Region:Middle East

Author(s):Geetanshi

Product Code:KRAD7345

Pages:80

Published On:December 2025

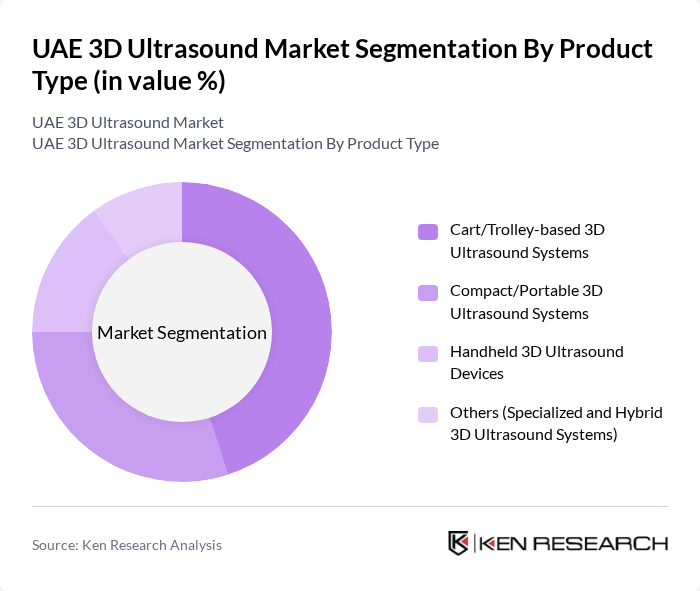

By Product Type:The product type segmentation includes various categories of 3D ultrasound systems, each catering to different healthcare needs. The dominant sub-segment in this category is the Cart/Trolley-based 3D Ultrasound Systems, which are widely used in hospitals and large diagnostic centers due to their higher performance, advanced imaging modes, and suitability for high-volume workflows. Compact/Portable 3D Ultrasound Systems are also gaining traction, especially in outpatient settings, emergency departments, and secondary care hospitals, due to their mobility, ease of deployment, and improving image quality. Handheld devices are emerging as a convenient option for point-of-care diagnostics, home and remote monitoring, and rapid triage, while specialized and hybrid systems are tailored for specific medical applications such as cardiology, obstetrics and gynecology, and interventional procedures.

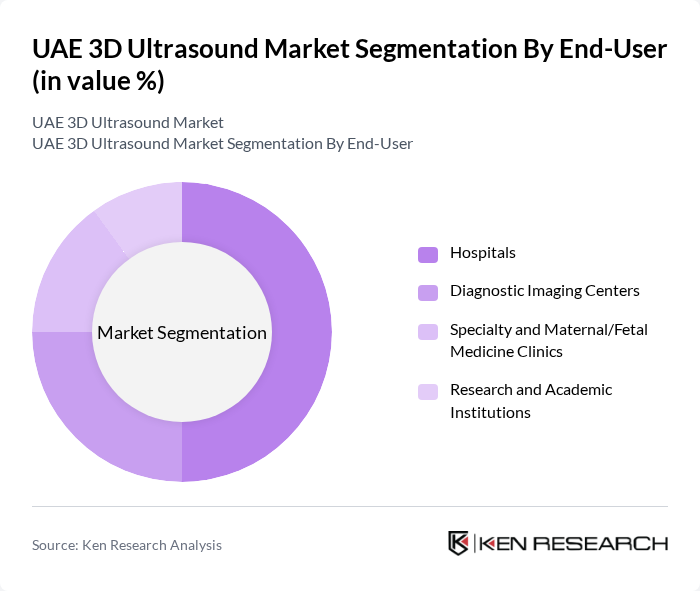

By End-User:The end-user segmentation highlights the various healthcare facilities utilizing 3D ultrasound technology. Hospitals represent the largest segment, driven by the need for comprehensive diagnostic services, advanced imaging capabilities across multiple departments, and continuous investments in upgrading radiology and women’s health equipment. Diagnostic Imaging Centers are also significant users, focusing on specialized imaging services for obstetrics, gynecology, cardiology, and general imaging, often leveraging high-end 3D and 4D systems to differentiate their service offerings. Specialty and Maternal/Fetal Medicine Clinics are increasingly adopting 3D ultrasound for prenatal care, fetal anomaly screening, and patient experience enhancement, while Research and Academic Institutions utilize these systems for educational purposes, clinical research, and protocol development. The growing emphasis on maternal and fetal health, along with broader preventive screening programs, is particularly boosting the demand in specialty clinics.

The UAE 3D Ultrasound Market is characterized by a dynamic mix of regional and international players. Leading participants such as GE HealthCare Technologies Inc., Philips Healthcare (Koninklijke Philips N.V.), Siemens Healthineers AG, Canon Medical Systems Corporation, Fujifilm Healthcare Corporation, Hitachi Healthcare (Fujifilm Sonosite, Inc.), Samsung Medison Co., Ltd., Shenzhen Mindray Bio-Medical Electronics Co., Ltd., Esaote S.p.A., Hologic, Inc., Alpinion Medical Systems Co., Ltd., Shenzhen SonoScape Medical Corp., Clarius Mobile Health Corp., Butterfly Network, Inc., United Imaging Healthcare Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE 3D ultrasound market appears promising, driven by ongoing technological innovations and a growing emphasis on patient-centered care. As healthcare facilities increasingly adopt portable ultrasound devices, the accessibility of imaging services is expected to improve significantly. Furthermore, the integration of artificial intelligence in imaging processes is anticipated to enhance diagnostic accuracy and efficiency, paving the way for more personalized healthcare solutions. The market is poised for growth as stakeholders recognize the value of advanced imaging in improving patient outcomes.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Cart/Trolley-based 3D Ultrasound Systems Compact/Portable 3D Ultrasound Systems Handheld 3D Ultrasound Devices Others (Specialized and Hybrid 3D Ultrasound Systems) |

| By End-User | Hospitals Diagnostic Imaging Centers Specialty and Maternal/Fetal Medicine Clinics Research and Academic Institutions |

| By Clinical Application | Obstetrics and Gynecology Cardiology and Vascular Imaging Radiology and General Imaging Urology and Other Applications |

| By Technology | D Ultrasound Imaging D Ultrasound Imaging D/4D Doppler Ultrasound Others (Fusion Imaging, AI-enabled 3D Ultrasound) |

| By Distribution Channel | Direct Sales (Subsidiaries and Local Offices) Authorized Local Distributors Online and E-Procurement Platforms Others (Group Purchasing & Tender-Based Channels) |

| By Emirate | Abu Dhabi Dubai Sharjah Other Emirates (Ajman, Fujairah, Ras Al Khaimah, Umm Al Quwain) |

| By Ownership & Policy Support | Public Sector Healthcare Facilities Private Sector Healthcare Facilities Public–Private Partnership (PPP) Projects Facilities Benefiting from Government Incentives and Grants |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Obstetric Ultrasound Services | 45 | Obstetricians, Ultrasound Technicians |

| Cardiology Imaging Solutions | 40 | Cardiologists, Medical Imaging Directors |

| Musculoskeletal Imaging Practices | 35 | Orthopedic Surgeons, Radiology Managers |

| Healthcare Equipment Procurement | 40 | Healthcare Administrators, Procurement Officers |

| Medical Device Distributors | 30 | Sales Managers, Product Specialists |

The UAE 3D Ultrasound Market is valued at approximately USD 45 million, reflecting a significant share of the overall ultrasound devices market in the country, driven by advancements in medical imaging technology and increasing healthcare expenditure.