Turkey LED Lighting & Smart Cities Market Overview

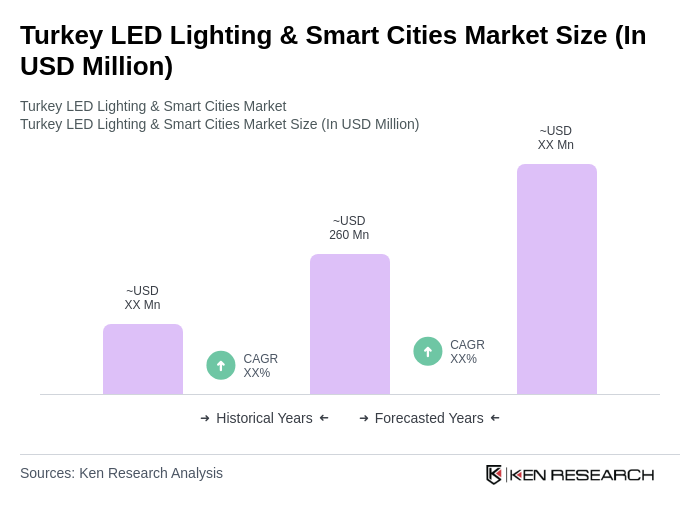

- The Turkey LED Lighting & Smart Cities Market is valued at USD 260 million, based on a five-year historical analysis. This growth is primarily driven by increasing urbanization, government initiatives promoting energy efficiency, and the rising demand for smart city solutions. The transition from traditional lighting to LED technology is a significant factor, as it offers cost savings, longer product lifespans, and environmental benefits. The market is also benefitting from the adoption of smart lighting systems, which enable remote control and automation, aligning with global trends in energy management and sustainability .

- Istanbul, Ankara, and Izmir are the dominant cities in the Turkey LED Lighting & Smart Cities Market. Istanbul leads due to its large population and extensive urban development projects, while Ankara benefits from government investments in infrastructure. Izmir's focus on sustainability and smart city initiatives further enhances its position in the market. These cities are at the forefront of integrating IoT-enabled lighting and smart city technologies, reflecting Turkey’s broader urban modernization efforts .

- The Turkish government has implemented regulations to promote energy-efficient lighting solutions. The Energy Efficiency Law No. 5627, issued by the Grand National Assembly of Turkey in 2007, mandates the use of energy-efficient lighting, including LED technology, in public buildings and spaces. The regulation requires municipalities and public institutions to prioritize LED lighting in new projects and retrofits, with compliance monitored by the Ministry of Energy and Natural Resources. This initiative aims to reduce energy consumption and greenhouse gas emissions, supporting Turkey's commitment to sustainable development .

