Region:Europe

Author(s):Shubham

Product Code:KRAB4967

Pages:96

Published On:October 2025

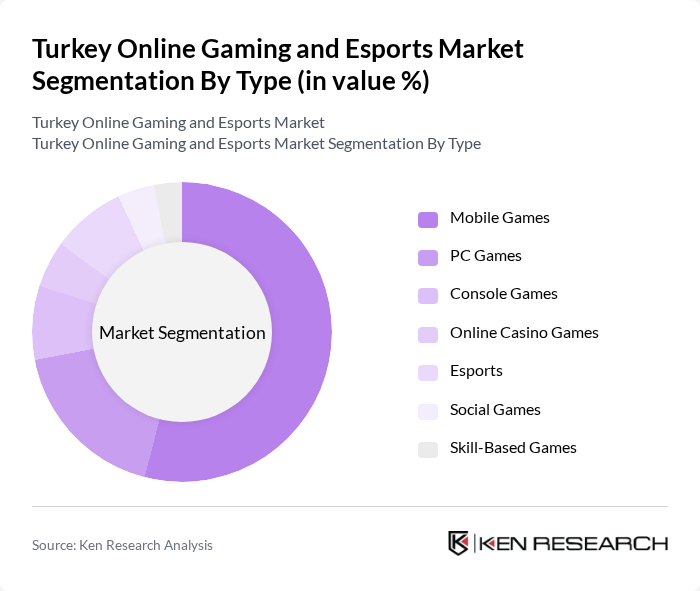

By Type:The online gaming and esports market in Turkey is segmented into various types, including mobile games, PC games, console games, online casino games, esports, social games, and skill-based games. Among these, mobile games have emerged as the leading segment due to the widespread adoption of smartphones and the convenience they offer for gaming on the go. The popularity of mobile games is further fueled by the availability of free-to-play models and in-game purchases, making them accessible to a broader audience .

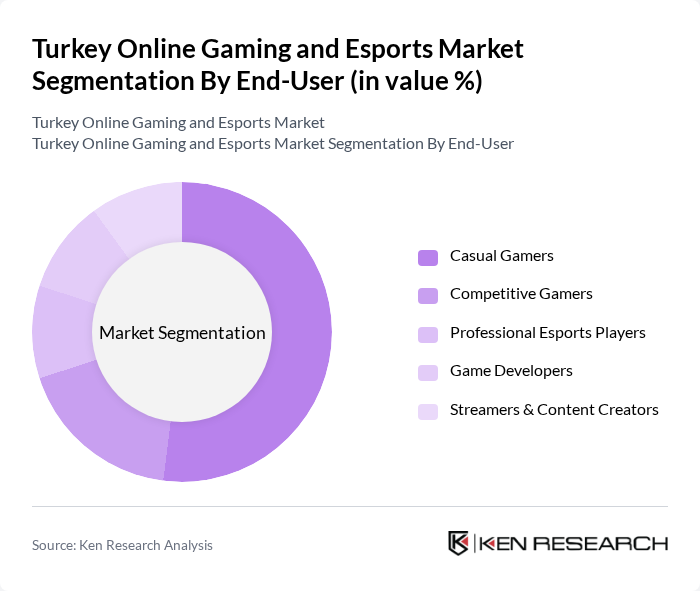

By End-User:The end-user segmentation of the Turkey Online Gaming and Esports Market includes casual gamers, competitive gamers, professional esports players, game developers, and streamers & content creators. Casual gamers represent the largest segment, driven by the increasing number of individuals engaging in gaming for entertainment and relaxation. The rise of social media and streaming platforms has also contributed to the growth of this segment, as casual gamers often share their experiences and connect with others .

The Turkey Online Gaming and Esports Market is characterized by a dynamic mix of regional and international players. Leading participants such as Peak Games, Masomo, Netmarble Turkey, Taleworlds Entertainment, Lokum Games, Gram Games, Rollic Games, Ace Games, Spyke Games, Good Job Games, Uncosoft, Brew Games, Riot Games Turkey, Tencent Games (Turkey Operations), Papara SuperMassive Esports contribute to innovation, geographic expansion, and service delivery in this space.

The future of Turkey's online gaming and esports market appears promising, driven by technological advancements and a growing user base. As internet penetration continues to rise, the demand for innovative gaming experiences will likely increase. Furthermore, the integration of augmented reality and virtual reality technologies is expected to enhance user engagement. With the youth demographic embracing gaming culture, the market is poised for significant growth, provided that regulatory challenges are addressed effectively.

| Segment | Sub-Segments |

|---|---|

| By Type | Mobile Games PC Games Console Games Online Casino Games Esports Social Games Skill-Based Games |

| By End-User | Casual Gamers Competitive Gamers Professional Esports Players Game Developers Streamers & Content Creators |

| By Age Group | Under 18 24 34 44 and Above |

| By Revenue Model | Free-to-Play Subscription-Based Pay-to-Play In-Game Purchases Advertising-Supported |

| By Distribution Channel | Online Platforms Mobile App Stores Direct Downloads Social Media Platforms |

| By Genre | Action Adventure Strategy Sports Simulation Puzzle Racing |

| By Platform | PC Mobile Console Cloud Gaming Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Mobile Gaming Users | 120 | Casual Gamers, Mobile Game Developers |

| PC Gaming Enthusiasts | 90 | Hardcore Gamers, PC Game Publishers |

| Esports Viewership | 60 | Esports Fans, Event Organizers |

| Game Streaming Platforms | 50 | Content Creators, Platform Managers |

| In-game Purchases | 70 | Freemium Game Players, Marketing Analysts |

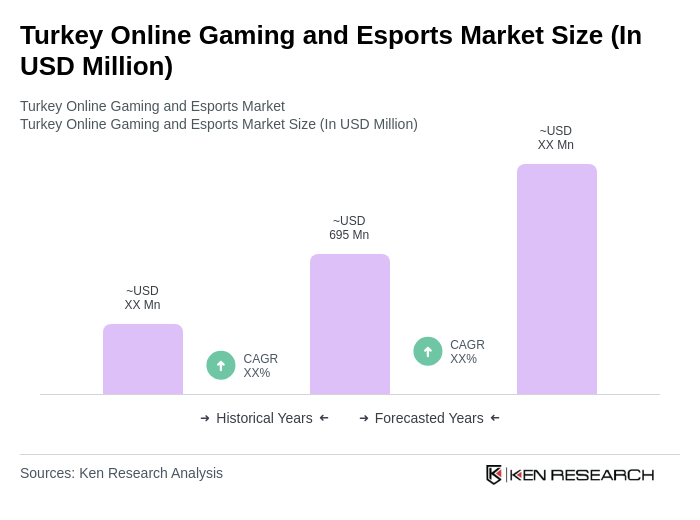

The Turkey Online Gaming and Esports Market is valued at approximately USD 695 million, driven by factors such as smartphone penetration, high-speed internet access, and a young, tech-savvy population. Mobile gaming is the primary revenue driver, accounting for over half of the sector's revenue.