Region:Middle East

Author(s):Dev

Product Code:KRAD5263

Pages:82

Published On:December 2025

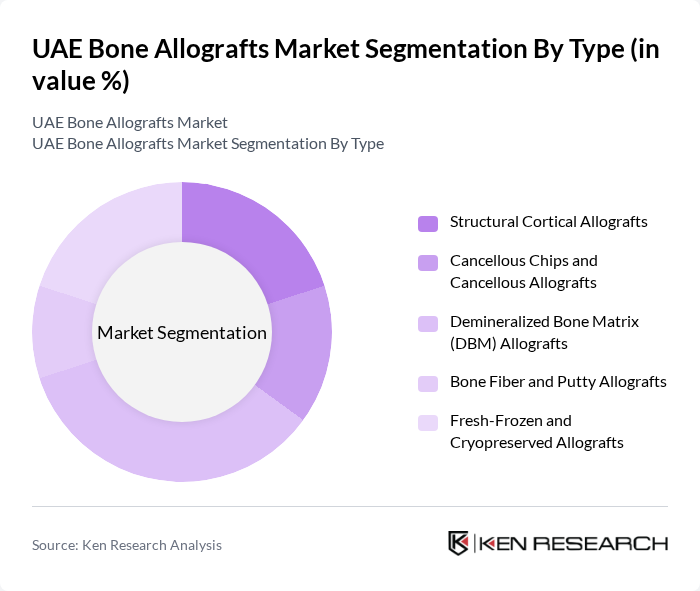

By Type:The market is segmented into various types of bone allografts, including Structural Cortical Allografts, Cancellous Chips and Cancellous Allografts, Demineralized Bone Matrix (DBM) Allografts, Bone Fiber and Putty Allografts, and Fresh-Frozen and Cryopreserved Allografts. This portfolio reflects the broader bone grafts and substitutes category, where allografts account for a substantial share of clinical use in orthopedic and dental procedures. Among these, Demineralized Bone Matrix (DBM) Allografts are leading the market due to their versatility and effectiveness in promoting bone healing and regeneration, as DBM provides osteoinductive growth factors in an easy-to-handle form. The increasing preference for minimally invasive surgical techniques, the growing adoption of DBM in orthopedic and dental applications, and the rising number of spinal fusion and dental implant procedures in the UAE are driving this segment's growth.

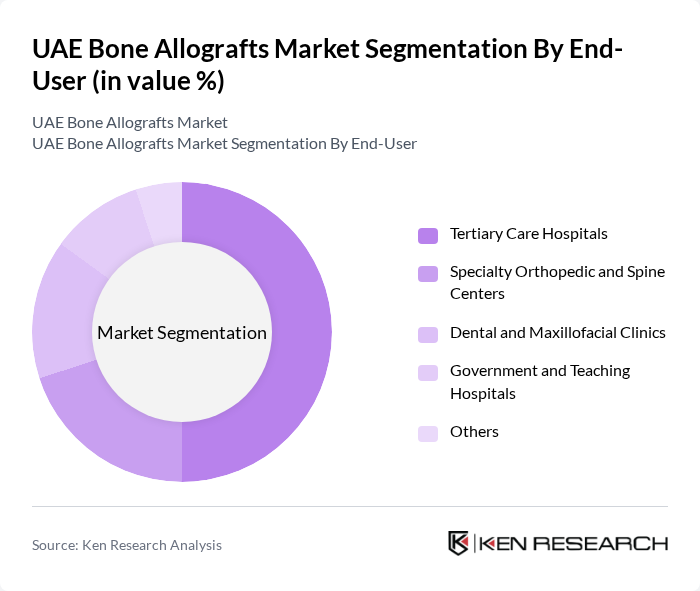

By End-User:The end-user segmentation includes Tertiary Care Hospitals, Specialty Orthopedic and Spine Centers, Dental and Maxillofacial Clinics, Government and Teaching Hospitals, and Others. Tertiary Care Hospitals dominate this segment due to their comprehensive services and advanced surgical capabilities, particularly in complex trauma, spine, and joint replacement surgeries where allografts are routinely used. These hospitals are equipped with state-of-the-art technology, multidisciplinary teams, and access to accredited tissue products, making them the preferred choice for complex orthopedic procedures that require the use of bone allografts, while specialty centers and dental clinics are rapidly increasing their utilization in niche and high-volume procedures.

The UAE Bone Allografts Market is characterized by a dynamic mix of regional and international players. Leading participants such as Medtronic plc, DePuy Synthes (Johnson & Johnson MedTech), Stryker Corporation, Zimmer Biomet Holdings Inc., AlloSource, LifeNet Health, Musculoskeletal Transplant Foundation (MTF Biologics), RTI Surgical, Integra LifeSciences, Bioventus LLC, Tissue Regenix Group plc, Orthofix Medical Inc., Geistlich Pharma AG, Baxter International Inc., Local and Regional Distributors (e.g., Gulf Drug LLC, Al Zahrawi Medical Supplies LLC) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE bone allografts market appears promising, driven by ongoing advancements in surgical techniques and a growing emphasis on patient-centric healthcare solutions. As healthcare infrastructure expands, the accessibility of allografts is expected to improve, facilitating better patient outcomes. Additionally, the integration of technology in surgical procedures will likely enhance the effectiveness of allografts, paving the way for innovative products that cater to the evolving needs of healthcare providers and patients alike.

| Segment | Sub-Segments |

|---|---|

| By Type | Structural Cortical Allografts Cancellous Chips and Cancellous Allografts Demineralized Bone Matrix (DBM) Allografts Bone Fiber and Putty Allografts Fresh-Frozen and Cryopreserved Allografts |

| By End-User | Tertiary Care Hospitals Specialty Orthopedic and Spine Centers Dental and Maxillofacial Clinics Government and Teaching Hospitals Others |

| By Application | Trauma and Fracture Management Joint Reconstruction and Revision Arthroplasty Spine Fusion and Deformity Correction Dental and Cranio-Maxillofacial Procedures Oncology and Bone Defect Reconstruction |

| By Source | Domestic Tissue Banks Imported Allografts Hospital-Based Tissue Programs Others |

| By Distribution Channel | Direct Sales to Hospitals and Clinics Authorized Medical Device Distributors Group Purchasing Organizations (GPOs) Others |

| By Region | Abu Dhabi Dubai Sharjah Ajman Others |

| By Regulatory Compliance | UAE MOHAP and DHA Approvals CE Marking FDA-Cleared Allograft Products ISO-Certified Tissue Banks and Facilities |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Orthopedic Surgeons | 60 | Surgeons specializing in joint replacement and trauma |

| Hospital Procurement Managers | 50 | Managers responsible for purchasing medical supplies and devices |

| Healthcare Policy Makers | 40 | Officials involved in healthcare regulations and standards |

| Patients with Bone Allograft Experience | 70 | Individuals who have undergone surgeries using bone allografts |

| Medical Device Manufacturers | 40 | Executives from companies producing bone allografts and related products |

The UAE Bone Allografts Market is valued at approximately USD 20 million, reflecting a significant share within the national bone grafts and substitutes segment, driven by increasing orthopedic surgeries and advancements in surgical techniques.