Turkey LED Lighting & Smart Cities Market Segmentation

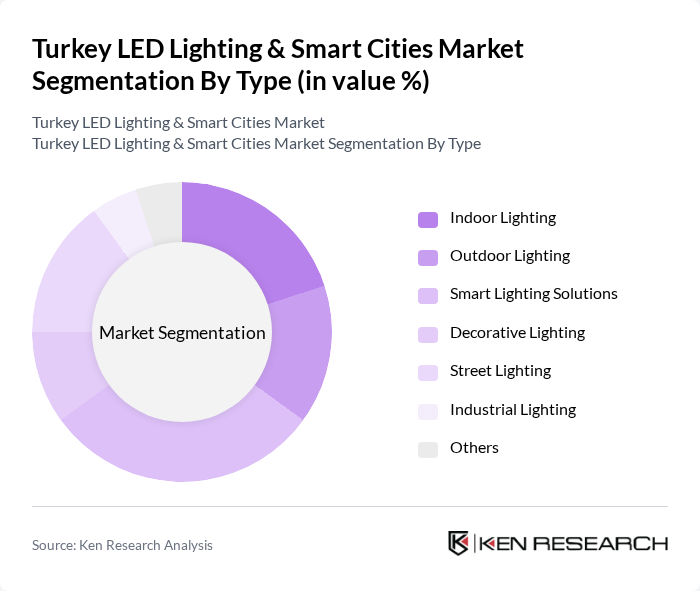

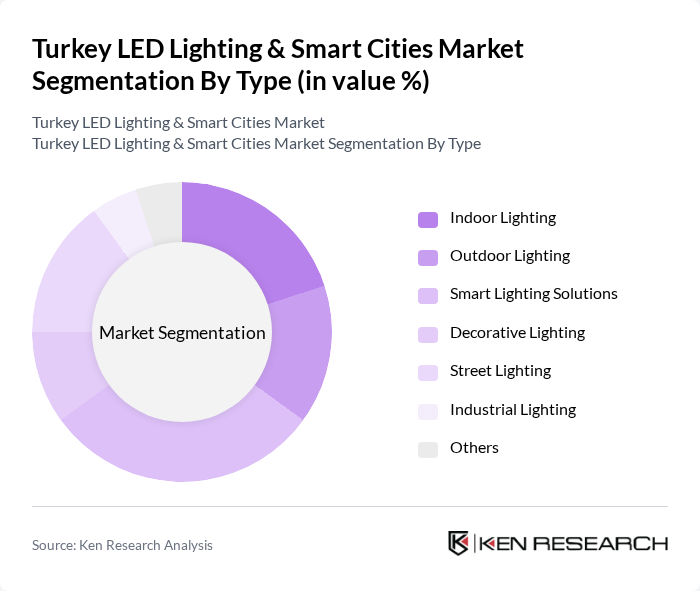

By Type:The market is segmented into various types of lighting solutions, including Indoor Lighting, Outdoor Lighting, Smart Lighting Solutions, Decorative Lighting, Street Lighting, Industrial Lighting, and Others. Each of these segments addresses different consumer needs and preferences, with applications in residential, commercial, and industrial settings. Among these, Smart Lighting Solutions are gaining significant traction due to their integration with IoT technologies, enabling advanced energy management, automation, and user convenience. Indoor and outdoor segments are also expanding as businesses and municipalities upgrade infrastructure for efficiency and safety .

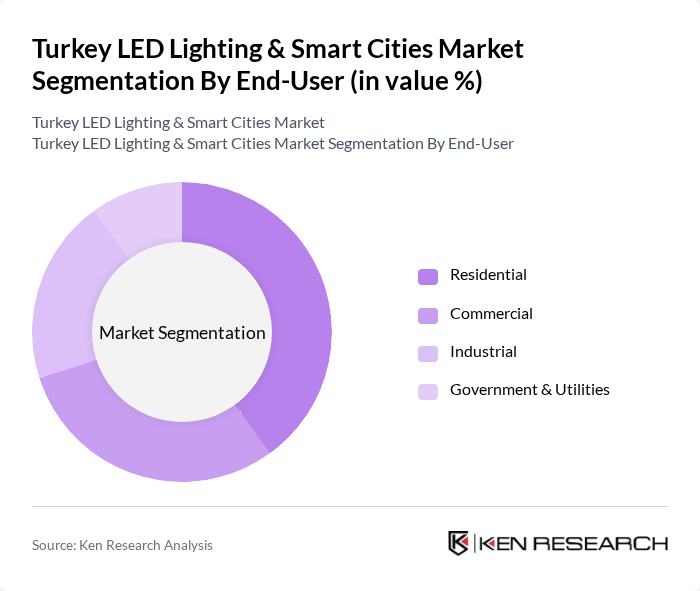

By End-User:The market is categorized by end-users, including Residential, Commercial, Industrial, and Government & Utilities. Each segment has distinct requirements and purchasing behaviors. The Residential segment is witnessing significant growth due to increasing consumer awareness about energy-efficient lighting solutions and the adoption of smart home technologies. The Commercial sector is also expanding as businesses seek to reduce operational costs and comply with energy standards. Industrial and government segments are investing in large-scale lighting upgrades for safety, compliance, and sustainability .

