Thailand Nutritional Supplements and Wellness Products Market Overview

- The Thailand Nutritional Supplements and Wellness Products Market is valued at USD 1.5 billion, based on a five-year historical analysis. This growth is primarily driven by increasing health consciousness among consumers, a rise in disposable incomes, and a growing aging population that seeks preventive healthcare solutions. The market has seen a significant uptick in demand for products that promote overall wellness and specific health benefits.

- Bangkok, as the capital city, dominates the market due to its large population and urban lifestyle, which fosters a higher demand for nutritional supplements. Other key regions include Chiang Mai and Phuket, where tourism and health trends contribute to the market's growth. The increasing availability of wellness products in urban centers further enhances consumer access and awareness.

- In 2023, the Thai government implemented regulations requiring all nutritional supplements to undergo rigorous safety and efficacy testing before market entry. This initiative aims to ensure consumer safety and enhance product quality, thereby fostering trust in the nutritional supplements sector and promoting responsible consumption among the population.

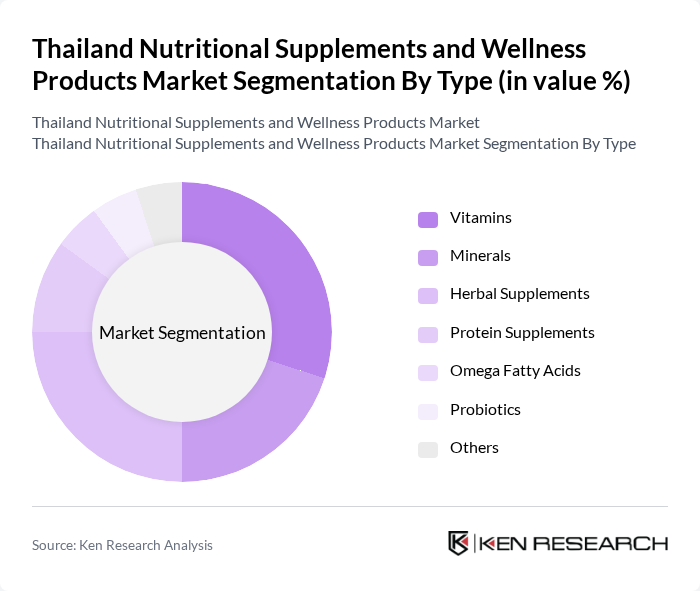

Thailand Nutritional Supplements and Wellness Products Market Segmentation

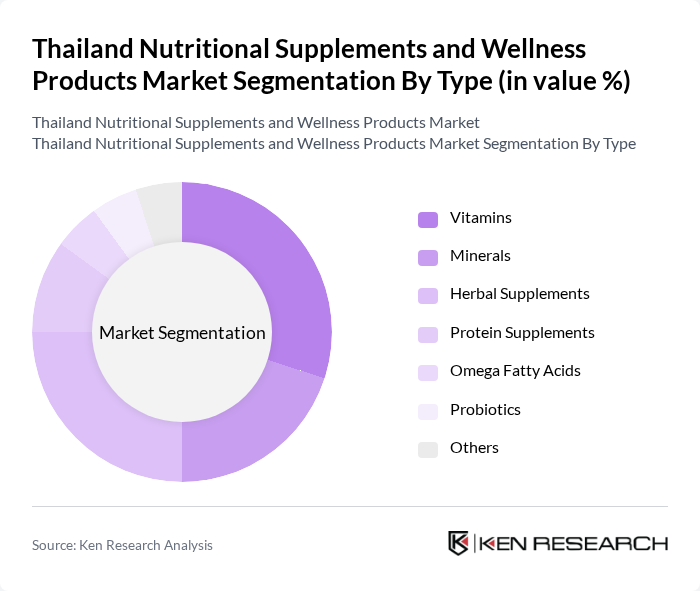

By Type:The market is segmented into various types of nutritional supplements, including vitamins, minerals, herbal supplements, protein supplements, omega fatty acids, probiotics, and others. Among these, vitamins and herbal supplements are particularly popular due to their perceived health benefits and natural origins. The increasing trend of preventive healthcare and self-medication has led to a surge in demand for these products, with consumers increasingly seeking natural and organic options.

