Region:Asia

Author(s):Dev

Product Code:KRAB0482

Pages:82

Published On:August 2025

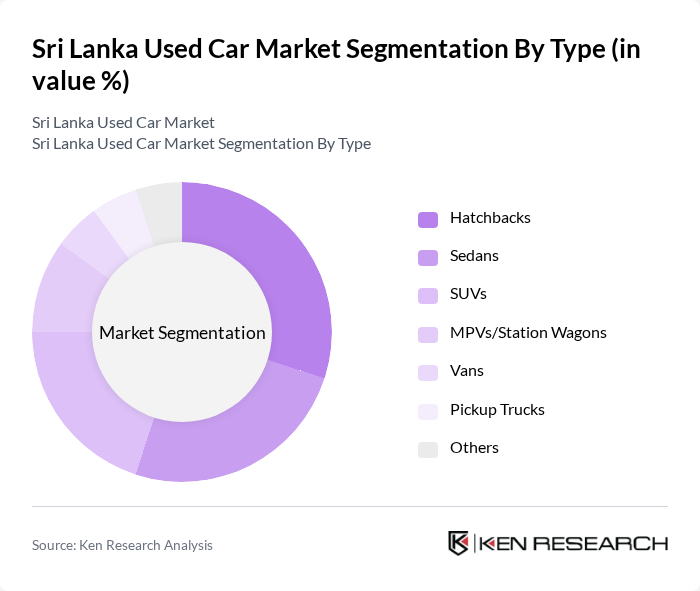

By Type:The used car market in Sri Lanka is segmented into various types, including hatchbacks, sedans, SUVs, MPVs/station wagons, vans, pickup trucks, and others. Among these, hatchbacks and SUVs are particularly popular due to their compact size and versatility, making them suitable for urban driving conditions. The demand for sedans remains steady, while MPVs and vans cater to larger families and commercial needs. The market is characterized by a diverse range of vehicle types, catering to different consumer preferences and requirements.

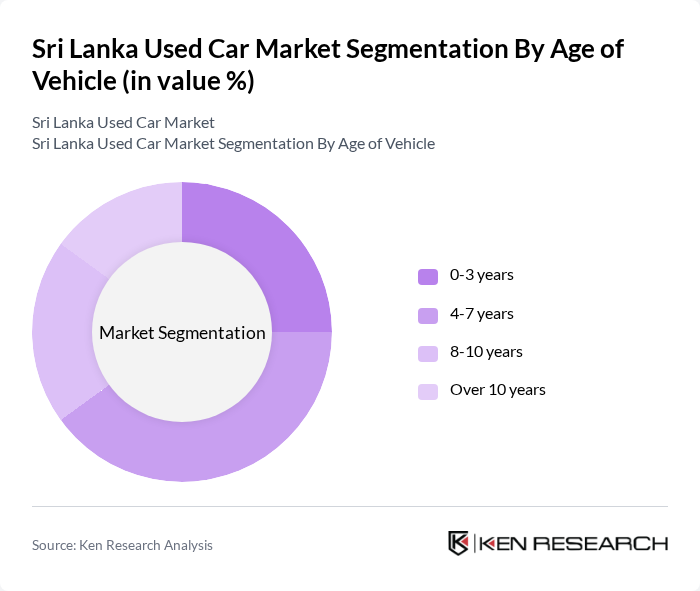

By Age of Vehicle:The segmentation by age of vehicle includes categories such as 0-3 years, 4-7 years, 8-10 years, and over 10 years. The market is predominantly driven by vehicles aged 4-7 years, as they strike a balance between affordability and reliability. Vehicles aged 0-3 years are also gaining traction among buyers looking for newer models at lower prices. The older segments (8-10 years and over 10 years) cater to budget-conscious consumers seeking economical options.

The Sri Lanka Used Car Market is characterized by a dynamic mix of regional and international players. Leading participants such as Toyota Lanka (Pvt) Ltd, United Motors Lanka PLC (Authorized Mitsubishi), Indra Traders (Pvt) Ltd, Associated Motorways (Private) Limited – AMW (Nissan, Suzuki), DIMO PLC (Mercedes-Benz, Jeep; multi-brand used), Ideal Motors (Pvt) Ltd (Mahindra), Stafford Motor Co. (Pvt) Ltd (Honda), Micro Cars Ltd / Micro Holdings (SsangYong; used/resale), CarMart (Pvt) Ltd (Porsche; prestige used), Kia Motors Lanka (Pvt) Ltd, Senok Trade Combine (Pvt) Ltd (Audi), Softlogic Automobiles (Pvt) Ltd (Ford, Daihatsu; used), Carmudi Sri Lanka (Online Marketplace), Riyasewana (Online Marketplace), ikman.lk Motors (Online Marketplace) contribute to innovation, geographic expansion, and service delivery in this space.

The Sri Lanka used car market is poised for transformation as digital transactions become increasingly prevalent, with online sales platforms expected to grow by 20% in future. Additionally, the rising interest in certified pre-owned vehicles is likely to enhance consumer trust and drive sales. As the market adapts to these trends, the focus on sustainability will also shape consumer preferences, leading to a more environmentally conscious approach to vehicle ownership and usage.

| Segment | Sub-Segments |

|---|---|

| By Type | Hatchbacks Sedans SUVs MPVs/Station Wagons Vans Pickup Trucks Others |

| By Age of Vehicle | 3 years 7 years 10 years Over 10 years |

| By Price Range | Below LKR 3 million LKR 3 million - LKR 6 million LKR 6 million - LKR 10 million Above LKR 10 million |

| By Fuel Type | Petrol Diesel Hybrid Electric |

| By Sales Channel | Unorganized (Private Sales/Independent Dealers) Organized Dealerships Online Platforms/Marketplaces Auctions |

| By Geographic Distribution | Western Province (incl. Colombo, Gampaha, Kalutara) Central Province Southern Province Northern Province Eastern Province |

| By Condition | Certified Pre-Owned Non-Certified Reconditioned Imports Accident-Repaired |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Used Car Dealerships | 80 | Dealership Owners, Sales Managers |

| Recent Used Car Buyers | 150 | Consumers aged 25-45, First-time Buyers |

| Automotive Industry Experts | 40 | Market Analysts, Automotive Consultants |

| Financial Institutions | 60 | Loan Officers, Credit Analysts |

| Government Regulatory Bodies | 40 | Policy Makers, Regulatory Officials |

The Sri Lanka used car market is valued at approximately LKR 75 billion, driven by increasing consumer demand for affordable transportation options and a growing middle class with rising disposable incomes.