Region:Middle East

Author(s):Dev

Product Code:KRAB6002

Pages:88

Published On:October 2025

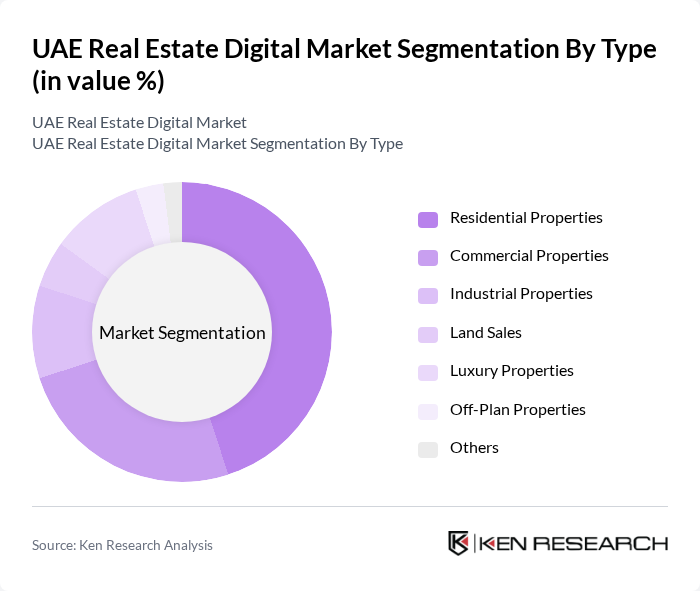

By Type:The market is segmented into various types, including Residential Properties, Commercial Properties, Industrial Properties, Land Sales, Luxury Properties, Off-Plan Properties, and Others. Among these, Residential Properties dominate the market due to the high demand for housing driven by population growth and urbanization. The trend towards digital platforms for buying and selling homes has further accelerated this segment's growth.

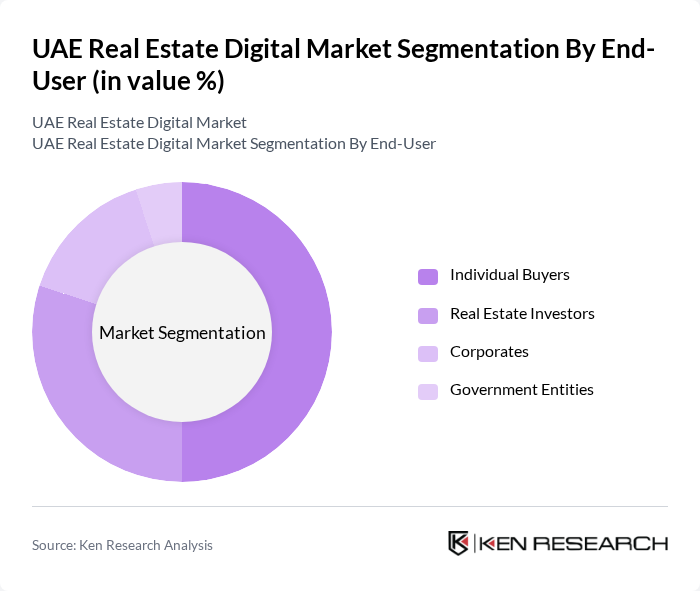

By End-User:The end-user segmentation includes Individual Buyers, Real Estate Investors, Corporates, and Government Entities. Individual Buyers represent the largest segment, driven by the increasing number of first-time homebuyers and the growing trend of digital property searches. The rise of online platforms has made it easier for individuals to access property listings and make informed decisions.

The UAE Real Estate Digital Market is characterized by a dynamic mix of regional and international players. Leading participants such as Property Finder, Bayut, Dubizzle, JustProperty, Abu Dhabi Commercial Bank (ADCB), Emaar Properties, Aldar Properties, DAMAC Properties, Nakheel, Azizi Developments, Sobha Realty, Meraas, Dubai Properties, JLL (Jones Lang LaSalle), Colliers International contribute to innovation, geographic expansion, and service delivery in this space.

The UAE real estate digital market is poised for significant transformation, driven by technological advancements and evolving consumer preferences. As the integration of artificial intelligence and big data analytics becomes more prevalent, platforms will enhance user experiences through personalized services. Additionally, the increasing focus on sustainability will likely shape property development trends, encouraging digital platforms to promote eco-friendly listings. These factors will collectively foster a more dynamic and responsive market landscape, positioning the UAE as a leader in digital real estate innovation.

| Segment | Sub-Segments |

|---|---|

| By Type | Residential Properties Commercial Properties Industrial Properties Land Sales Luxury Properties Off-Plan Properties Others |

| By End-User | Individual Buyers Real Estate Investors Corporates Government Entities |

| By Sales Channel | Online Marketplaces Real Estate Agencies Direct Sales Auctions |

| By Property Size | Small Properties Medium Properties Large Properties |

| By Investment Type | Buy-to-Let Flipping Long-term Investment |

| By Geographic Location | Dubai Abu Dhabi Sharjah Ajman |

| By Price Range | Below AED 500,000 AED 500,000 - AED 1,000,000 AED 1,000,000 - AED 2,000,000 Above AED 2,000,000 |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Property Buyers | 150 | First-time Home Buyers, Investors |

| Commercial Real Estate Investors | 100 | Real Estate Fund Managers, Corporate Buyers |

| Real Estate Agents and Brokers | 120 | Licensed Real Estate Agents, Brokerage Owners |

| Property Management Firms | 80 | Property Managers, Operations Directors |

| Digital Marketing Specialists in Real Estate | 70 | Marketing Managers, Digital Strategists |

The UAE Real Estate Digital Market is valued at approximately USD 5 billion, reflecting significant growth driven by the increasing adoption of digital platforms for property transactions and enhanced consumer access to real estate information.