Region:Middle East

Author(s):Shubham

Product Code:KRAD2013

Pages:82

Published On:December 2025

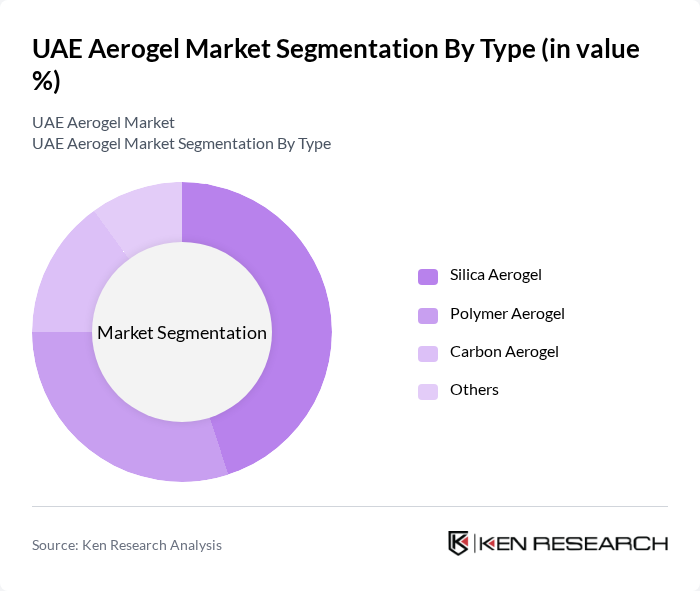

By Type:The aerogel market in the UAE is segmented into four main types: Silica Aerogel, Polymer Aerogel, Carbon Aerogel, and Others. Among these, Silica Aerogel is the most dominant due to its superior thermal insulation properties and lightweight characteristics, making it highly sought after in construction and aerospace applications. The increasing focus on energy efficiency and sustainability in building materials further drives the demand for Silica Aerogel, positioning it as a preferred choice for various insulation needs.

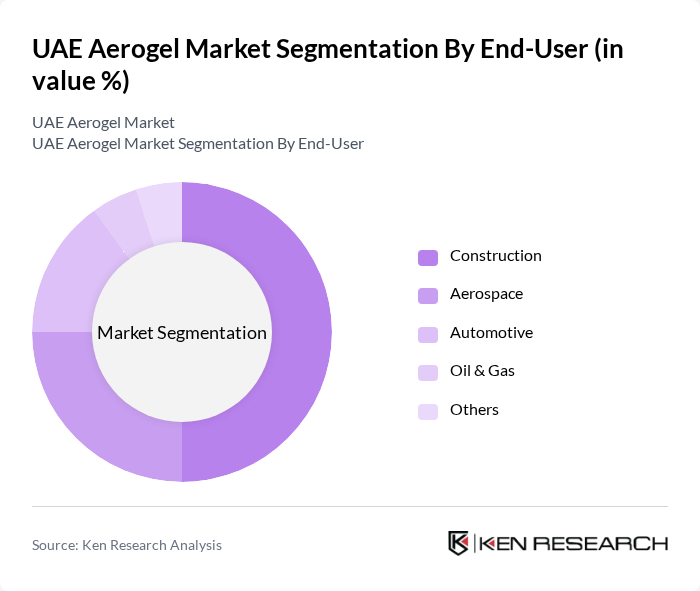

By End-User:The end-user segmentation of the UAE Aerogel Market includes Construction, Aerospace, Automotive, Oil & Gas, and Others. The Construction sector leads the market, driven by the growing demand for energy-efficient building materials and the implementation of stringent building codes focused on sustainability. The aerospace industry also significantly contributes to market growth, as aerogels are increasingly used in thermal insulation for aircraft, enhancing fuel efficiency and performance.

The UAE Aerogel Market is characterized by a dynamic mix of regional and international players. Leading participants such as Aspen Aerogels, Cabot Corporation, Aerogel Technologies, BASF SE, Dow Chemical Company, 3M Company, Nano High-Tech, JIOS Aerogel, Armacell International, Insulon, Thermal Insulation Solutions, Aerogel Technologies LLC, GCP Applied Technologies, Superglass Insulation, Aerogel Solutions contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE aerogel market appears promising, driven by technological innovations and a growing focus on sustainability. Advances in aerogel production techniques are expected to lower costs and enhance material properties, making them more accessible for various applications. Additionally, as the UAE continues to invest in energy-efficient infrastructure and green building initiatives, the demand for aerogels is likely to increase, positioning them as a key player in the region's construction and energy sectors.

| Segment | Sub-Segments |

|---|---|

| By Type | Silica Aerogel Polymer Aerogel Carbon Aerogel Others |

| By End-User | Construction Aerospace Automotive Oil & Gas Others |

| By Application | Thermal Insulation Acoustic Insulation Oil & Gas Applications Others |

| By Form | Blanket Granules Coatings Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | Abu Dhabi Dubai Sharjah Others |

| By Policy Support | Government Subsidies Tax Incentives Research Grants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Sector Applications | 100 | Project Managers, Architects |

| Aerospace Industry Utilization | 75 | Engineering Managers, Product Development Leads |

| Oil & Gas Sector Insulation | 60 | Procurement Managers, Safety Officers |

| Consumer Goods Packaging | 50 | Product Managers, Supply Chain Analysts |

| Research & Development Insights | 80 | R&D Directors, Material Scientists |

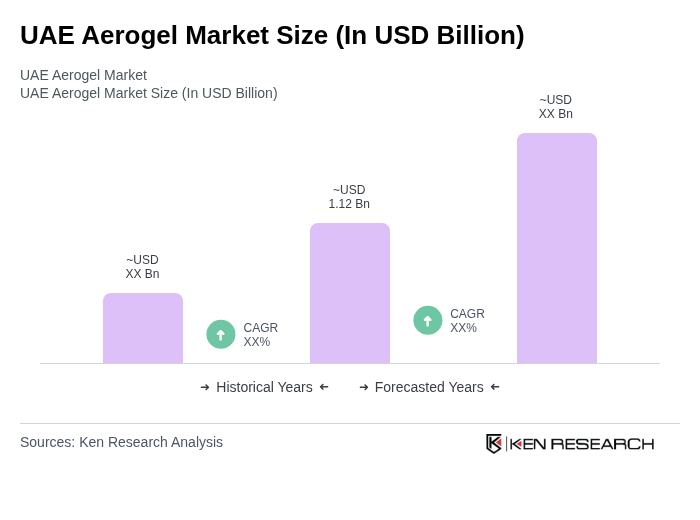

The UAE Aerogel Market is valued at approximately USD 1.12 billion, reflecting a robust demand for lightweight and energy-efficient insulation materials across various sectors, including construction, oil & gas, automotive, and aerospace.