Region:Middle East

Author(s):Rebecca

Product Code:KRAC8510

Pages:100

Published On:November 2025

By Type:The biodegradable plastic market is segmented into starch-based plastics, PLA (Polylactic Acid), PHA (Polyhydroxyalkanoates), PBAT (Polybutylene Adipate Terephthalate), and other biodegradable plastics. PLA is gaining significant traction due to its versatility and wide application in packaging and consumer goods. Starch-based plastics remain popular, especially in food packaging, for their cost-effectiveness and biodegradability. The demand for sustainable packaging solutions and compliance with new regulatory standards are accelerating the growth of these subsegments .

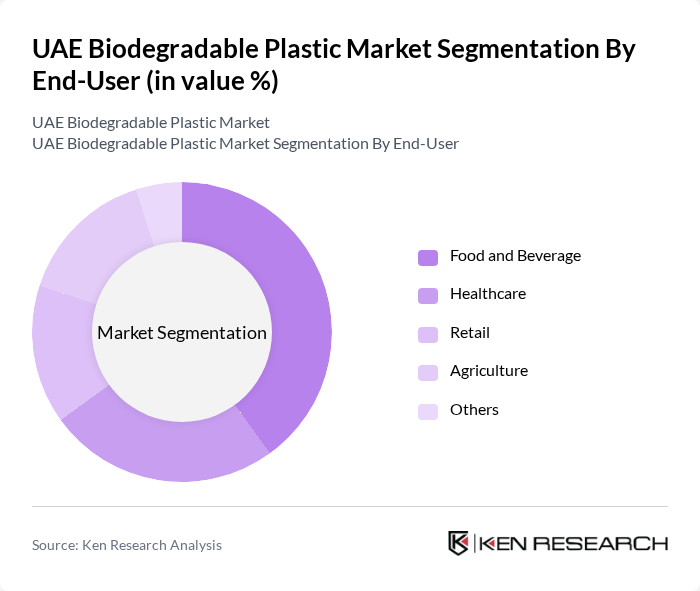

By End-User:The end-user segmentation includes food and beverage, healthcare, retail, agriculture, and others. The food and beverage sector is the largest consumer of biodegradable plastics, driven by the increasing demand for sustainable packaging solutions and regulatory compliance. The healthcare sector is also emerging as a significant user, utilizing biodegradable materials for medical disposables and packaging. Growing environmental awareness and sustainability commitments among businesses are pushing various industries to adopt biodegradable alternatives .

The UAE Biodegradable Plastic Market is characterized by a dynamic mix of regional and international players. Leading participants such as Ecoway Biopolymers LLC (MYEARTH), EcoPack Solutions, Avani Eco, Novamont S.p.A., BASF SE, NatureWorks LLC, TIPA Corp, TotalEnergies Corbion PLA, Earthpack, Vegware, Biome Bioplastics Ltd, Plantic Technologies, Green Dot Bioplastics, Biofase, and Cardia Bioplastics contribute to innovation, geographic expansion, and service delivery in this space .

The future of the UAE biodegradable plastic market appears promising, driven by increasing environmental regulations and consumer demand for sustainable products. As the government continues to enforce stricter regulations on plastic usage, manufacturers are likely to invest more in research and development of innovative biodegradable materials. Additionally, the growing trend towards e-commerce is expected to further boost the demand for biodegradable packaging solutions, creating a robust market landscape for eco-friendly alternatives in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Starch-based Plastics PLA (Polylactic Acid) PHA (Polyhydroxyalkanoates) PBAT (Polybutylene Adipate Terephthalate) Other Biodegradable Plastics |

| By End-User | Food and Beverage Healthcare Retail Agriculture Others |

| By Application | Packaging Disposable Tableware Agricultural Films Medical Applications Others |

| By Distribution Channel | Online Retail Supermarkets/Hypermarkets Specialty Stores Direct Sales Others |

| By Region | Abu Dhabi Dubai Sharjah Ajman Others |

| By Material Source | Renewable Resources Recycled Materials Biowaste Others |

| By Product Form | Films Bags Containers Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food Packaging Sector | 100 | Packaging Managers, Sustainability Coordinators |

| Agricultural Applications | 60 | Agronomists, Farm Managers |

| Consumer Goods Industry | 70 | Product Managers, Marketing Directors |

| Retail Sector Insights | 50 | Retail Managers, Supply Chain Analysts |

| Environmental NGOs Feedback | 40 | Policy Advocates, Environmental Scientists |

The UAE Biodegradable Plastic Market is valued at approximately USD 12 million, reflecting a growing trend towards sustainable materials driven by environmental awareness and government regulations promoting eco-friendly products.