Region:Europe

Author(s):Geetanshi

Product Code:KRAB2780

Pages:80

Published On:October 2025

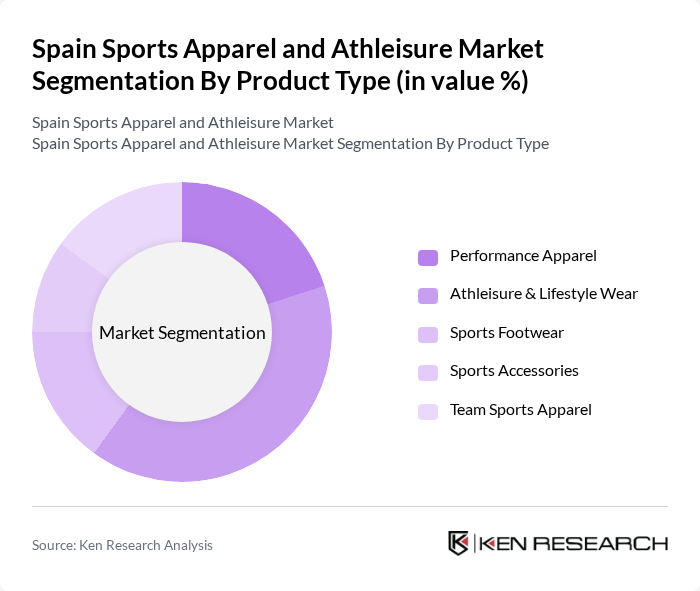

By Product Type:The product type segmentation includes various categories such as Performance Apparel, Athleisure & Lifestyle Wear, Sports Footwear, Sports Accessories, and Team Sports Apparel. Among these, Athleisure & Lifestyle Wear has emerged as the leading segment, driven by changing consumer preferences towards comfort and versatility in clothing. The trend of wearing sports apparel in casual settings has significantly boosted this segment's popularity, making it a dominant force in the market .

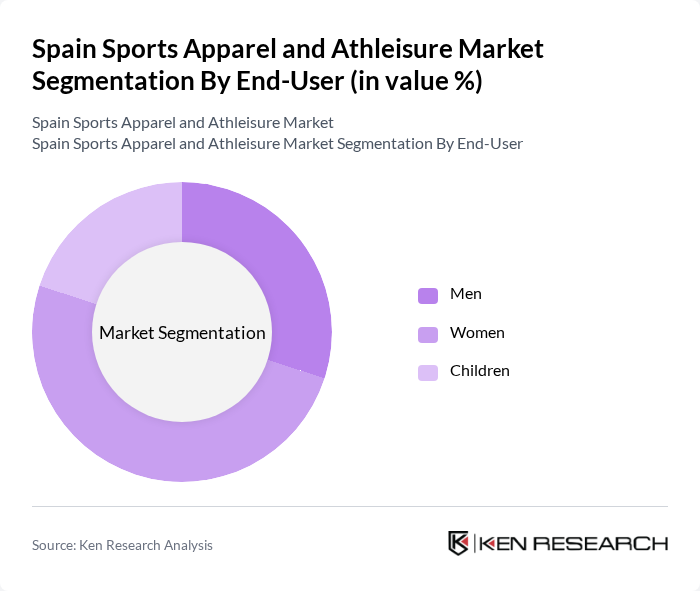

By End-User:The end-user segmentation encompasses Men, Women, and Children. The Women’s segment is currently the most significant contributor to the market, reflecting a growing trend of female participation in sports and fitness activities. Women are increasingly seeking stylish yet functional apparel, which has led to a surge in demand for athleisure and performance wear tailored specifically for them .

The Spain Sports Apparel and Athleisure Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nike, Inc., Adidas AG, Puma SE, Under Armour, Inc., Decathlon S.A., ASICS Corporation, New Balance Athletics, Inc., Reebok International Ltd., Lululemon Athletica Inc., Oysho España S.A. (Inditex Group), Joma Sport, S.A., Sprinter Megacentros del Deporte S.L., El Corte Inglés S.A., Décimas (Grupo Sport Street S.L.), HOFF Brand S.L., Mango Sports (Punto Fa, S.L.), Fabletics, Inc., Gymshark Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Spain sports apparel and athleisure market appears promising, driven by ongoing trends in health consciousness and fashion. As consumers increasingly seek multifunctional clothing, brands that innovate in design and sustainability will likely thrive. Additionally, the integration of smart technology into apparel is expected to gain traction, enhancing user experience. Companies that adapt to these trends while addressing challenges such as competition and raw material costs will be well-positioned for success in the evolving market landscape.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Performance Apparel Athleisure & Lifestyle Wear Sports Footwear Sports Accessories Team Sports Apparel |

| By End-User | Men Women Children |

| By Sales Channel | Online Direct-to-Consumer (D2C) Brands Multi-brand E-commerce Platforms Specialty Sports Retailers Department Stores & Hypermarkets |

| By Distribution Mode | Wholesale Retail E-commerce |

| By Price Range | Budget Mid-Range Premium |

| By Brand Loyalty | Established Global Brands Local Spanish Brands Private Labels |

| By Fabric Type | Synthetic Fabrics Natural Fabrics Blended Fabrics |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences in Sports Apparel | 120 | Active Consumers, Fitness Enthusiasts |

| Retail Insights from Sports Apparel Stores | 80 | Store Managers, Sales Representatives |

| Trends in Athleisure Wear | 100 | Fashion Retail Buyers, Trend Analysts |

| Impact of Social Media on Sports Apparel Purchases | 60 | Social Media Influencers, Digital Marketers |

| Consumer Attitudes towards Sustainability in Apparel | 70 | Sustainability Advocates, Eco-conscious Consumers |

The Spain Sports Apparel and Athleisure Market is valued at approximately USD 6.1 billion, reflecting a significant growth trend driven by increasing health consciousness and the popularity of athleisure wear as everyday clothing.