South Africa Online Gaming and Esports Market Overview

- The South Africa Online Gaming and Esports Market is valued at USD 1.1 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing penetration of smartphones, improved internet connectivity, and a growing acceptance of online gaming as a legitimate form of entertainment. The rise in disposable income among the youth demographic, the shift to digital game distribution, and the expansion of mobile gaming platforms have also contributed significantly to the market's expansion.

- Key cities such as Johannesburg, Cape Town, and Durban dominate the market due to their high population density and urbanization. These cities have a vibrant gaming culture, supported by numerous gaming events and esports tournaments, which attract both local and international players. The presence of major gaming companies and tech hubs in these areas further enhances their dominance in the online gaming landscape.

- The National Gambling Amendment Act, 2008, as administered by the National Gambling Board and provincial licensing authorities, governs online gambling in South Africa. This legislation establishes a framework for licensing online gaming operators, mandates compliance with consumer protection standards, and requires operators to implement responsible gambling measures. The Act’s operational provisions ensure that online gambling activities are regulated, with oversight on licensing, advertising, and player protection.

South Africa Online Gaming and Esports Market Segmentation

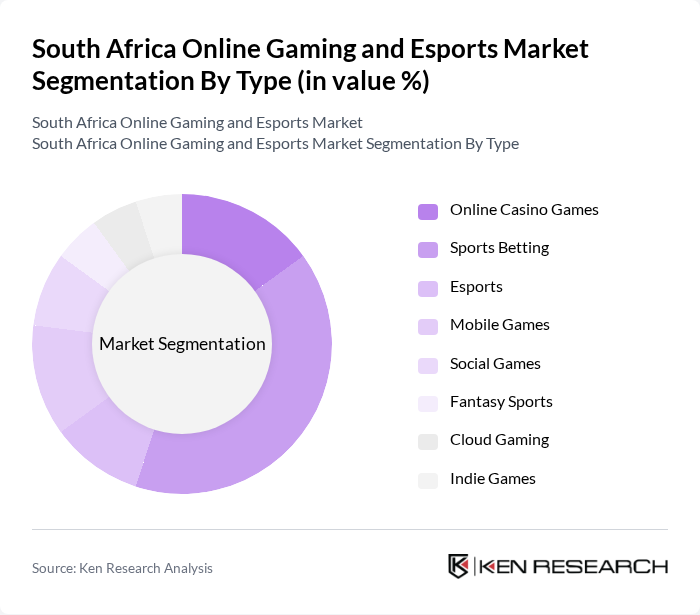

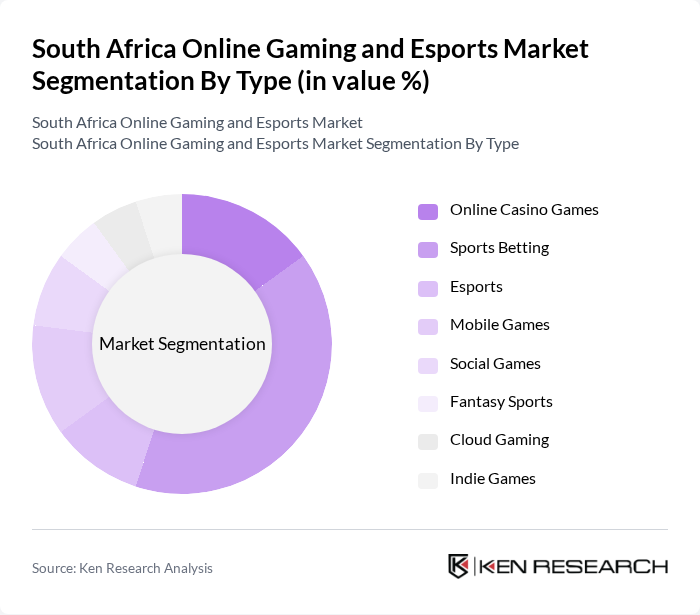

By Type:The online gaming and esports market is segmented into various types, including Online Casino Games, Sports Betting, Esports, Mobile Games, Social Games, Fantasy Sports, Cloud Gaming, and Indie Games. Among these,Sports Bettinghas emerged as the leading segment, driven by the popularity of sports events, the rapid adoption of mobile betting platforms, and the increasing number of regulated operators offering betting services. The convenience of mobile applications and the expansion of digital payment options have also contributed to the growth of this segment, making it easily accessible to a wider audience.

