Region:Europe

Author(s):Dev

Product Code:KRAB6103

Pages:84

Published On:October 2025

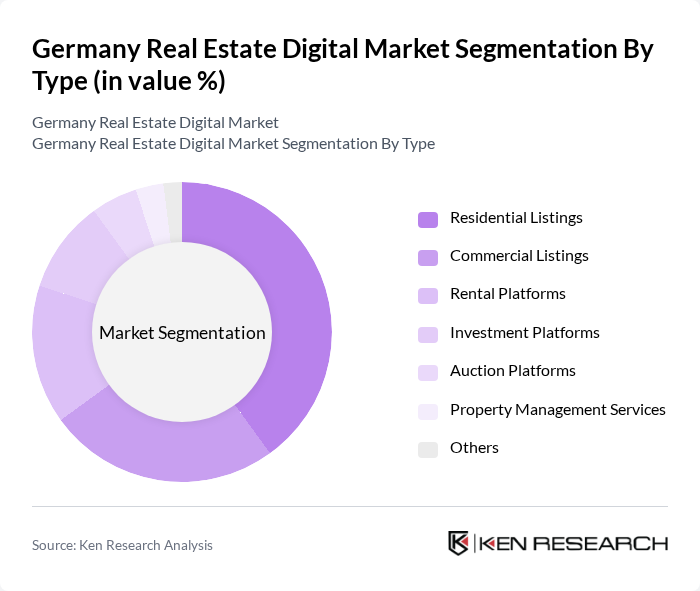

By Type:The market is segmented into various types, including Residential Listings, Commercial Listings, Rental Platforms, Investment Platforms, Auction Platforms, Property Management Services, and Others. Each of these subsegments caters to different consumer needs and preferences, with Residential Listings being particularly popular due to the high demand for housing in urban areas.

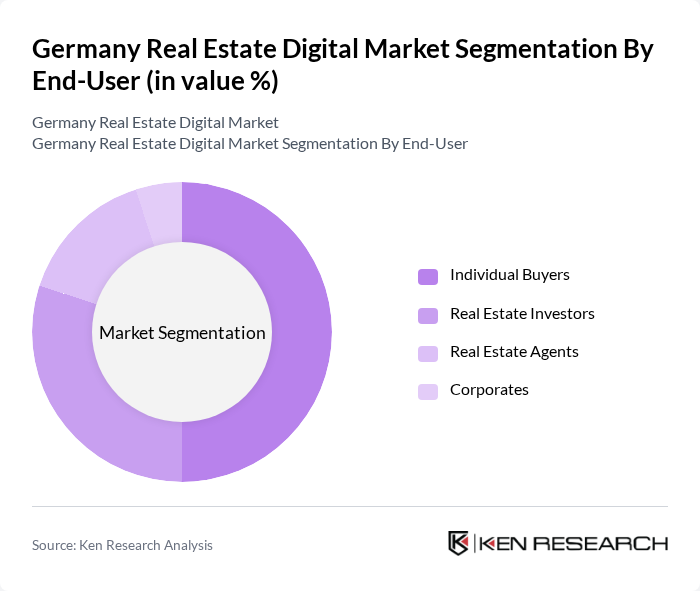

By End-User:The end-user segmentation includes Individual Buyers, Real Estate Investors, Real Estate Agents, and Corporates. Individual Buyers represent a significant portion of the market, driven by the increasing trend of homeownership and the desire for personal investment in real estate.

The Germany Real Estate Digital Market is characterized by a dynamic mix of regional and international players. Leading participants such as ImmobilienScout24, Immowelt AG, eBay Kleinanzeigen, Homeday GmbH, PlanetHome AG, Funda, Baufi24, Ziegert Bank- und Immobilienconsulting GmbH, Engel & Völkers AG, Vonovia SE, Deutsche Wohnen SE, LEG Immobilien AG, TAG Immobilien AG, Grand City Properties S.A., ADO Properties S.A. contribute to innovation, geographic expansion, and service delivery in this space.

The future of Germany's real estate digital market appears promising, driven by technological innovations and evolving consumer preferences. As urbanization continues, digital platforms will increasingly integrate advanced technologies like AI and blockchain to enhance transaction security and efficiency. Additionally, the growing emphasis on sustainability will likely shape market offerings, with more platforms focusing on eco-friendly properties. Overall, the market is poised for significant transformation, adapting to the needs of a tech-savvy population seeking seamless real estate experiences.

| Segment | Sub-Segments |

|---|---|

| By Type | Residential Listings Commercial Listings Rental Platforms Investment Platforms Auction Platforms Property Management Services Others |

| By End-User | Individual Buyers Real Estate Investors Real Estate Agents Corporates |

| By Sales Channel | Online Marketplaces Direct Sales Mobile Applications Social Media Platforms |

| By Property Type | Single-Family Homes Multi-Family Homes Commercial Properties Land Sales |

| By Geographic Focus | Major Cities Suburban Areas Rural Areas International Listings |

| By Customer Segment | First-Time Buyers Luxury Buyers Investors Renters |

| By Service Type | Listing Services Marketing Services Consulting Services Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Real Estate Agents | 150 | Real Estate Agents, Brokers |

| Commercial Property Developers | 100 | Property Developers, Investment Managers |

| Technology Providers in Real Estate | 80 | Tech Entrepreneurs, Product Managers |

| Real Estate Investors | 70 | Institutional Investors, Private Equity Firms |

| Digital Marketing Specialists for Real Estate | 60 | Marketing Managers, Digital Strategists |

The Germany Real Estate Digital Market is valued at approximately USD 5 billion, reflecting significant growth driven by the increasing digitization of real estate transactions and the rise of online property listings.