Region:Middle East

Author(s):Shubham

Product Code:KRAD3484

Pages:92

Published On:November 2025

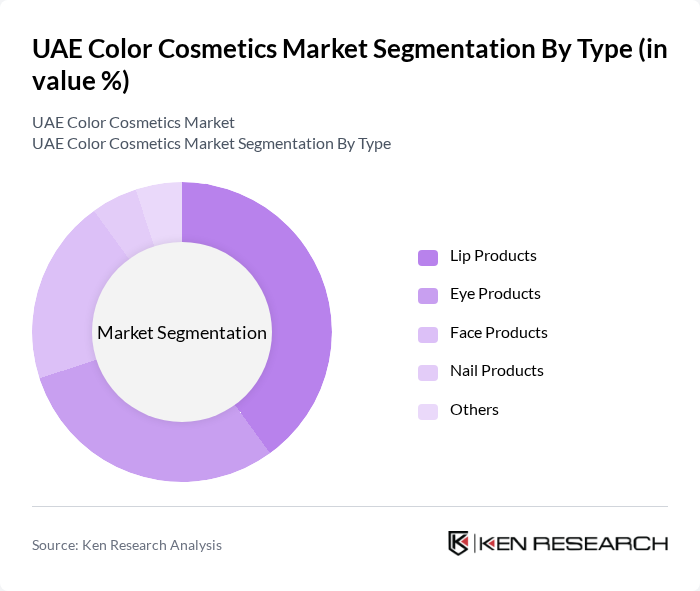

By Type:The market is segmented into various types, including Lip Products, Eye Products, Face Products, Nail Products, and Others. Among these, Lip Products dominate the market due to their high consumer demand and frequent usage. The trend of bold lip colors and innovative formulations has led to a significant increase in sales. Eye Products, including eyeliners and eyeshadows, also show strong performance, driven by the growing interest in eye makeup tutorials and social media influence.

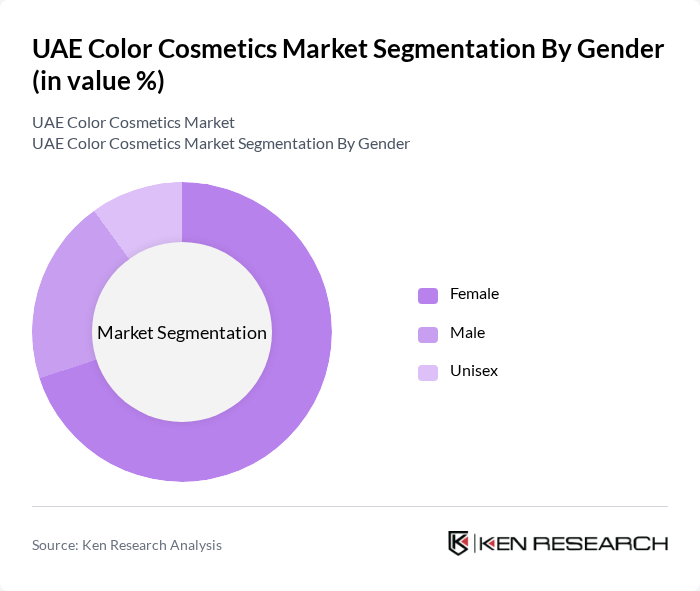

By Gender:The market is segmented by gender into Female, Male, and Unisex products. Female consumers dominate the market, accounting for a significant portion of color cosmetics sales. This is largely due to the traditional association of cosmetics with women's beauty routines. However, the Male segment is witnessing rapid growth as more men embrace grooming and beauty products, influenced by changing societal norms and increased marketing efforts targeting this demographic.

The UAE Color Cosmetics Market is characterized by a dynamic mix of regional and international players. Leading participants such as L'Oréal Middle East, Estée Lauder Companies Inc., Procter & Gamble, Unilever, Shiseido Company, Limited, Coty Inc., Revlon, Inc., Avon Products, Inc., Mary Kay Inc., Amway Corporation, Oriflame Cosmetics S.A., Beiersdorf AG, Clarins Group, Kiko Milano, Fenty Beauty, Huda Beauty, Kayali, Sephora Middle East, MAC Cosmetics, Charlotte Tilbury contribute to innovation, geographic expansion, and service delivery in this space.

The UAE color cosmetics market is poised for dynamic growth, driven by evolving consumer preferences and technological advancements. As the demand for clean beauty products continues to rise, brands are expected to innovate with transparency in ingredient sourcing. Additionally, the integration of augmented reality in online shopping experiences will enhance consumer engagement. The market is likely to see increased collaboration with local influencers, further driving brand loyalty and expanding reach within diverse consumer segments.

| Segment | Sub-Segments |

|---|---|

| By Type | Lip Products Eye Products Face Products Nail Products Others |

| By Gender | Female Male Unisex |

| By Distribution Channel | Online Retail Offline Retail Specialty Stores Supermarkets/Hypermarkets Others |

| By Price Range | Premium Mid-range Economy Others |

| By Packaging Type | Tube Jar Bottle Others |

| By Age Group | Teenagers Young Adults Middle-aged Adults Seniors |

| By Region | Abu Dhabi Dubai Sharjah Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Color Cosmetics Sales | 120 | Store Managers, Beauty Advisors |

| Online Color Cosmetics Purchases | 100 | E-commerce Managers, Digital Marketing Specialists |

| Consumer Preferences in Color Cosmetics | 150 | Female Consumers aged 18-45 |

| Trends in Makeup Artistry | 80 | Professional Makeup Artists, Beauty Influencers |

| Market Insights from Distributors | 70 | Distribution Managers, Supply Chain Coordinators |

The UAE Color Cosmetics Market is valued at approximately USD 200 million, reflecting a robust growth trajectory driven by increasing consumer demand for beauty products and innovative formulations that cater to diverse preferences.