Region:Europe

Author(s):Dev

Product Code:KRAA4638

Pages:85

Published On:September 2025

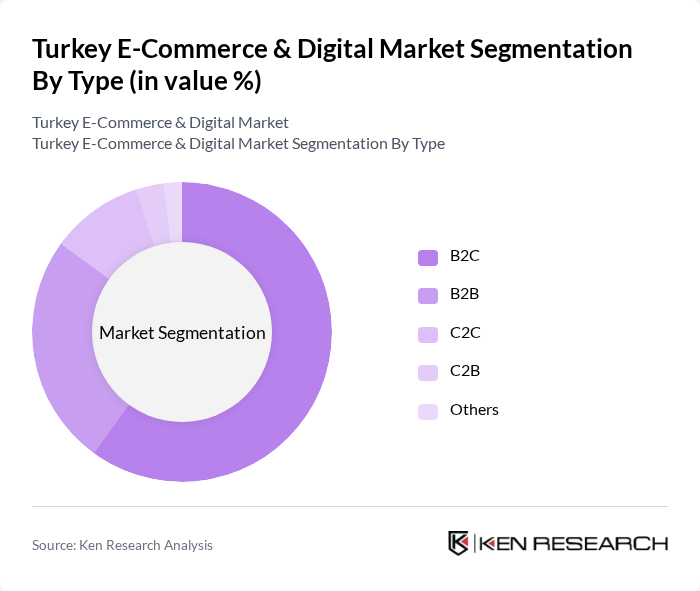

By Type:The Turkey E-Commerce & Digital Market is segmented into various types, including B2C, B2B, C2C, C2B, and others. Among these, the B2C segment is the most dominant, driven by the increasing number of online shoppers and the growing preference for convenience in purchasing goods and services. The B2B segment is also significant, as businesses increasingly leverage online platforms for procurement and sales. The C2C and C2B segments are emerging but still represent a smaller share of the market.

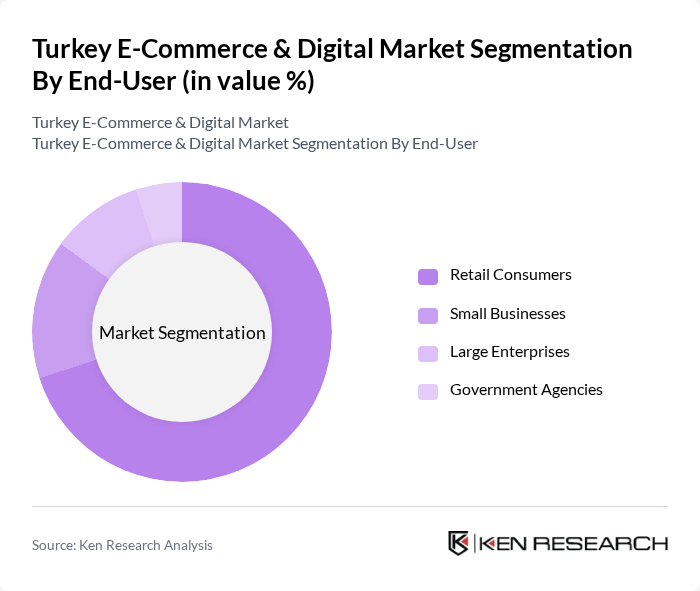

By End-User:The market is also segmented by end-users, which include retail consumers, small businesses, large enterprises, and government agencies. Retail consumers dominate the market, driven by the increasing adoption of online shopping and the convenience it offers. Small businesses are increasingly utilizing e-commerce platforms to reach a broader audience, while large enterprises leverage these platforms for efficiency and cost-effectiveness. Government agencies are also beginning to engage in e-commerce for procurement and service delivery.

The Turkey E-Commerce & Digital Market is characterized by a dynamic mix of regional and international players. Leading participants such as Trendyol, Hepsiburada, N11, GittiGidiyor, Çiçeksepeti, PttAVM, Amazon Turkey, eBay Turkey, Modanisa, Vivense, Getir, Yemeksepeti, Armut, Sahibinden, Biletix contribute to innovation, geographic expansion, and service delivery in this space.

The Turkey e-commerce market is poised for significant growth, driven by technological advancements and changing consumer behaviors. As internet penetration increases and mobile commerce continues to rise, businesses will need to adapt to evolving consumer preferences. The integration of AI and big data analytics will enhance personalization, while sustainability trends will shape product offerings. In the near future, the market is expected to witness a shift towards more innovative solutions, creating a dynamic environment for both established players and new entrants.

| Segment | Sub-Segments |

|---|---|

| By Type | B2C B2B C2C C2B Others |

| By End-User | Retail Consumers Small Businesses Large Enterprises Government Agencies |

| By Sales Channel | Online Marketplaces Brand Websites Social Media Platforms Mobile Apps |

| By Product Category | Electronics Fashion Home Goods Health & Beauty Others |

| By Payment Method | Credit/Debit Cards Digital Wallets Bank Transfers Cash on Delivery |

| By Customer Demographics | Age Groups Income Levels Geographic Distribution |

| By Customer Behavior | Frequency of Purchase Average Order Value Brand Loyalty Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Electronics E-commerce | 150 | Online Shoppers, Product Reviewers |

| Fashion and Apparel Online Sales | 120 | Fashion Retailers, Marketing Managers |

| Grocery Delivery Services | 100 | Logistics Coordinators, Operations Managers |

| Health and Beauty E-commerce | 80 | Brand Managers, E-commerce Specialists |

| Home Goods and Furniture Online Market | 90 | Retail Buyers, Supply Chain Analysts |

The Turkey E-Commerce & Digital Market is valued at approximately USD 30 billion, reflecting significant growth driven by increased internet penetration, mobile device usage, and a shift in consumer behavior towards online shopping.