives for the purchase of electric and hybrid vehicles, promoting the transition to greener transportation. The Plan Moves III, issued by the Ministry for Ecological Transition and the Demographic Challenge, provides direct subsidies for both new and used electric vehicles, subject to compliance with vehicle age and emission standards. This initiative aims to encourage consumers to opt for used electric vehicles, thereby enhancing the sustainability of the automotive sector.

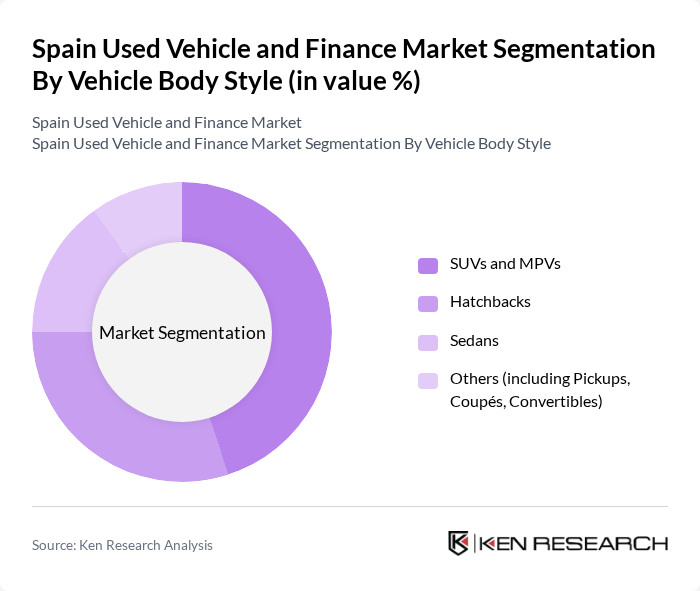

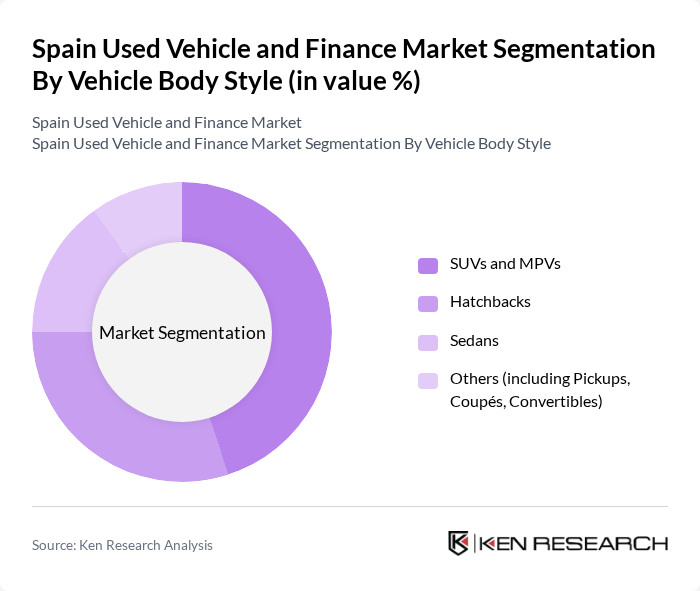

Spain Used Vehicle and Finance Market Segmentation

By Vehicle Body Style:The vehicle body style segmentation includes various categories such as hatchbacks, sedans, SUVs and MPVs, and others, which encompass pickups, coupés, and convertibles. SUVs and MPVs currently dominate the market, driven by consumer preference for versatility, larger capacity, and suitability for family and leisure activities. Hatchbacks remain popular for their compact size and fuel efficiency, ideal for urban driving, while sedans appeal to families and professionals seeking comfort and space. The "Others" category caters to niche markets.

By Vendor Type:The vendor type segmentation is divided into organized and unorganized sectors. The organized sector, comprising established dealerships and online platforms, dominates the market due to reliability, customer service, extensive inventory, and the growing adoption of digital sales channels. Unorganized vendors, including private sellers, cater to budget-conscious consumers seeking lower prices. The organized sector's emphasis on quality assurance, certified pre-owned programs, and financing options continues to drive market leadership.

