Region:Asia

Author(s):Dev

Product Code:KRAB3129

Pages:96

Published On:October 2025

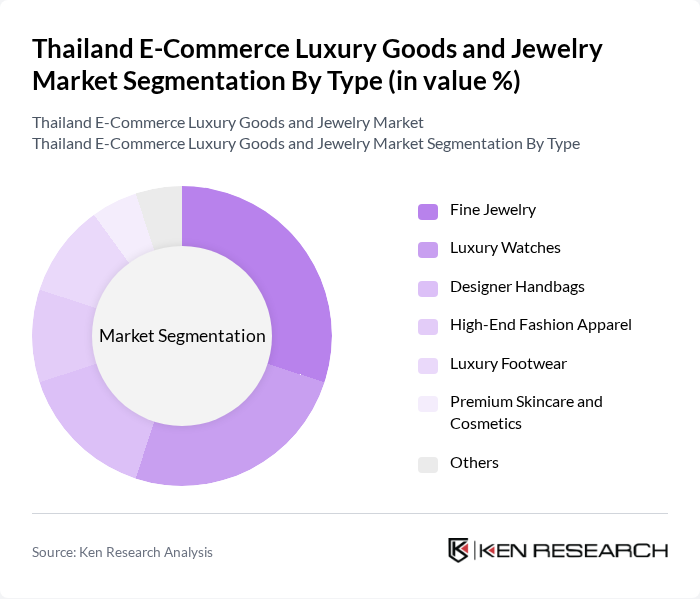

By Type:The market is segmented into various types of luxury goods, including Fine Jewelry, Luxury Watches, Designer Handbags, High-End Fashion Apparel, Luxury Footwear, Premium Skincare and Cosmetics, and Others. Among these, Fine Jewelry is currently the leading sub-segment, driven by a growing preference for personalized and unique pieces among consumers. The demand for luxury watches is also significant, as they are often seen as status symbols. The increasing trend of gifting luxury items for special occasions further boosts the market.

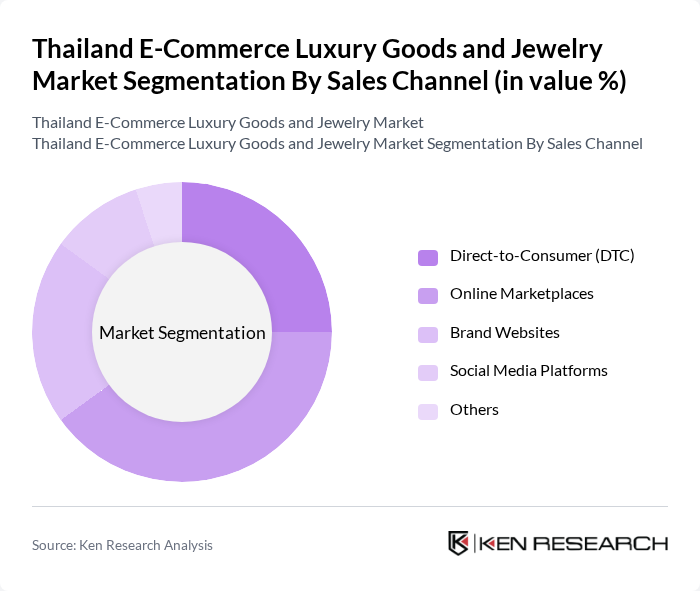

By Sales Channel:The market is also segmented by sales channels, including Direct-to-Consumer (DTC), Online Marketplaces, Brand Websites, Social Media Platforms, and Others. The Online Marketplaces segment is currently the most dominant, as consumers increasingly prefer the convenience and variety offered by platforms like Lazada and Shopee. DTC sales are also growing, as brands seek to establish a direct relationship with consumers, enhancing brand loyalty and customer experience.

The Thailand E-Commerce Luxury Goods and Jewelry Market is characterized by a dynamic mix of regional and international players. Leading participants such as Central Group, Siam Piwat, The Mall Group, King Power International, Luxasia, TGF Group, Jaspal Group, Pandora Jewelry, Swarovski, Chopard, Cartier, Louis Vuitton, Gucci, Tiffany & Co., Hermès contribute to innovation, geographic expansion, and service delivery in this space.

The Thailand e-commerce luxury goods market is poised for significant transformation, driven by technological advancements and changing consumer preferences. As personalization becomes a key focus, brands are expected to leverage data analytics to enhance customer experiences. Additionally, the integration of augmented reality (AR) and virtual reality (VR) technologies will revolutionize online shopping, allowing consumers to engage with products in innovative ways. This evolution will likely attract a younger demographic, further expanding the market's reach and potential.

| Segment | Sub-Segments |

|---|---|

| By Type | Fine Jewelry Luxury Watches Designer Handbags High-End Fashion Apparel Luxury Footwear Premium Skincare and Cosmetics Others |

| By Sales Channel | Direct-to-Consumer (DTC) Online Marketplaces Brand Websites Social Media Platforms Others |

| By Price Range | Under 5,000 THB ,000 - 20,000 THB ,000 - 50,000 THB Above 50,000 THB |

| By Consumer Demographics | Age Group (18-24, 25-34, 35-44, 45+) Gender Income Level Urban vs Rural |

| By Occasion | Weddings Anniversaries Birthdays Corporate Gifts Others |

| By Brand Loyalty | Brand Loyal Customers Brand Switchers First-Time Buyers |

| By Product Origin | Domestic Brands International Brands Artisan and Handcrafted Goods Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Jewelry Purchasers | 150 | Affluent Consumers, Jewelry Enthusiasts |

| High-End Fashion Retailers | 100 | Store Managers, Brand Representatives |

| E-commerce Platform Operators | 80 | Product Managers, Marketing Directors |

| Luxury Goods Market Analysts | 60 | Market Researchers, Industry Consultants |

| Jewelry Designers and Artisans | 70 | Independent Designers, Craftsmanship Experts |

The Thailand E-Commerce Luxury Goods and Jewelry Market is valued at approximately USD 3.5 billion, reflecting significant growth driven by rising disposable incomes and a shift towards online shopping, particularly among younger consumers.