Region:Europe

Author(s):Shubham

Product Code:KRAB0567

Pages:82

Published On:August 2025

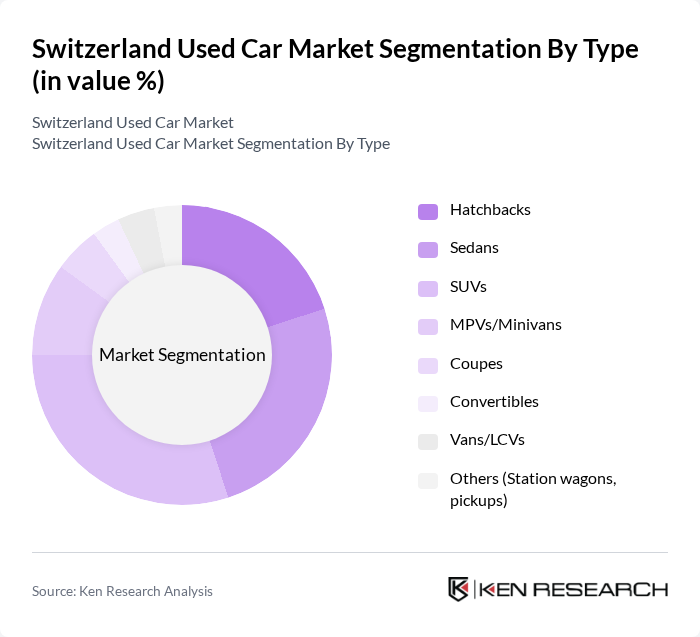

By Type:The used car market in Switzerland is segmented into various types, including hatchbacks, sedans, SUVs, MPVs/minivans, coupes, convertibles, vans/LCVs, and others such as station wagons and pickups. Among these, SUVs have gained significant popularity due to their versatility and spaciousness, appealing to families and outdoor enthusiasts. Hatchbacks and sedans also maintain a strong presence, favored for their fuel efficiency and compact size, making them ideal for urban driving.

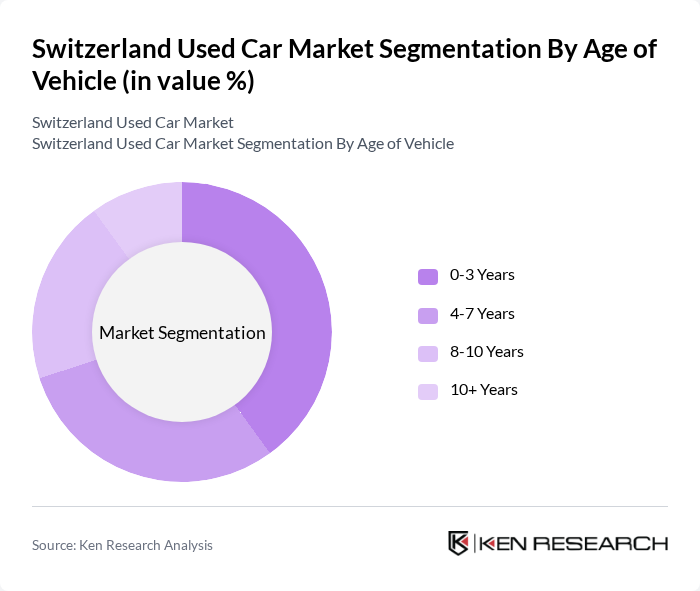

By Age of Vehicle:The age of vehicles in the used car market is categorized into four segments: 0-3 years, 4-7 years, 8-10 years, and 10+ years. The 0-3 years segment is particularly dominant, as consumers are increasingly inclined towards newer models that offer advanced technology and better fuel efficiency. Vehicles aged 4-7 years also see considerable demand, as they provide a balance between affordability and modern features.

The Switzerland Used Car Market is characterized by a dynamic mix of regional and international players. Leading participants such as AMAG Group AG (AMAG Automobil- und Motoren AG), Emil Frey Group (Emil Frey AG), AutoScout24 Schweiz AG, Car For You AG, Carvolution AG, autoricardo.ch (Ricardo AG), Leasingmarkt.ch AG, CarTrader AG (carforyou/carforyou.ch marketplace), Mobile.de Schweiz (cross-border platform activity), Gowago AG, ALD Automotive | LeasePlan (LeasePlan Schweiz AG), Sixt Car Sales Switzerland (Sixt Schweiz), Hertz Car Sales Switzerland (Hertz Autoverkauf), Toyota Occasion Plus (Toyota AG Switzerland CPO), BMW Premium Selection (BMW (Schweiz) AG CPO) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Swiss used car market appears promising, driven by evolving consumer preferences and technological advancements. As the demand for electric and hybrid vehicles continues to rise, the market is likely to see an increase in the availability of certified pre-owned options. Additionally, the integration of advanced technologies in vehicles will enhance consumer interest, making used cars more appealing. Overall, the market is expected to adapt to these trends, fostering growth and innovation in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Hatchbacks Sedans SUVs MPVs/Minivans Coupes Convertibles Vans/LCVs Others (Station wagons, pickups) |

| By Age of Vehicle | 3 Years 7 Years 10 Years + Years |

| By Fuel Type | Petrol Diesel Hybrid (HEV/PHEV) Electric (BEV) Others (CNG/LPG) |

| By Price Range | Under CHF 10,000 CHF 10,000 - CHF 20,000 CHF 20,000 - CHF 30,000 Over CHF 30,000 |

| By Sales Channel | Franchised dealerships (OEM-backed CPO) Independent dealers Online platforms/marketplaces Private sales Auctions/wholesale |

| By Condition | Certified Pre-Owned Non-Certified |

| By Region | Zurich Geneva Basel Bern Vaud (Lausanne) Aargau Ticino Others (Rest of Switzerland) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Used Car Dealerships | 120 | Dealership Owners, Sales Managers |

| Recent Used Car Buyers | 150 | Consumers aged 25-55, First-time Buyers |

| Automotive Financing Institutions | 90 | Loan Officers, Financial Analysts |

| Automotive Industry Experts | 60 | Market Analysts, Economic Advisors |

| Consumer Behavior Analysts | 50 | Research Analysts, Marketing Professionals |

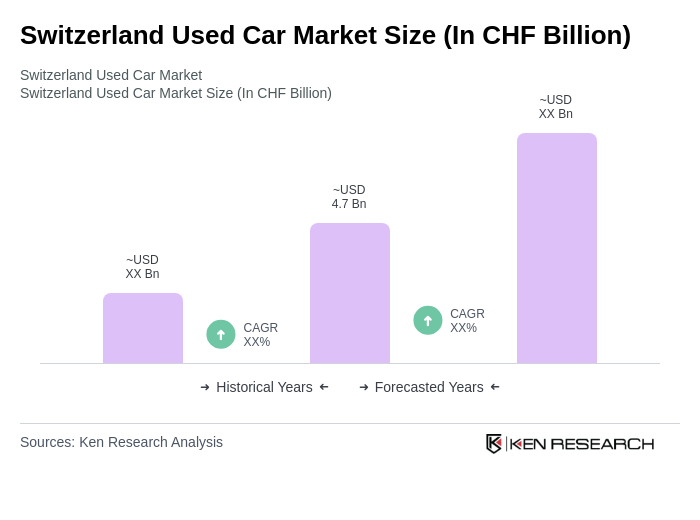

The Switzerland used car market is valued at CHF 4.7 billion, reflecting a steady growth driven by increasing consumer demand for affordable transportation and a trend towards sustainability, particularly in certified pre-owned vehicles.