Spain Used Vehicle and Finance Market Competitive Landscape

The Spain Used Vehicle and Finance Market is characterized by a dynamic mix of regional and international players. Leading participants such as OcasionPlus, AutoScout24, Coches.net, Flexicar, CarNext, Clicars, ALD Automotive, Arval, BBVA Autorenting, Santander Consumer Finance, Volkswagen Financial Services, Renault Selection, Peugeot Ocasión, Kia Ocasión, Toyota Ocasión contribute to innovation, geographic expansion, and service delivery in this space.

Spain Used Vehicle and Finance Market Industry Analysis

Growth Drivers

- Increasing Demand for Affordable Transportation:The demand for affordable transportation in Spain is driven by a significant portion of the population, with over30% of households earning less than €27,000 annually. This economic reality pushes consumers towards used vehicles, which are typically priced between€11,000 and €16,000. Additionally, the average cost of new vehicles in Spain has risen to approximately€32,000, making used options more appealing. The affordability factor is crucial as it aligns with the financial capabilities of many consumers.

- Rise in Urbanization and Population Mobility:Spain's urban population is projected to reach83%in future. This urbanization trend increases the need for personal transportation solutions, particularly in metropolitan areas like Madrid and Barcelona. As public transport systems face capacity issues, the demand for used vehicles is expected to rise, with urban dwellers seeking convenient and flexible mobility options. This shift is further supported by a growing population, which is anticipated to exceed47 millionin future.

- Expansion of Online Vehicle Marketplaces:The online vehicle marketplace in Spain has seen a remarkable growth, with platforms like AutoScout24 and Coches.net reportingover 5 million monthly visitors. This digital shift facilitates easier access to used vehicles, allowing consumers to compare prices and features from the comfort of their homes. The convenience of online shopping is further enhanced by the increasing smartphone penetration, which reachedapproximately 90%, making it easier for consumers to engage in vehicle purchases online.

Market Challenges

- Economic Fluctuations Affecting Consumer Spending:Economic instability in Spain, characterized by a GDP growth rate ofapproximately 2.5%in future, poses a significant challenge for the used vehicle market. Fluctuations in consumer confidence, driven by inflation rates projected to hover around3.5%, can lead to reduced discretionary spending. As consumers tighten their budgets, the demand for used vehicles may decline, impacting sales and financing options available in the market.

- Regulatory Changes Impacting Vehicle Sales:The Spanish government is implementing stricter regulations on emissions, with new standards set to take effect in future. These regulations may limit the sale of older used vehicles that do not meet the new criteria, potentially reducing the available inventory. Additionally, changes in tax policies, such as increased taxes on older vehicles, could deter consumers from purchasing used cars, further complicating the market landscape.

Spain Used Vehicle and Finance Market Future Outlook

The future of the used vehicle market in Spain appears promising, driven by evolving consumer preferences and technological advancements. The increasing shift towards online purchasing and digital financing solutions is expected to enhance accessibility for consumers. Additionally, the growing interest in sustainable transportation options, including electric and hybrid vehicles, will likely shape market dynamics. As the regulatory environment stabilizes, opportunities for certified pre-owned programs may emerge, providing consumers with more reliable options while boosting market confidence.

Market Opportunities

- Expansion of Electric and Hybrid Used Vehicles:The demand for electric and hybrid used vehicles is on the rise, with sales expected to increase byapproximately 15% in future. This trend is driven by government incentives and a growing consumer preference for environmentally friendly options. As more electric vehicles enter the used market, consumers will have access to affordable, sustainable transportation solutions, enhancing market growth.

- Growth in Digital Financing Solutions:The digital financing landscape is evolving, with online platforms offering tailored financing options for used vehicles. In future, it is projected thatover 35% of used vehicle purchases will be financed digitally. This shift not only simplifies the financing process but also attracts a younger demographic, increasing overall market participation and driving sales growth in the used vehicle sector.