Region:Middle East

Author(s):Shubham

Product Code:KRAD6687

Pages:82

Published On:December 2025

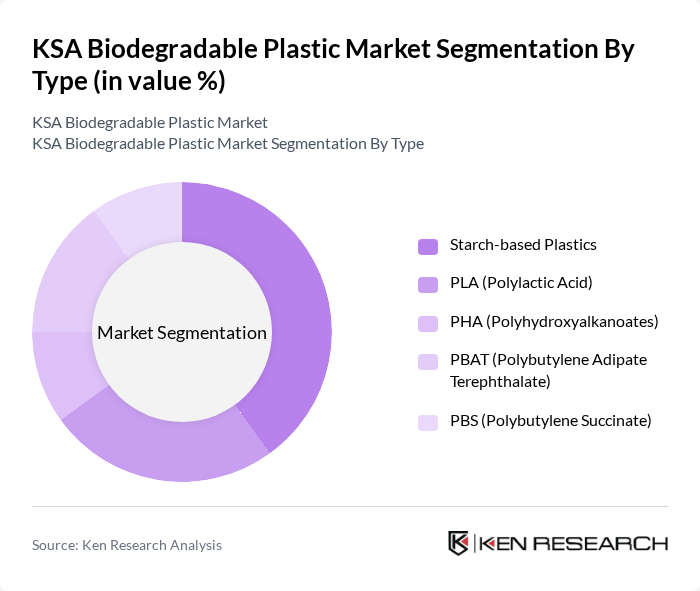

By Type:The biodegradable plastic market can be segmented into various types, including starch-based plastics, PLA (Polylactic Acid), PHA (Polyhydroxyalkanoates), PBAT (Polybutylene Adipate Terephthalate), and PBS (Polybutylene Succinate). In KSA, starch-based plastics currently represent the leading subsegment in terms of revenue, supported by their cost-effectiveness and suitability for carrier bags and flexible packaging, while PLA, PBAT, PBS, and PHA are gaining traction in rigid packaging, disposable items, and agricultural films. Growing interest from food service operators, retailers, and brand owners in compostable and bio-based formats is reinforcing demand for these materials across multiple applications.

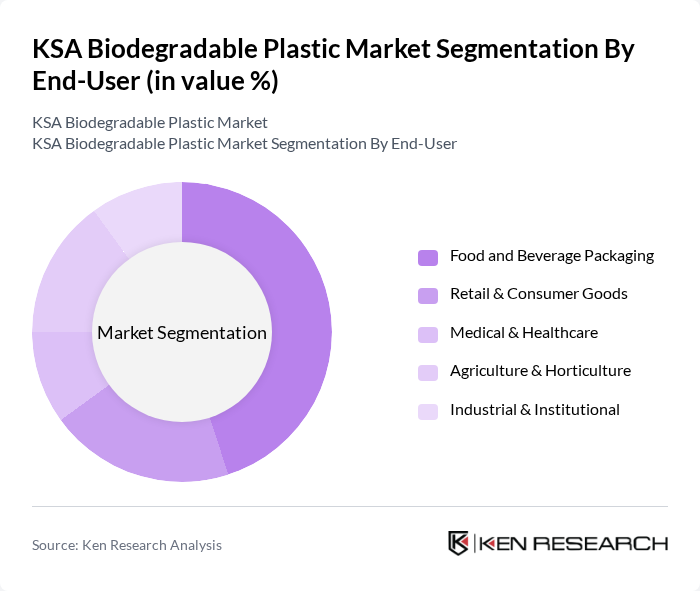

By End-User:The end-user segmentation includes food and beverage packaging, retail & consumer goods, medical & healthcare, agriculture & horticulture, and industrial & institutional applications. The food and beverage packaging segment is the most significant contributor to the market, driven by high consumption of single-use foodservice items, takeaway packaging, and flexible packs where brand owners are actively shifting to biodegradable or compostable alternatives. This trend is fueled by consumer awareness regarding environmental issues, retailer sustainability commitments, and the need for compliance with government standards on plastic waste reduction and biodegradable product specifications.

The KSA Biodegradable Plastic Market is characterized by a dynamic mix of regional and international players. Leading participants such as SABIC (Saudi Basic Industries Corporation), Saudi Top Plastic Factory (Top Plastic), Napco National Packaging Co., Takween Advanced Industries, Zamil Plastic Industries Ltd., Al Watania Plastics, Intercare Limited (Saudi Arabia), Balfakih Plastic Factory, Riyadh Plastic Factory, Al-Jabr Plastic Factory, BASF SE, TotalEnergies Corbion PLA, NatureWorks LLC, Novamont S.p.A., FKuR Kunststoff GmbH contribute to innovation, geographic expansion, and service delivery in this space.

The future of the KSA biodegradable plastic market appears promising, driven by a combination of regulatory support and shifting consumer preferences towards sustainable products. As the government continues to enforce stricter regulations on plastic waste and promotes eco-friendly initiatives, the market is likely to witness increased investment in biodegradable technologies. Additionally, the growing trend of sustainability in various sectors, including retail and food services, will further enhance the adoption of biodegradable plastics, creating a robust market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Starch-based Plastics PLA (Polylactic Acid) PHA (Polyhydroxyalkanoates) PBAT (Polybutylene Adipate Terephthalate) PBS (Polybutylene Succinate) |

| By End-User | Food and Beverage Packaging Retail & Consumer Goods Medical & Healthcare Agriculture & Horticulture Industrial & Institutional |

| By Application | Flexible & Rigid Packaging Bags & Carrier Bags Disposable Tableware & Foodservice Items Agricultural Mulch Films & Plant Pots Medical & Hygiene Products |

| By Distribution Channel | Direct Sales to Converters & Brand Owners Industrial Distributors E-commerce & Online B2B Platforms Retail & Cash-and-Carry Others |

| By Region | Central Region (incl. Riyadh) Eastern Region (incl. Dammam & Jubail) Western Region (incl. Jeddah & Makkah) Southern Region |

| By Material Source | Corn & Sugarcane-based Feedstock Starch & Other Agricultural Residues Petroleum-based Biodegradable Polymers Blends & Compounds |

| By Product Form | Films & Sheets Bags & Sacks Rigid Containers & Trays Fibers, Moulded Articles & Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Packaging Industry Stakeholders | 120 | Product Managers, Sustainability Coordinators |

| Agricultural Sector Users | 80 | Farm Managers, Agricultural Product Distributors |

| Consumer Goods Manufacturers | 70 | Operations Managers, R&D Directors |

| Environmental Regulatory Bodies | 40 | Policy Makers, Environmental Analysts |

| Retail Sector Decision Makers | 90 | Supply Chain Managers, Procurement Officers |

The KSA Biodegradable Plastic Market is valued at approximately USD 120 million, reflecting a significant growth trend driven by increasing environmental awareness and government initiatives promoting sustainable materials.