Region:Europe

Author(s):Geetanshi

Product Code:KRAB5808

Pages:92

Published On:October 2025

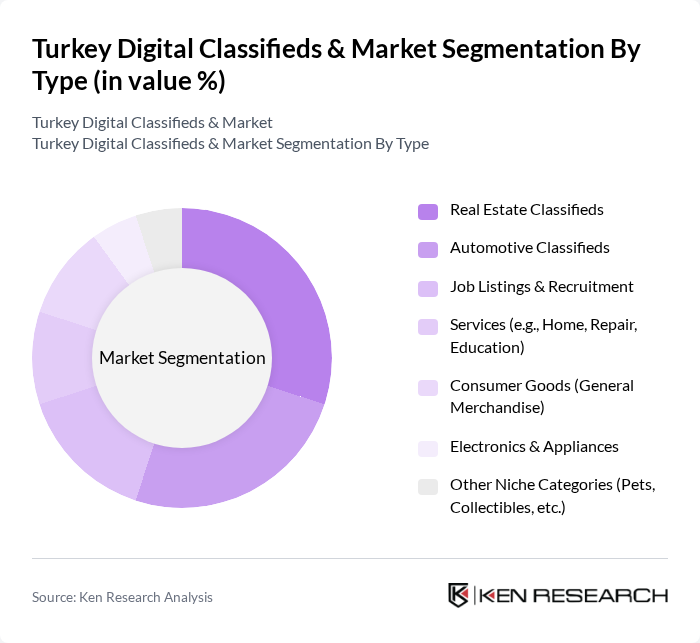

By Type:The Turkey Digital Classifieds & Market is segmented into Real Estate Classifieds, Automotive Classifieds, Job Listings & Recruitment, Services (including Home, Repair, Education), Consumer Goods (General Merchandise), Electronics & Appliances, and Other Niche Categories such as Pets and Collectibles. Each segment addresses specific consumer needs and preferences, reflecting the diverse demand patterns in Turkey's digital economy.

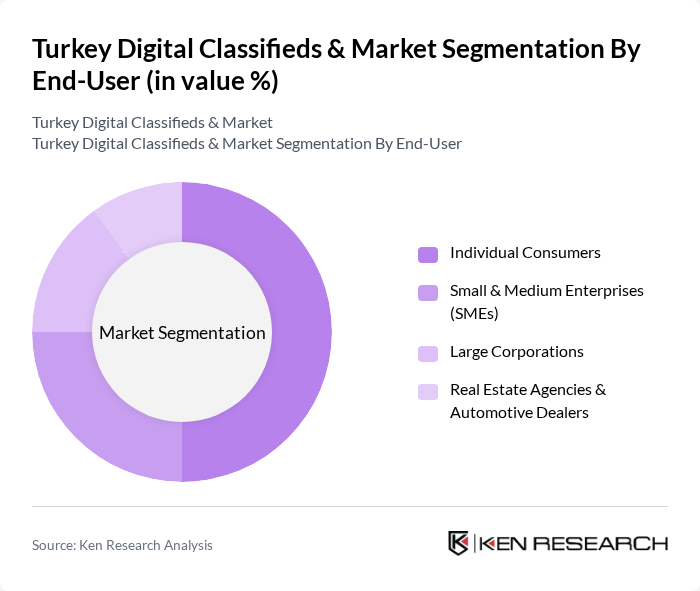

By End-User:The market is also segmented by end-users, including Individual Consumers, Small & Medium Enterprises (SMEs), Large Corporations, and Real Estate Agencies & Automotive Dealers. Each end-user group demonstrates distinct requirements and digital engagement patterns, influencing the broader market landscape.

The Turkey Digital Classifieds & Market is characterized by a dynamic mix of regional and international players. Leading participants such as Sahibinden.com, Letgo, N11.com, Hepsiburada, GittiGidiyor, Araba.com, Emlakjet, Hürriyet Emlak, Zingat, Arabam.com, Vitrinova, Toptan.com, Modanisa, Trendyol, and Pazarama contribute to innovation, geographic expansion, and service delivery in this space.

The future of Turkey's digital classifieds market appears promising, driven by technological advancements and evolving consumer preferences. As internet penetration continues to rise, platforms are likely to enhance their offerings through AI-driven personalization and improved user experiences. Additionally, the integration of secure payment solutions will address consumer trust issues, fostering greater participation in online transactions. The market is expected to adapt to changing demographics, with younger consumers increasingly favoring digital platforms for their buying and selling needs.

| Segment | Sub-Segments |

|---|---|

| By Type | Real Estate Classifieds Automotive Classifieds Job Listings & Recruitment Services (e.g., Home, Repair, Education) Consumer Goods (General Merchandise) Electronics & Appliances Other Niche Categories (Pets, Collectibles, etc.) |

| By End-User | Individual Consumers Small & Medium Enterprises (SMEs) Large Corporations Real Estate Agencies & Automotive Dealers |

| By Sales Channel | Dedicated Online Classifieds Platforms Mobile Applications Social Media Marketplaces Hybrid/Offline Channels |

| By Geographic Coverage | Major Metropolitan Areas (Istanbul, Ankara, Izmir) Secondary Cities Rural & Regional Markets |

| By Pricing Model | Free Listings Featured/Paid Listings Subscription-Based Services |

| By User Demographics | Age Groups Income Levels Education Levels |

| By Product Condition | New Used Refurbished |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Real Estate Listings | 60 | Real Estate Agents, Property Managers |

| Automotive Sales | 50 | Car Dealership Owners, Sales Managers |

| Job Listings | 40 | HR Managers, Recruitment Specialists |

| Consumer Goods Sales | 45 | Small Business Owners, E-commerce Managers |

| Service Offerings | 40 | Service Providers, Freelancers |

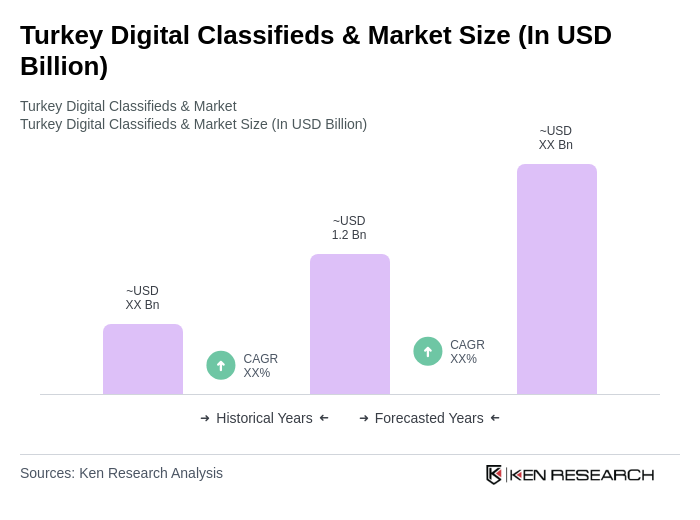

The Turkey Digital Classifieds & Market is valued at approximately USD 1.2 billion, driven by increased internet penetration, mobile device usage, and a shift towards online shopping and digital services.