Turkey LED Lighting & Smart Cities Market Competitive Landscape

The Turkey LED Lighting & Smart Cities Market is characterized by a dynamic mix of regional and international players. Leading participants such as Signify (Philips Lighting) Türkiye, Osram Türkiye, GE Lighting Türkiye, Schneider Electric Türkiye, Siemens Türkiye, Panasonic Türkiye, Ekol Ayd?nlatma, Ekinoks Ayd?nlatma, Ayd?nlatma Sanayi, EAE Elektrik, Trakya Elektrik, Ekol Enerji, Ekol Lamba, Arçelik (Beko, Grundig), Vestel contribute to innovation, geographic expansion, and service delivery in this space.

Turkey LED Lighting & Smart Cities Market Industry Analysis

Growth Drivers

- Increasing Urbanization:Turkey's urban population is projected to reach80%by the future, up from 82% in 2020, according to the World Bank. This rapid urbanization drives the demand for efficient lighting solutions in cities. As urban areas expand, the need for sustainable infrastructure, including LED lighting, becomes critical. The Turkish government has allocated approximatelyUSD 1.5 billionfor urban development projects, which will significantly enhance the adoption of LED technologies in metropolitan areas.

- Government Initiatives for Smart Cities:The Turkish government has committed overUSD 1 billionto develop smart city projects by the future, focusing on integrating advanced technologies, including LED lighting. These initiatives aim to improve urban living standards and reduce energy consumption. The Ministry of Environment and Urbanization has set a target to implement smart lighting systems inmajor cities, which will enhance public safety and reduce operational costs for municipalities.

- Technological Advancements in LED Lighting:The LED lighting sector in Turkey is experiencing significant technological advancements, with investments exceedingUSD 500 millionin R&D by the future. Innovations such as smart sensors and IoT integration are enhancing the functionality of LED systems. The Turkish Standards Institute has introduced new standards for smart lighting, promoting energy efficiency and sustainability. This technological evolution is expected to drive market growth as municipalities seek to modernize their lighting infrastructure.

Market Challenges

- High Initial Investment Costs:The transition to LED lighting systems involves substantial upfront costs, estimated at aroundUSD 1.2 billionfor municipalities in Turkey by the future. Many local governments face budget constraints, making it challenging to allocate funds for these investments. Although LED systems offer long-term savings, the initial financial burden can deter adoption, particularly in smaller municipalities with limited resources.

- Limited Awareness Among Consumers:Despite the benefits of LED lighting, consumer awareness remains low, with only40%of the population familiar with its advantages as per recent surveys. This lack of knowledge hampers market growth, as consumers may prefer traditional lighting solutions. Educational campaigns and outreach programs are essential to increase awareness and drive demand for energy-efficient lighting options in residential and commercial sectors.

Turkey LED Lighting & Smart Cities Market Future Outlook

The future of the Turkey LED lighting and smart cities market appears promising, driven by ongoing urbanization and government support for smart initiatives. By the future, the integration of IoT technologies in lighting solutions is expected to enhance energy efficiency and user experience. Additionally, the focus on sustainability will likely lead to increased investments in renewable energy sources, further promoting the adoption of LED lighting. As public-private partnerships grow, innovative financing models may emerge, facilitating broader access to advanced lighting technologies.

Market Opportunities

- Expansion of Smart City Projects:The Turkish government’s commitment to smart city initiatives presents a significant opportunity for LED lighting companies. With over30 citiestargeted for smart upgrades by the future, the demand for innovative lighting solutions is expected to surge. This expansion will create a favorable environment for partnerships between technology providers and municipalities, enhancing market growth.

- Integration of IoT in Lighting Solutions:The integration of IoT technologies into LED lighting systems offers substantial market potential. By the future, the demand for connected lighting solutions is projected to increase, driven by the need for energy efficiency and smart management. This trend will enable real-time monitoring and control, providing municipalities with enhanced operational efficiency and reduced energy costs.