Region:Asia

Author(s):Rebecca

Product Code:KRAB5944

Pages:90

Published On:October 2025

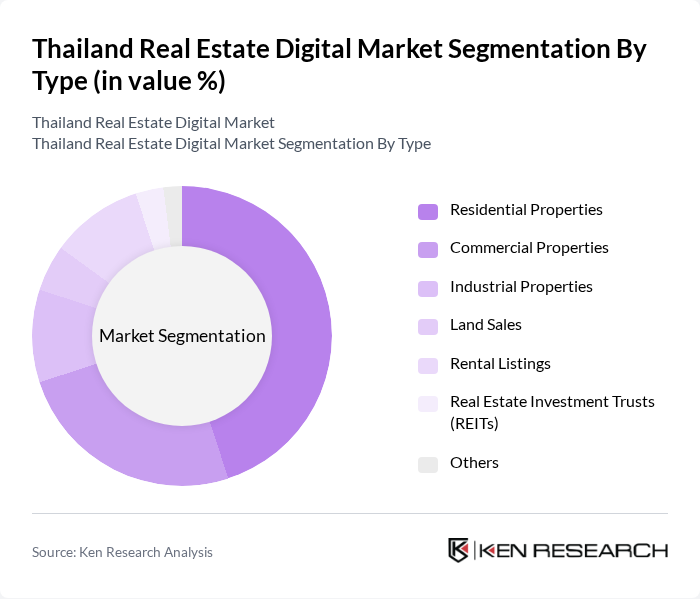

By Type:The market can be segmented into various types, including Residential Properties, Commercial Properties, Industrial Properties, Land Sales, Rental Listings, Real Estate Investment Trusts (REITs), and Others. Among these, Residential Properties dominate the market due to the high demand for housing driven by urbanization and population growth. The increasing trend of homeownership and the rise of digital platforms for property listings have further fueled this segment's growth.

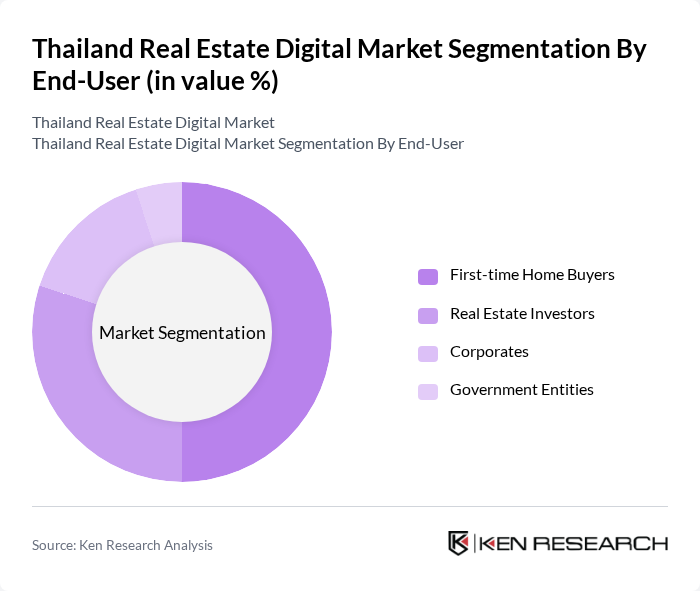

By End-User:The end-user segmentation includes First-time Home Buyers, Real Estate Investors, Corporates, and Government Entities. First-time Home Buyers represent the largest segment, driven by favorable financing options and government incentives aimed at promoting homeownership. The increasing availability of online resources and platforms has made it easier for this demographic to navigate the real estate market, contributing to its dominance.

The Thailand Real Estate Digital Market is characterized by a dynamic mix of regional and international players. Leading participants such as PropertyGuru Group, Hipflat, Thai Apartment, Baania, FazWaz, Ananda Development, Sansiri Public Company Limited, AP Thailand Public Company Limited, LPN Development Public Company Limited, Pruksa Real Estate Public Company Limited, SET-listed Property Companies, Siamese Asset Public Company Limited, Noble Development Public Company Limited, RML Group, Land and Houses Public Company Limited contribute to innovation, geographic expansion, and service delivery in this space.

The Thailand real estate digital market is expected to evolve significantly, driven by technological advancements and changing consumer preferences. The integration of AI and big data analytics will enhance property search experiences, while the rise of virtual tours will transform how properties are showcased. Additionally, the increasing focus on sustainability will shape new developments, aligning with global trends. As the market matures, platforms that prioritize user experience and security will likely emerge as leaders in this dynamic landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Residential Properties Commercial Properties Industrial Properties Land Sales Rental Listings Real Estate Investment Trusts (REITs) Others |

| By End-User | First-time Home Buyers Real Estate Investors Corporates Government Entities |

| By Sales Channel | Online Marketplaces Real Estate Agencies Direct Sales Auctions |

| By Property Size | Small Properties Medium Properties Large Properties |

| By Investment Type | Residential Investments Commercial Investments Mixed-Use Developments |

| By Geographic Location | Bangkok Chiang Mai Phuket Pattaya |

| By Price Range | Low-End Properties Mid-Range Properties High-End Properties |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Property Buyers | 150 | First-time Homebuyers, Investors |

| Commercial Real Estate Investors | 100 | Real Estate Fund Managers, Corporate Buyers |

| Property Management Firms | 80 | Property Managers, Asset Managers |

| Real Estate Agents and Brokers | 120 | Licensed Real Estate Agents, Brokers |

| Urban Development Planners | 70 | City Planners, Urban Development Consultants |

The Thailand Real Estate Digital Market is valued at approximately USD 2.5 billion, reflecting significant growth driven by the increasing adoption of digital platforms for property transactions and enhanced internet penetration among consumers.