Region:Europe

Author(s):Rebecca

Product Code:KRAB2865

Pages:99

Published On:October 2025

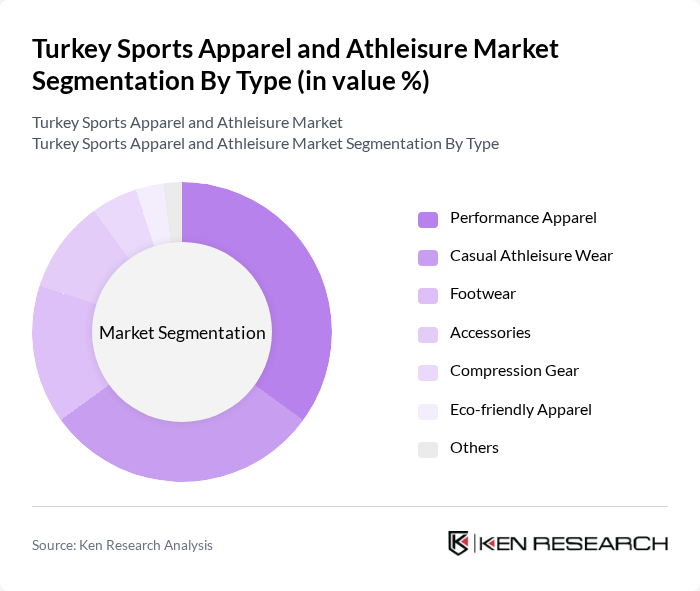

By Type:The market is segmented into various types, including Performance Apparel, Casual Athleisure Wear, Footwear, Accessories, Compression Gear, Eco-friendly Apparel, and Others. Among these, Performance Apparel is currently the leading segment due to the increasing participation in sports and fitness activities. Consumers are increasingly seeking high-quality, functional apparel that enhances performance and comfort during workouts. Casual Athleisure Wear is also gaining traction as it blends style with functionality, appealing to a broader audience seeking versatile everyday wear .

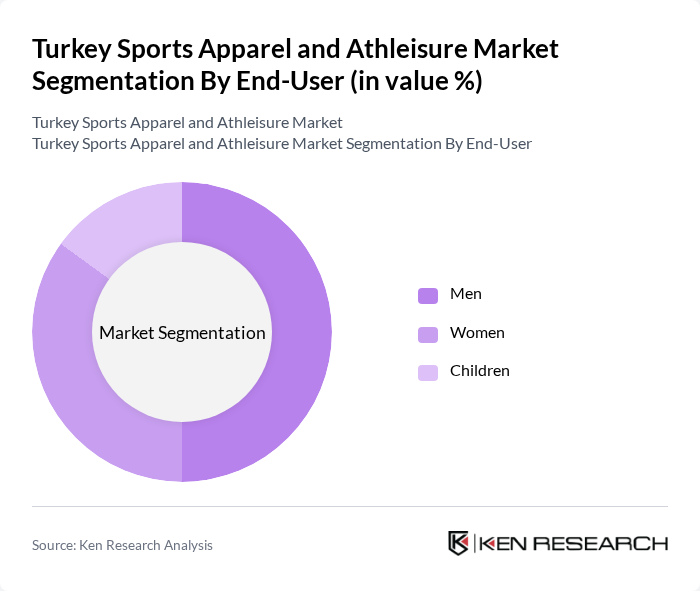

By End-User:The market is segmented by end-user into Men, Women, and Children. The Men's segment dominates the market, driven by a growing interest in fitness and sports among male consumers. Women are also increasingly participating in sports and fitness activities, leading to a significant rise in demand for women's sports apparel. The Children's segment is growing as parents are more inclined to invest in activewear for their kids, promoting a healthy lifestyle from a young age. Men’s sports apparel is the largest segment by revenue, while the women’s segment is experiencing the fastest growth .

The Turkey Sports Apparel and Athleisure Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nike Turkey, Adidas Turkey, PUMA Turkey, Decathlon Turkey, Under Armour Turkey, Hummel Turkey, Kappa Turkey, Reebok Turkey, Columbia Sportswear Turkey, Skechers Turkey, New Balance Turkey, Asics Turkey, The North Face Turkey, Mizuno Turkey, Lotto Turkey, Lescon, Sportive, Zorlu Tekstil, LC Waikiki, Defacto contribute to innovation, geographic expansion, and service delivery in this space.

The Turkey sports apparel and athleisure market is poised for significant growth, driven by increasing health consciousness and the rise of athleisure fashion. As e-commerce continues to expand, brands will need to enhance their online presence to capture the growing digital consumer base. Additionally, sustainability trends will likely shape product development, with consumers favoring eco-friendly options. The market is expected to adapt to these trends, fostering innovation and collaboration among brands and influencers to remain competitive in future.

| Segment | Sub-Segments |

|---|---|

| By Type | Performance Apparel Casual Athleisure Wear Footwear Accessories Compression Gear Eco-friendly Apparel Others |

| By End-User | Men Women Children |

| By Distribution Channel | Online Retail Specialty Stores Department Stores Discount Stores Supermarkets/Hypermarkets Direct Sales Others |

| By Price Range | Premium Mid-range Budget |

| By Occasion | Sports Activities Casual Wear Gym and Fitness Outdoor Activities |

| By Material | Cotton Polyester Nylon Synthetic Blends |

| By Brand Loyalty | Brand Loyal Customers Price-sensitive Customers Trend-driven Customers |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences in Sports Apparel | 100 | Active Consumers, Fitness Enthusiasts |

| Retail Insights on Athleisure Trends | 60 | Store Managers, Retail Buyers |

| Market Dynamics in E-commerce for Sports Apparel | 50 | E-commerce Managers, Digital Marketing Specialists |

| Brand Perception and Loyalty Studies | 70 | Brand Managers, Marketing Executives |

| Product Development Feedback from Athletes | 40 | Professional Athletes, Coaches |

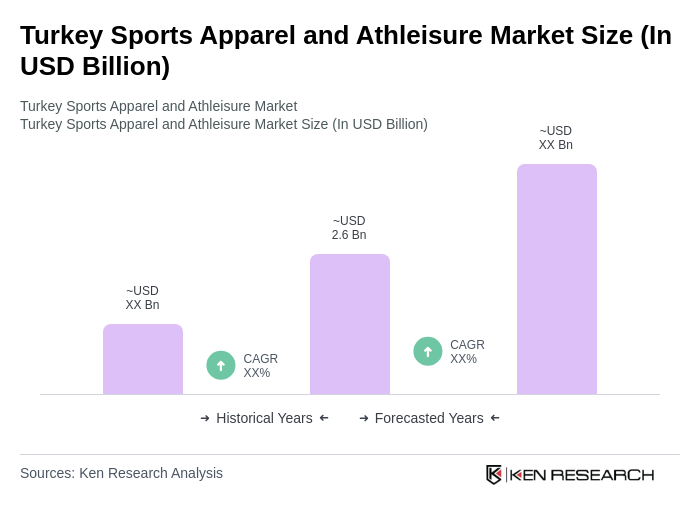

The Turkey Sports Apparel and Athleisure Market is valued at approximately USD 2.6 billion, reflecting a significant growth trend driven by increasing health consciousness and the popularity of athleisure as everyday wear.