Region:Asia

Author(s):Shubham

Product Code:KRAA4710

Pages:82

Published On:September 2025

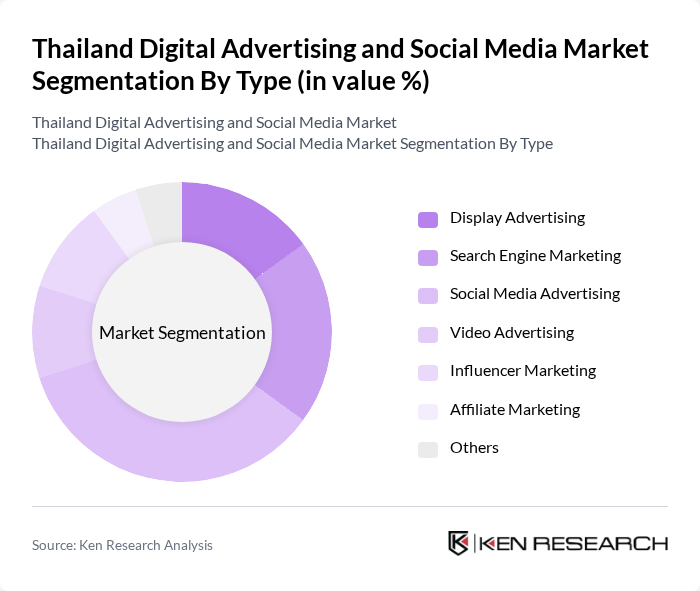

By Type:The market is segmented into various types, including Display Advertising, Search Engine Marketing, Social Media Advertising, Video Advertising, Influencer Marketing, Affiliate Marketing, and Others. Among these, Social Media Advertising has emerged as the dominant segment, driven by the widespread use of platforms like Facebook and Instagram. Brands are increasingly leveraging these channels to engage with consumers directly, resulting in higher conversion rates and brand loyalty.

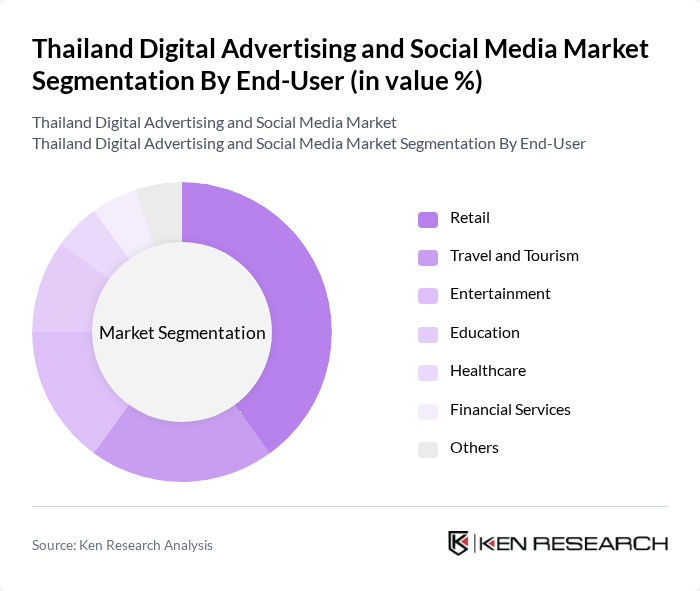

By End-User:The end-user segmentation includes Retail, Travel and Tourism, Entertainment, Education, Healthcare, Financial Services, and Others. The Retail sector is the leading segment, as businesses increasingly adopt digital marketing strategies to reach consumers directly. The rise of e-commerce and online shopping has further accelerated this trend, making retail a key driver of growth in the digital advertising landscape.

The Thailand Digital Advertising and Social Media Market is characterized by a dynamic mix of regional and international players. Leading participants such as Google Thailand, Facebook Thailand, LINE Corporation, Twitter Thailand, TikTok Thailand, Grab Thailand, Agoda, Lazada Thailand, Central Group, True Corporation, AIS, CP Group, Kasikorn Bank, Bangkok Bank, Thai Airways contribute to innovation, geographic expansion, and service delivery in this space.

The future of Thailand's digital advertising and social media market appears promising, driven by technological advancements and evolving consumer behaviors. As brands increasingly adopt artificial intelligence for personalized marketing, the demand for innovative advertising solutions will rise. Additionally, the integration of augmented reality in campaigns is expected to enhance user engagement. With a focus on sustainability and ethical advertising practices, companies will need to adapt to changing consumer expectations while leveraging emerging technologies to maintain competitive advantages.

| Segment | Sub-Segments |

|---|---|

| By Type | Display Advertising Search Engine Marketing Social Media Advertising Video Advertising Influencer Marketing Affiliate Marketing Others |

| By End-User | Retail Travel and Tourism Entertainment Education Healthcare Financial Services Others |

| By Platform | YouTube TikTok Others |

| By Campaign Type | Brand Awareness Campaigns Lead Generation Campaigns Engagement Campaigns Conversion Campaigns Retargeting Campaigns Others |

| By Content Format | Text Ads Image Ads Video Ads Carousel Ads Stories Ads Others |

| By Budget Size | Small Budget Medium Budget Large Budget Others |

| By Geographic Focus | Urban Areas Rural Areas National Campaigns Regional Campaigns Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Digital Advertising Agencies | 100 | Agency Owners, Account Managers |

| Social Media Marketing | 80 | Social Media Strategists, Content Creators |

| Consumer Engagement Insights | 120 | Marketing Analysts, Brand Managers |

| Advertising Technology Providers | 70 | Product Managers, Sales Directors |

| Market Research Firms | 60 | Research Analysts, Data Scientists |

The Thailand Digital Advertising and Social Media Market is valued at approximately USD 1.5 billion, reflecting significant growth driven by increased smartphone penetration, internet connectivity, and a shift in consumer behavior towards online platforms for shopping and information.