Region:Asia

Author(s):Geetanshi

Product Code:KRAA8006

Pages:98

Published On:September 2025

By Type:The digital advertising landscape in South Korea is diverse, encompassing various types of advertising strategies. Display advertising, search engine marketing, and social media advertising are among the most prominent types. Display advertising is favored for its visual appeal, while search engine marketing is crucial for driving traffic. Social media advertising has gained immense popularity due to the high engagement rates on platforms like Facebook and Instagram. Video advertising is also on the rise, capitalizing on the growing consumption of video content. Native advertising and affiliate marketing are increasingly being utilized to blend promotional content seamlessly with user experiences.

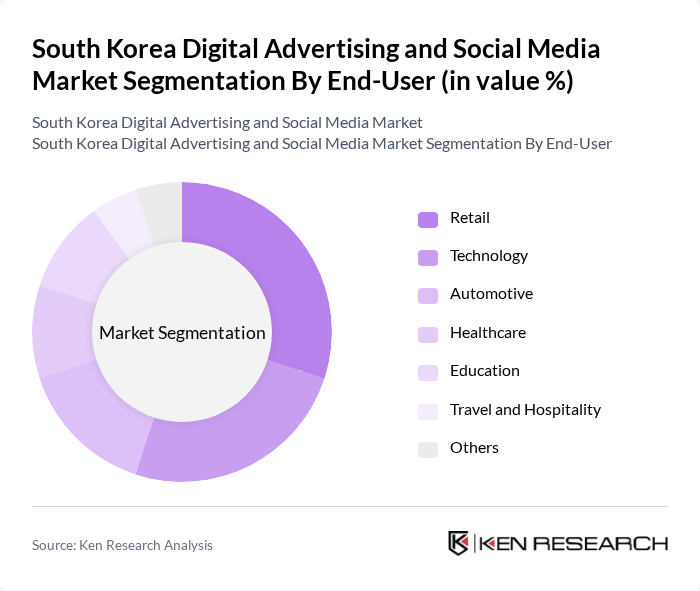

By End-User:The end-user segmentation in the South Korea Digital Advertising and Social Media Market reveals a variety of industries leveraging digital advertising. Retail is a significant contributor, driven by the e-commerce boom. The technology sector follows closely, utilizing digital platforms to promote innovative products. Automotive and healthcare industries are also increasingly investing in digital marketing to reach consumers effectively. Education and travel sectors are adapting to digital trends, while other industries are gradually recognizing the importance of online presence for brand visibility.

The South Korea Digital Advertising and Social Media Market is characterized by a dynamic mix of regional and international players. Leading participants such as Samsung Ads, Naver Corporation, Kakao Corp, SK Telecom, LG Uplus, Daum Communications, CJ ENM, LINE Corporation, Google Korea, Facebook Korea, YouTube Korea, TikTok Korea, Adfitter, Dable, TMON contribute to innovation, geographic expansion, and service delivery in this space.

The South Korean digital advertising and social media market is poised for significant evolution, driven by technological advancements and changing consumer behaviors. As mobile and e-commerce continue to grow, brands will increasingly adopt innovative advertising strategies, including personalized content and AI-driven analytics. The rise of social commerce will further integrate shopping experiences within social media platforms, enhancing consumer engagement. Companies that adapt to these trends and prioritize compliance with evolving regulations will likely thrive in this dynamic landscape, ensuring sustainable growth and competitive advantage.

| Segment | Sub-Segments |

|---|---|

| By Type | Display Advertising Search Engine Marketing Social Media Advertising Video Advertising Native Advertising Affiliate Marketing Others |

| By End-User | Retail Technology Automotive Healthcare Education Travel and Hospitality Others |

| By Platform | YouTube KakaoTalk Naver TikTok Others |

| By Campaign Type | Brand Awareness Campaigns Lead Generation Campaigns Engagement Campaigns Conversion Campaigns Retargeting Campaigns Others |

| By Content Type | Text Ads Image Ads Video Ads Interactive Ads Sponsored Content Others |

| By Budget Size | Small Budget Medium Budget Large Budget Enterprise Budget Others |

| By Geographic Focus | Urban Areas Suburban Areas Rural Areas National Campaigns Regional Campaigns Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Digital Advertising Agencies | 100 | Marketing Directors, Account Managers |

| Social Media Platforms | 80 | Product Managers, Advertising Sales Executives |

| Consumer Insights on Social Media | 150 | Social Media Users, Brand Engagement Specialists |

| Retail Sector Digital Marketing | 90 | Digital Marketing Managers, E-commerce Directors |

| Technology Sector Advertising Strategies | 70 | Chief Marketing Officers, Digital Strategy Leads |

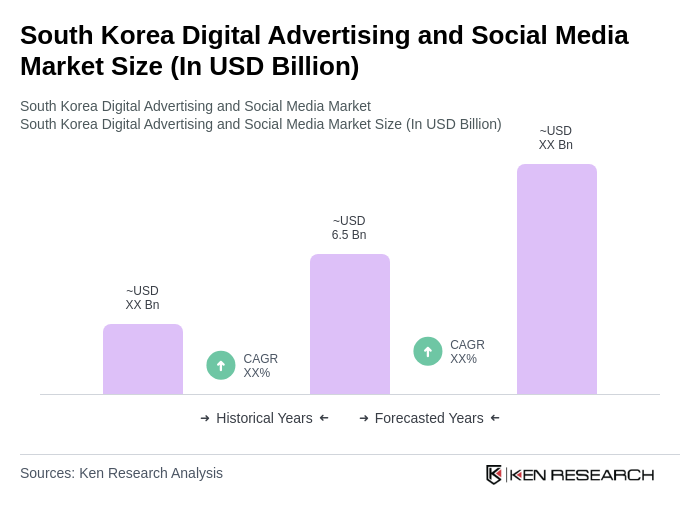

The South Korea Digital Advertising and Social Media Market is valued at approximately USD 6.5 billion, reflecting significant growth driven by smartphone penetration, social media usage, and the rise of e-commerce, prompting businesses to invest in digital marketing strategies.