Region:Middle East

Author(s):Dev

Product Code:KRAD6402

Pages:96

Published On:December 2025

By Service Type:The service type segmentation includes various categories such as Customer Interaction Services, Finance & Accounting Outsourcing, Human Resource & Payroll Outsourcing, Procurement & Supply Chain Outsourcing, Knowledge Process & Analytics Services, Legal & Compliance Process Outsourcing, and Others. Customer Interaction Services, particularly customer experience and contact-center outsourcing, hold a leading share of the UAE BPO market, supported by strong demand from telecom, banking, government, and retail clients for omnichannel support, multilingual capabilities, and 24/7 service delivery. Companies are investing in contact centers, digital CX platforms, and analytics-driven customer experience solutions to enhance service delivery and customer satisfaction.

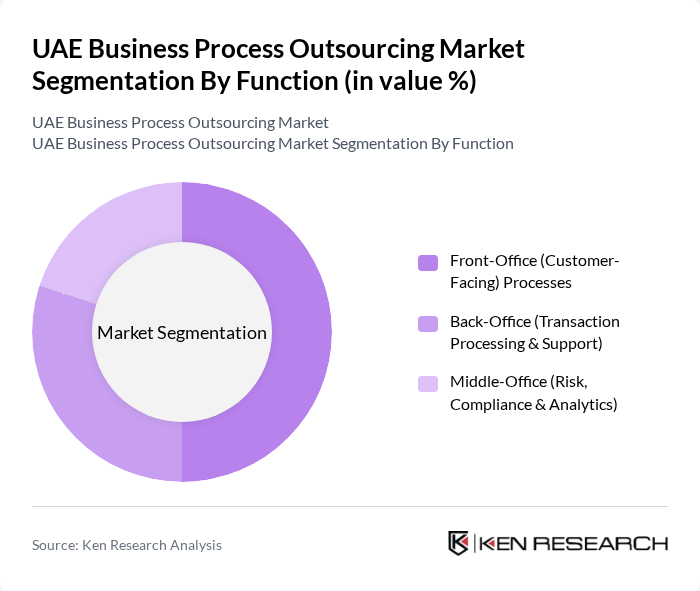

By Function:The function segmentation includes Front-Office (Customer-Facing) Processes, Back-Office (Transaction Processing & Support), and Middle-Office (Risk, Compliance & Analytics). The Front-Office processes dominate the market as businesses increasingly prioritize customer engagement, omnichannel service, and experience-led differentiation, reflecting broader regional trends where customer care and voice-processing services account for the largest share of BPO revenues. This trend is driven by the need for personalized services, faster response times, and the growing importance of real-time customer feedback and analytics in shaping business strategies.

The UAE Business Process Outsourcing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Etisalat by e& (Etisalat Services Holding / Eshraq Facilities Services & Contact Centers), du (Emirates Integrated Telecommunications Company) – Business & Contact Center Services, Emirates NBD – Shared Services & Operations Center, Dubai Government Shared Services (Dubai Digital / Dubai Smart Government), Teleperformance UAE, Concentrix UAE, Transguard Group – Contact Center & Business Support Services, Dulsco Group – Outsourcing & Managed Services, Serco Middle East, Expo City Dubai / Former Expo 2020 Shared Services Operations, IBM Middle East (UAE), Accenture Middle East (UAE), Wipro UAE, Infosys BPM – Middle East Operations, HCLTech (HCL Technologies) UAE contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE BPO market appears promising, driven by ongoing digital transformation and the increasing adoption of advanced technologies. As businesses continue to prioritize cost efficiency and customer experience, the demand for specialized outsourcing services is expected to rise. Additionally, the integration of AI and automation will likely reshape service delivery, enhancing operational efficiency. The market is poised for growth, with strategic partnerships and innovation playing crucial roles in shaping its trajectory.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Customer Interaction Services (Contact Center, CX) Finance & Accounting Outsourcing Human Resource & Payroll Outsourcing Procurement & Supply Chain Outsourcing Knowledge Process & Analytics Services Legal & Compliance Process Outsourcing Others (Data Entry, Document Management, PRO & Back-Office Services) |

| By Function | Front-Office (Customer-Facing) Processes Back-Office (Transaction Processing & Support) Middle-Office (Risk, Compliance & Analytics) |

| By End-User Industry | Banking, Financial Services & Insurance (BFSI) IT & Telecommunications Healthcare & Life Sciences Retail & E-Commerce Government & Public Sector Travel, Tourism & Hospitality Manufacturing & Industrial Real Estate & Construction Energy & Utilities Others |

| By Outsourcing Type | Onshore (Domestic) Outsourcing Nearshore Outsourcing Offshore Outsourcing |

| By Deployment / Delivery Model | On-Premise Cloud-Based / Hosted Hybrid Delivery |

| By Ownership Model | Captive / In-house Shared Service Centers Third-Party Service Providers |

| By Client Size | Large Enterprises Medium Enterprises Small Enterprises |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| IT Outsourcing Services | 70 | IT Managers, CTOs, Business Analysts |

| Customer Support Outsourcing | 60 | Customer Service Managers, Call Center Supervisors |

| HR Outsourcing Solutions | 50 | HR Directors, Talent Acquisition Managers |

| Finance and Accounting BPO | 40 | Finance Managers, CFOs, Accountants |

| Marketing and Sales Outsourcing | 50 | Marketing Directors, Sales Managers, Business Development Executives |

The UAE Business Process Outsourcing market is valued at approximately USD 5.1 billion, reflecting significant growth driven by demand for cost-effective solutions and technological advancements in areas such as cloud-based delivery and automation.