Region:Middle East

Author(s):Shubham

Product Code:KRAB8026

Pages:99

Published On:October 2025

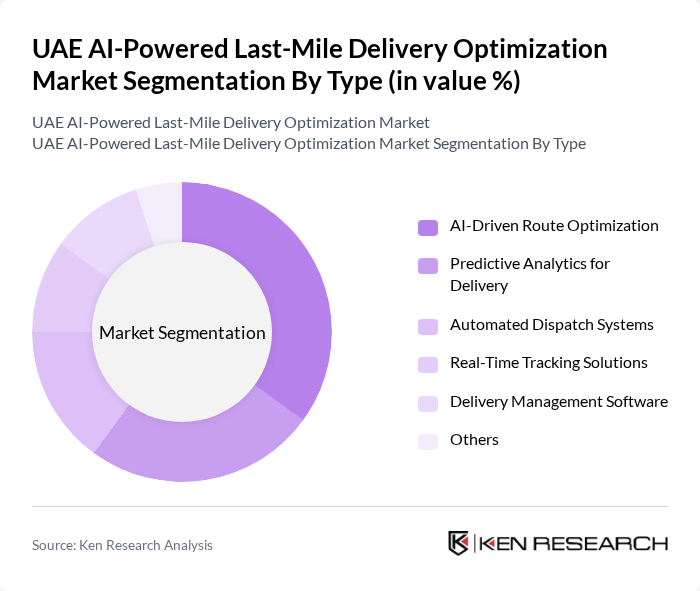

By Type:The market is segmented into various types of AI-powered solutions that enhance last-mile delivery efficiency. The subsegments include AI-Driven Route Optimization, Predictive Analytics for Delivery, Automated Dispatch Systems, Real-Time Tracking Solutions, Delivery Management Software, and Others. Among these, AI-Driven Route Optimization is the leading subsegment, as it significantly reduces delivery times and operational costs by utilizing advanced algorithms to determine the most efficient routes. The increasing demand for timely deliveries in e-commerce and logistics sectors drives the adoption of this technology.

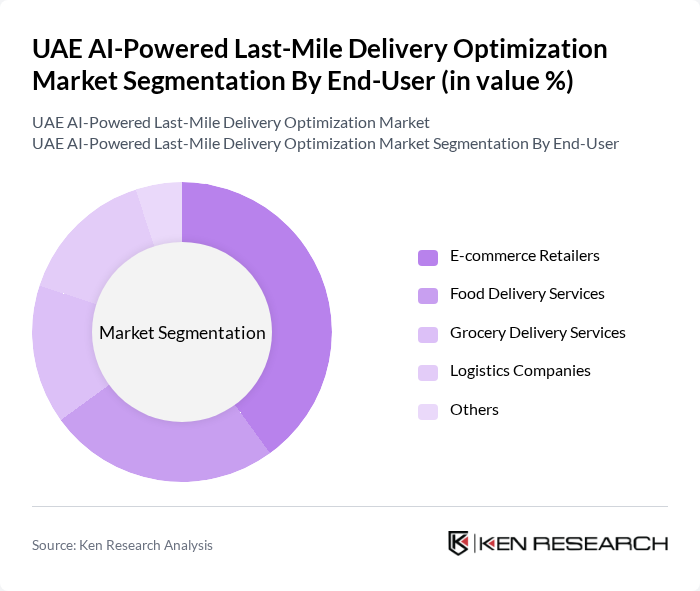

By End-User:The end-user segmentation includes E-commerce Retailers, Food Delivery Services, Grocery Delivery Services, Logistics Companies, and Others. E-commerce Retailers dominate this segment, driven by the surge in online shopping and the need for efficient delivery solutions. The growing consumer preference for home delivery services has led to increased investments in AI-powered last-mile delivery technologies by e-commerce platforms, enhancing their operational capabilities and customer satisfaction.

The UAE AI-Powered Last-Mile Delivery Optimization Market is characterized by a dynamic mix of regional and international players. Leading participants such as Fetchr, Talabat, Zajel, Aramex, DHL Express, UPS, Noon, Amazon, Carrefour, Deliveroo, Postaplus, Emirates Post, MenaPay, Qwik, Fadfree contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE AI-powered last-mile delivery optimization market appears promising, driven by technological advancements and increasing consumer expectations. As urbanization continues, with the population projected to reach 10 million in future, logistics companies will need to adapt to the growing demand for efficient delivery solutions. The integration of AI technologies will enhance operational efficiency, while partnerships with e-commerce platforms will further streamline logistics processes, ensuring timely deliveries and improved customer satisfaction.

| Segment | Sub-Segments |

|---|---|

| By Type | AI-Driven Route Optimization Predictive Analytics for Delivery Automated Dispatch Systems Real-Time Tracking Solutions Delivery Management Software Others |

| By End-User | E-commerce Retailers Food Delivery Services Grocery Delivery Services Logistics Companies Others |

| By Delivery Mode | B2C Delivery B2B Delivery C2C Delivery Same-Day Delivery Scheduled Delivery Others |

| By Geographic Coverage | Urban Areas Suburban Areas Rural Areas Cross-Border Delivery Others |

| By Customer Segment | Individual Consumers Small Businesses Large Enterprises Government Agencies Others |

| By Delivery Vehicle Type | Motorcycles Vans Drones Electric Vehicles Others |

| By Pricing Model | Pay-Per-Delivery Subscription-Based Tiered Pricing Dynamic Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Last-Mile Delivery | 150 | Logistics Managers, E-commerce Directors |

| Food Delivery Services | 100 | Operations Managers, Delivery Coordinators |

| Technology Providers for AI Logistics | 80 | Product Managers, Software Engineers |

| Consumer Insights on Delivery Preferences | 200 | End Consumers, E-commerce Shoppers |

| Government and Regulatory Bodies | 50 | Policy Makers, Transportation Officials |

The UAE AI-Powered Last-Mile Delivery Optimization Market is valued at approximately USD 1.2 billion, driven by the rapid growth of e-commerce and advancements in AI technologies that enhance operational efficiency in logistics.