Region:Asia

Author(s):Rebecca

Product Code:KRAB2973

Pages:100

Published On:October 2025

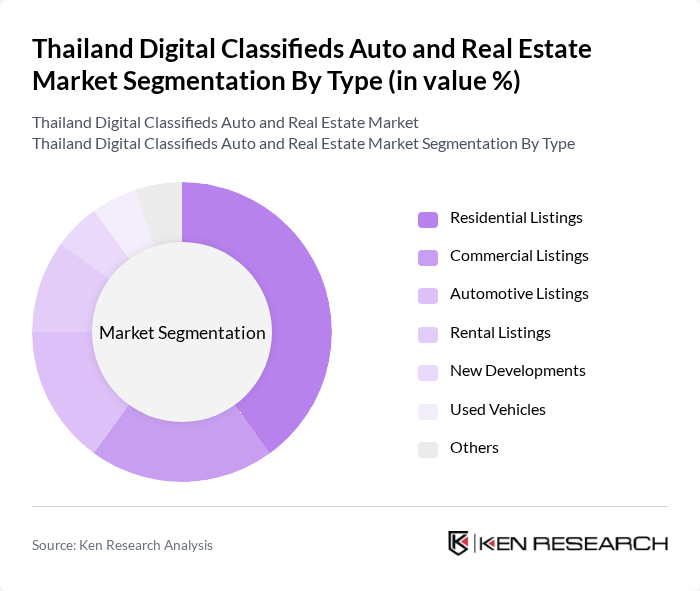

By Type:The market is segmented into various types, including Residential Listings, Commercial Listings, Automotive Listings, Rental Listings, New Developments, Used Vehicles, and Others. Among these, Residential Listings dominate the market due to the increasing demand for housing solutions, driven by urban migration and changing lifestyle preferences. The trend towards online property searches has further solidified the position of residential listings as the leading segment.

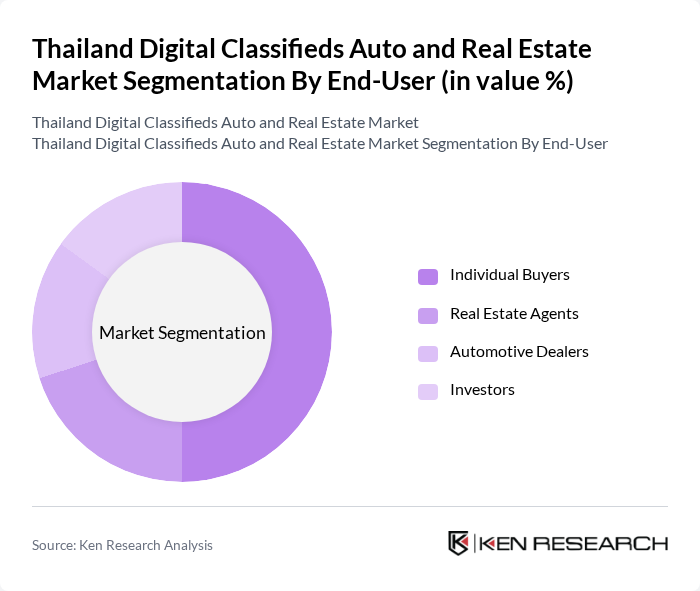

By End-User:The end-user segmentation includes Individual Buyers, Real Estate Agents, Automotive Dealers, and Investors. Individual Buyers represent the largest segment, driven by the increasing number of first-time homebuyers and car owners seeking convenient online platforms for their purchases. The growing trend of digital engagement among consumers has made it easier for individual buyers to access listings and make informed decisions.

The Thailand Digital Classifieds Auto and Real Estate Market is characterized by a dynamic mix of regional and international players. Leading participants such as PropertyGuru, Hipflat, Kaidee, Thai Property, 99.co, RentHub, One2car, Baania, Trovit, Chao Phraya, Dot Property, Ananda Development, Sansiri, AP Thailand, LPN Development contribute to innovation, geographic expansion, and service delivery in this space.

The Thailand digital classifieds market is poised for significant transformation, driven by technological advancements and evolving consumer preferences. The integration of artificial intelligence in listings will enhance personalization, improving user experiences. Additionally, the growth of virtual tours is expected to revolutionize property viewing, making it more accessible. As urbanization continues and mobile commerce expands, the market will likely see increased engagement, paving the way for innovative solutions that cater to the needs of modern consumers.

| Segment | Sub-Segments |

|---|---|

| By Type | Residential Listings Commercial Listings Automotive Listings Rental Listings New Developments Used Vehicles Others |

| By End-User | Individual Buyers Real Estate Agents Automotive Dealers Investors |

| By Sales Channel | Online Platforms Mobile Applications Social Media Offline Listings |

| By Price Range | Budget Listings Mid-Range Listings Luxury Listings |

| By Geographic Location | Bangkok Chiang Mai Phuket Pattaya |

| By User Demographics | Millennials Gen X Baby Boomers |

| By Market Segment | First-Time Buyers Repeat Buyers Investors Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Auto Classifieds Users | 150 | Car Buyers, Sellers, and Dealers |

| Real Estate Listings Users | 120 | Home Buyers, Real Estate Agents, Property Managers |

| Digital Platform Operators | 80 | Product Managers, Marketing Directors |

| Industry Experts | 50 | Market Analysts, Economic Advisors |

| Advertising Agencies | 70 | Digital Marketing Specialists, Media Buyers |

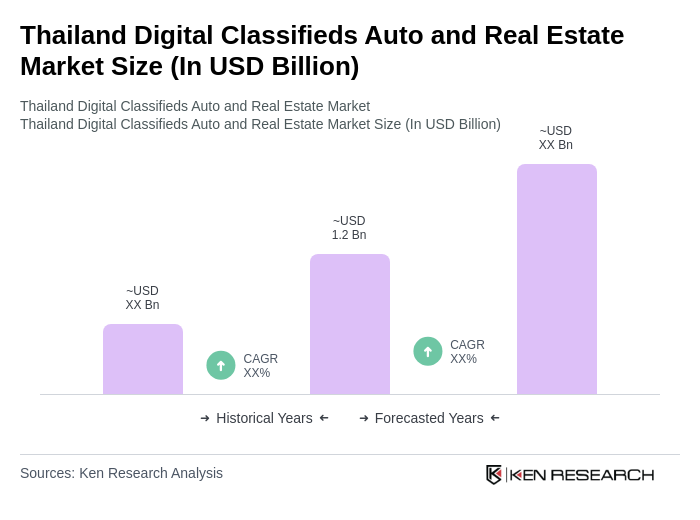

The Thailand Digital Classifieds Auto and Real Estate Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by increased internet penetration, mobile device usage, and a shift towards online platforms for buying and selling properties and vehicles.