Region:Middle East

Author(s):Shubham

Product Code:KRAA8518

Pages:85

Published On:November 2025

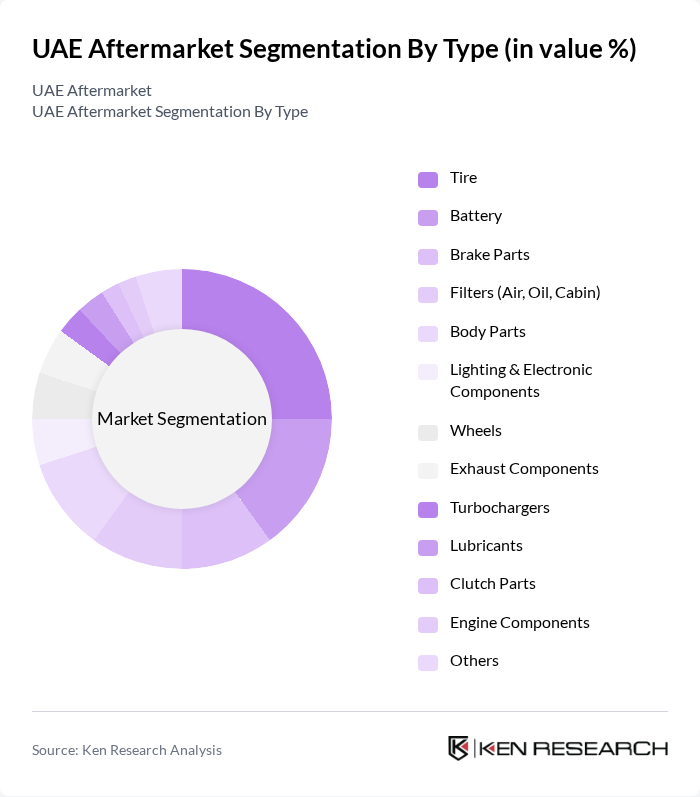

By Type:The market is segmented into various types of automotive parts, including Tire, Battery, Brake Parts, Filters (Air, Oil, Cabin), Body Parts, Lighting & Electronic Components, Wheels, Exhaust Components, Turbochargers, Lubricants, Clutch Parts, Engine Components, and Others. Among these, the Tire segment is currently dominating the market due to the high frequency of tire replacements driven by wear and tear, as well as seasonal changes that necessitate tire changes. The growing awareness of road safety and performance also influences consumer preferences towards high-quality tires.

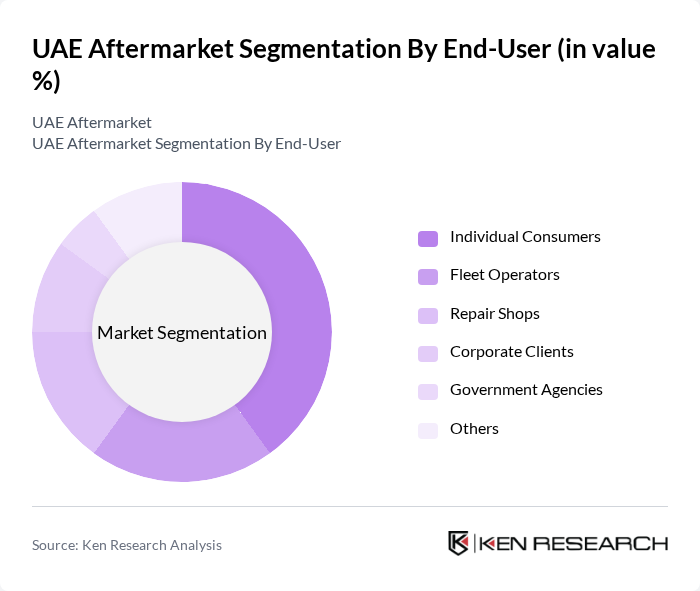

By End-User:The end-user segmentation includes Individual Consumers, Fleet Operators, Repair Shops, Corporate Clients, Government Agencies, and Others. The Individual Consumers segment is leading the market, driven by the increasing number of personal vehicles and the growing trend of DIY maintenance among car owners. This segment's growth is further supported by the rising disposable income, with per capita income averaging over USD 45,000, and the increasing awareness of vehicle upkeep among consumers.

The UAE Aftermarket Automotive Parts market is characterized by a dynamic mix of regional and international players. Leading participants such as Al-Futtaim Automotive, Al Naboodah Group Enterprises, Al Tayer Motors, Central Trading Company LLC, Galadari Automobiles Co. Ltd, Arabian Automobiles Company, Union Auto Parts, Bosch Middle East, ACDelco (General Motors), Zafco Trading LLC, Al Masaood Automobiles, Emirates Motor Company, Al Habtoor Motors, Al Majid Motors, Bridgestone Middle East & Africa FZE contribute to innovation, geographic expansion, and service delivery in this space.

The UAE aftermarket industry is poised for transformative growth, driven by technological advancements and evolving consumer preferences. The increasing adoption of electric vehicles (EVs) is expected to reshape the aftermarket landscape, with a projected 20% of new vehicle sales being EVs in future. Additionally, the integration of smart automotive technologies will enhance service offerings, creating new revenue streams. As the market adapts to these trends, businesses that embrace innovation and sustainability will likely thrive in this dynamic environment.

| Segment | Sub-Segments |

|---|---|

| By Type | Tire Battery Brake Parts Filters (Air, Oil, Cabin) Body Parts Lighting & Electronic Components Wheels Exhaust Components Turbochargers Lubricants Clutch Parts Engine Components Others |

| By End-User | Individual Consumers Fleet Operators Repair Shops Corporate Clients Government Agencies Others |

| By Vehicle Type | Passenger Cars Commercial Vehicles Two-Wheelers Heavy-Duty Vehicles Others |

| By Distribution Channel | Retailers Wholesalers Distributors Online Retail Others |

| By Region | Abu Dhabi Dubai Sharjah Ajman Ras Al Khaimah Fujairah Others |

| By Product Lifecycle Stage | New Parts Remanufactured Parts Used Parts Others |

| By Service Type | Maintenance Services Repair Services Customization Services Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Parts Retailers | 60 | Store Managers, Sales Executives |

| Service Center Operations | 50 | Service Managers, Technicians |

| Consumer Insights on Aftermarket Products | 100 | Car Owners, Automotive Enthusiasts |

| Distribution Channels Analysis | 40 | Logistics Managers, Supply Chain Analysts |

| Market Trends in Electric Vehicle Aftermarket | 40 | EV Owners, Industry Experts |

The UAE Aftermarket Automotive Parts Market is valued at approximately USD 7.3 billion, driven by increasing vehicle ownership, demand for maintenance, and customization trends among consumers.