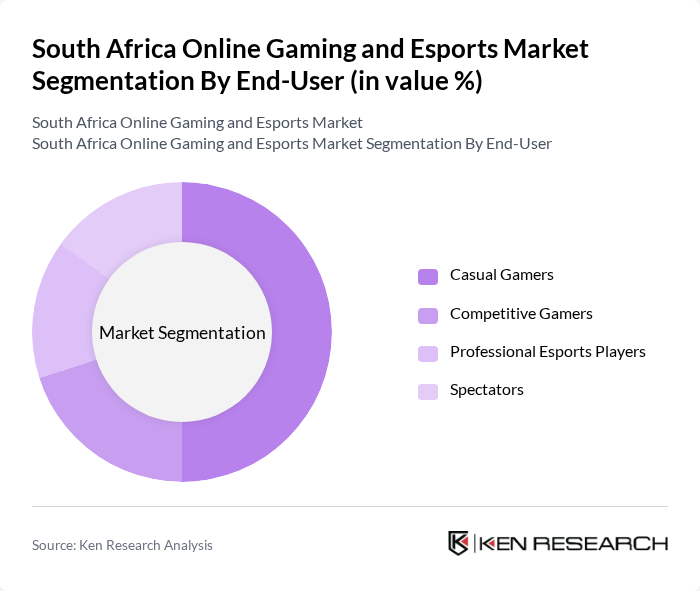

By End-User:The market is also segmented by end-users, which include Casual Gamers, Competitive Gamers, Professional Esports Players, and Spectators.Casual Gamersrepresent the largest segment, as they engage in gaming primarily for entertainment and leisure. The increasing availability of free-to-play games, the proliferation of mobile gaming, and the accessibility of digital distribution platforms have attracted a vast number of casual gamers, significantly contributing to the overall market growth.

South Africa Online Gaming and Esports Market Competitive Landscape

The South Africa Online Gaming and Esports Market is characterized by a dynamic mix of regional and international players. Leading participants such as Naspers Limited, Betway, 888 Holdings, SuperSport, Rivalry Corp, GGBet, Playbet, Bet.co.za, Hollywoodbets, Yebo Casino, Lottoland, BetXchange, SunBet, Gaming Innovation Group, Kagiso Interactive, Nyamakop, Carry1st, SmartSoft, VeliTech, Supabets contribute to innovation, geographic expansion, and service delivery in this space.

South Africa Online Gaming and Esports Market Industry Analysis

Growth Drivers

- Increasing Internet Penetration:As of future, South Africa's internet penetration rate is projected to reach 66%, with approximately 40 million users accessing the web. This growth is driven by improved infrastructure and affordable data plans, which have made online gaming more accessible. The World Bank reports that increased connectivity has led to a surge in online gaming participation, with over 11 million South Africans engaging in various gaming platforms, significantly boosting the market's growth potential.

- Rise of Mobile Gaming:Mobile gaming in South Africa is experiencing rapid growth, with over 26 million mobile gamers expected in future. The availability of affordable smartphones and mobile data has made gaming accessible to a broader audience. According to industry reports, mobile gaming revenue is projected to exceed ZAR 3.5 billion, driven by popular titles and in-game purchases. This trend is reshaping the gaming landscape, making mobile platforms a primary driver of market expansion.

- Expansion of Esports Tournaments:The esports sector in South Africa is gaining momentum, with over 55 major tournaments scheduled in future, attracting thousands of participants and viewers. The local esports market is estimated to generate ZAR 1.7 billion in revenue, fueled by sponsorships and advertising. This growth is supported by the increasing popularity of competitive gaming among youth, with an estimated 1.5 million active esports players, creating a vibrant ecosystem for both players and investors.

Market Challenges

- Regulatory Uncertainty:The South African online gaming market faces significant regulatory challenges, with unclear laws affecting operators and consumers. As of future, only 32% of online gaming operators are licensed, leading to a lack of consumer trust and potential legal issues. The National Gambling Board is working on reforms, but the slow pace of regulatory clarity hampers market growth and deters investment in the sector.

- Payment Processing Issues:Payment processing remains a critical challenge in South Africa's online gaming market, with only 42% of transactions successfully completed due to banking restrictions and fraud concerns. The South African Reserve Bank has stringent regulations that complicate online transactions, leading to a frustrating experience for users. This issue limits the potential for revenue growth and discourages international operators from entering the market.

South Africa Online Gaming and Esports Market Future Outlook

The South African online gaming and esports market is poised for significant transformation in the coming years, driven by technological advancements and changing consumer preferences. With the rise of virtual reality and augmented reality gaming, new immersive experiences are expected to attract a broader audience. Additionally, the increasing integration of gaming into social platforms will foster community engagement, enhancing user retention. As regulatory frameworks evolve, they will likely create a more conducive environment for investment and innovation, further propelling market growth.

Market Opportunities

- Development of Local Content:There is a growing opportunity for the creation of local gaming content, which can resonate with South African players. By investing in culturally relevant games, developers can tap into a market that values local narratives, potentially increasing user engagement and loyalty. This could lead to a projected revenue increase of ZAR 600 million in future.

- Partnerships with Telecom Providers:Collaborations with telecom companies can enhance the gaming experience by offering bundled data packages and exclusive content. Such partnerships can drive user acquisition and retention, with estimates suggesting that these initiatives could boost subscriber numbers by 25% in the next two years, significantly impacting market dynamics.