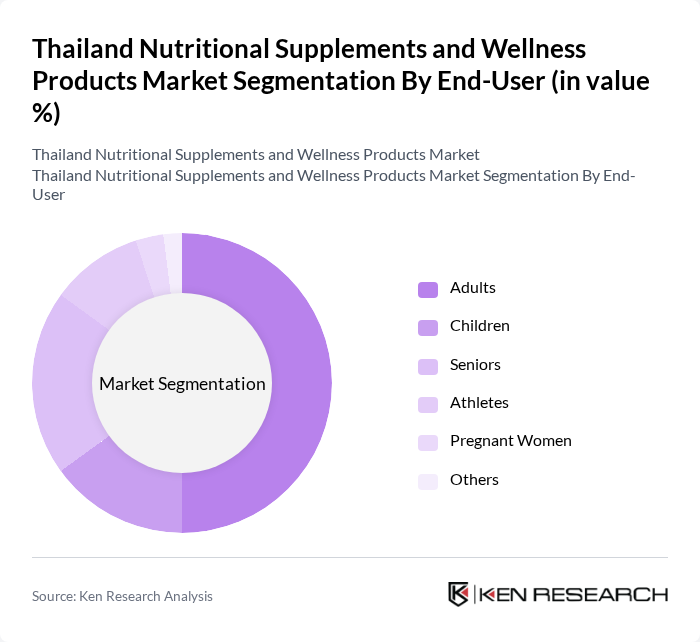

By End-User:The end-user segmentation includes adults, children, seniors, athletes, pregnant women, and others. Adults represent the largest segment, driven by a growing awareness of health and wellness. The increasing trend of fitness and active lifestyles among younger demographics has also led to a rise in demand for supplements tailored to athletes and fitness enthusiasts. Additionally, the aging population is contributing to the growth of products aimed at seniors, focusing on health maintenance and disease prevention.

Thailand Nutritional Supplements and Wellness Products Market Competitive Landscape

The Thailand Nutritional Supplements and Wellness Products Market is characterized by a dynamic mix of regional and international players. Leading participants such as Herbalife Nutrition Ltd., Amway Corporation, Blackmores Limited, GNC Holdings, Inc., Nestlé S.A., Abbott Laboratories, Bayer AG, DSM Nutritional Products, Nature's Way Products, LLC, Swisse Wellness Pty Ltd., USANA Health Sciences, Inc., Herbalife Nutrition Ltd., MegaFood, LLC, NOW Foods, Inc., Solgar Inc. contribute to innovation, geographic expansion, and service delivery in this space.

Thailand Nutritional Supplements and Wellness Products Market Industry Analysis

Growth Drivers

- Increasing Health Awareness:The Thai population is becoming increasingly health-conscious, with 70% of adults actively seeking nutritional supplements to enhance their well-being. This trend is supported by a rise in health-related media coverage, with a 30% increase in health articles published in the current year compared to the previous year. Additionally, the Thai government has invested approximately THB 1.5 billion in health promotion campaigns, further driving consumer interest in wellness products and nutritional supplements.

- Rising Disposable Incomes:Thailand's GDP per capita is projected to reach THB 400,000 in the future, reflecting a 5% increase from the previous year. This growth in disposable income allows consumers to allocate more funds towards health and wellness products. As a result, the demand for premium nutritional supplements is expected to rise, with a notable 20% increase in sales of high-end products reported in the current year. This trend indicates a shift towards quality over quantity in consumer purchasing behavior.

- Aging Population:By the future, approximately 20% of Thailand's population will be aged 60 and above, creating a significant demand for nutritional supplements tailored to older adults. This demographic shift is accompanied by a projected increase in healthcare spending, estimated at THB 1 trillion, as older individuals seek products that support their health and longevity. Consequently, companies are focusing on developing specialized supplements to cater to the unique needs of this growing segment.

Market Challenges

- Regulatory Compliance Issues:The Thai nutritional supplements market faces stringent regulatory requirements, with over 1,000 new regulations introduced in the current year alone. Companies must navigate complex compliance processes, which can lead to delays in product launches and increased operational costs. Non-compliance can result in fines exceeding THB 500,000, creating a significant barrier for new entrants and smaller businesses attempting to establish themselves in the market.

- Consumer Misinformation:The prevalence of misinformation regarding nutritional supplements poses a significant challenge, with 60% of consumers expressing confusion about product efficacy. This issue is exacerbated by the rise of social media influencers promoting unverified claims, leading to skepticism among potential buyers. As a result, companies must invest in consumer education initiatives, which can divert resources from product development and marketing efforts, hindering overall market growth.

Thailand Nutritional Supplements and Wellness Products Market Future Outlook

The Thailand nutritional supplements and wellness products market is poised for significant evolution, driven by technological advancements and changing consumer preferences. The integration of digital health solutions is expected to enhance personalized nutrition, allowing consumers to tailor supplements to their specific needs. Additionally, the growing emphasis on sustainability will likely influence product development, with companies increasingly adopting eco-friendly practices. These trends indicate a dynamic market landscape that prioritizes health, personalization, and environmental responsibility in the future.

Market Opportunities

- Expansion of Product Lines:Companies have the opportunity to diversify their product offerings by introducing innovative supplements targeting specific health concerns, such as immunity and mental health. This strategy can attract a broader customer base, particularly among younger consumers who prioritize holistic health solutions. The potential for increased sales is significant, with an estimated THB 500 million in additional revenue projected from new product lines in the future.

- Increasing Demand for Organic Products:The organic supplement market in Thailand is expected to grow by THB 300 million in the future, driven by rising consumer interest in natural and organic ingredients. This trend presents an opportunity for brands to capitalize on the health-conscious demographic seeking clean-label products. By aligning with this demand, companies can enhance their market positioning and attract environmentally aware consumers.