Region:Middle East

Author(s):Geetanshi

Product Code:KRAA9041

Pages:96

Published On:November 2025

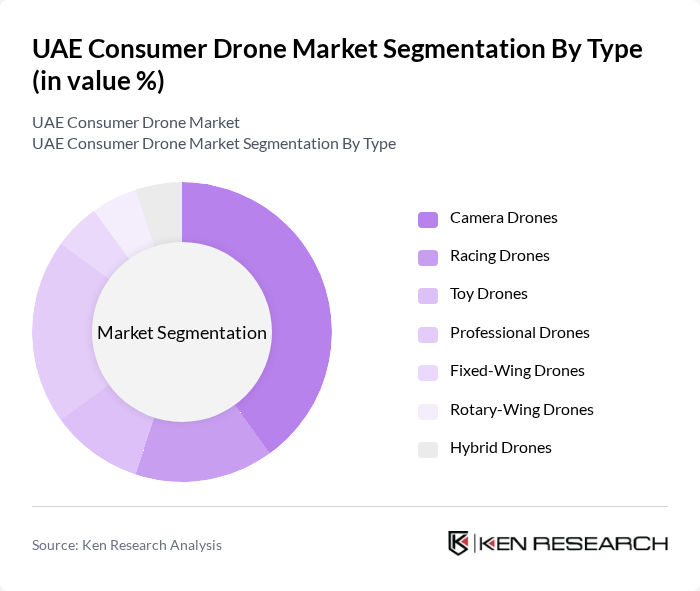

By Type:The market is segmented into various types of drones, including Camera Drones, Racing Drones, Toy Drones, Professional Drones, Fixed-Wing Drones, Rotary-Wing Drones, and Hybrid Drones. Among these, Camera Drones are the most popular due to their versatility and high demand for aerial photography and videography. Racing Drones are gaining traction among enthusiasts, while Toy Drones cater to the younger demographic. Professional Drones are increasingly used in commercial applications, contributing to market growth.

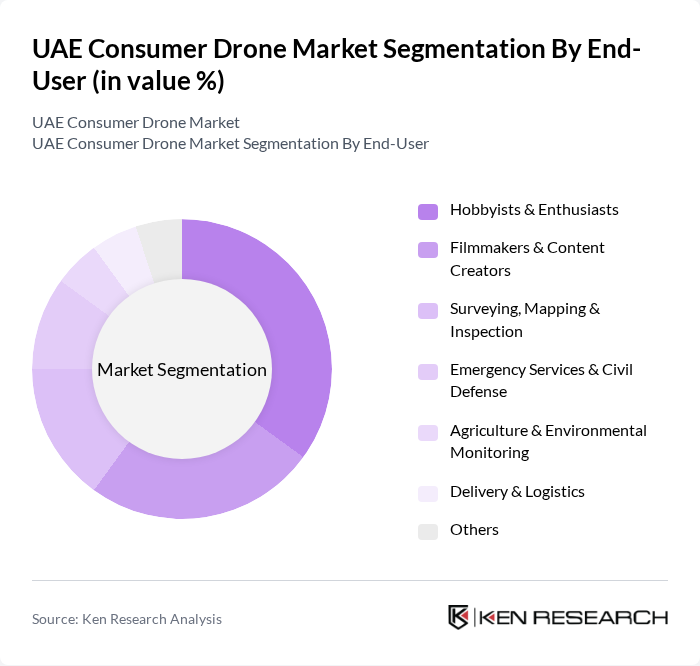

By End-User:The end-user segmentation includes Hobbyists & Enthusiasts, Filmmakers & Content Creators, Surveying, Mapping & Inspection, Emergency Services & Civil Defense, Agriculture & Environmental Monitoring, Delivery & Logistics, and Others. Hobbyists and Enthusiasts dominate the market, driven by the growing interest in drone racing and recreational flying. Filmmakers and content creators also represent a significant segment, utilizing drones for high-quality aerial footage. The increasing use of drones in agriculture and logistics is expected to further enhance market dynamics.

The UAE Consumer Drone Market is characterized by a dynamic mix of regional and international players. Leading participants such as DJI, Parrot Drones, Yuneec, Autel Robotics, Skydio, Holy Stone, Hubsan, Walkera, EHang, Aerialtronics, senseFly, Delair, Wingtra, Quantum Systems, Flyability, Falcon Eye Drones, Abu Dhabi Autonomous Systems Investments (ADASI), Keeta Drone, Thales Group, Boeing contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE consumer drone market appears promising, driven by ongoing technological innovations and increasing consumer engagement. As autonomous drone technology continues to evolve, we can expect enhanced functionalities that cater to diverse consumer needs. Furthermore, the integration of artificial intelligence and machine learning will likely improve user experience and operational efficiency, making drones more appealing to a wider audience. The market is poised for significant growth as these trends unfold, creating new opportunities for both consumers and businesses.

| Segment | Sub-Segments |

|---|---|

| By Type | Camera Drones Racing Drones Toy Drones Professional Drones Fixed-Wing Drones Rotary-Wing Drones Hybrid Drones |

| By End-User | Hobbyists & Enthusiasts Filmmakers & Content Creators Surveying, Mapping & Inspection Emergency Services & Civil Defense Agriculture & Environmental Monitoring Delivery & Logistics Others |

| By Region | Abu Dhabi Dubai Sharjah Ajman Ras Al Khaimah Fujairah Umm Al Quwain Others |

| By Technology | GPS-enabled Drones FPV (First Person View) Drones AI-integrated Drones Autonomous Drones Others |

| By Application | Aerial Photography & Videography Agricultural Monitoring & Crop Spraying Infrastructure & Construction Inspection Search and Rescue Operations Delivery & Logistics Environmental Monitoring Others |

| By Investment Source | Private Investments Government Funding Corporate Venture Capital Crowdfunding Others |

| By Policy Support | Government Grants Tax Incentives Regulatory Support Drone-Friendly Zones Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Drone Retail Market | 120 | Retail Managers, Sales Executives |

| Commercial Drone Applications | 100 | Business Owners, Operations Managers |

| Government Drone Usage | 80 | Public Sector Officials, Regulatory Bodies |

| Drone Enthusiast Community | 70 | Hobbyists, Drone Club Members |

| Drone Technology Innovators | 60 | R&D Managers, Product Developers |

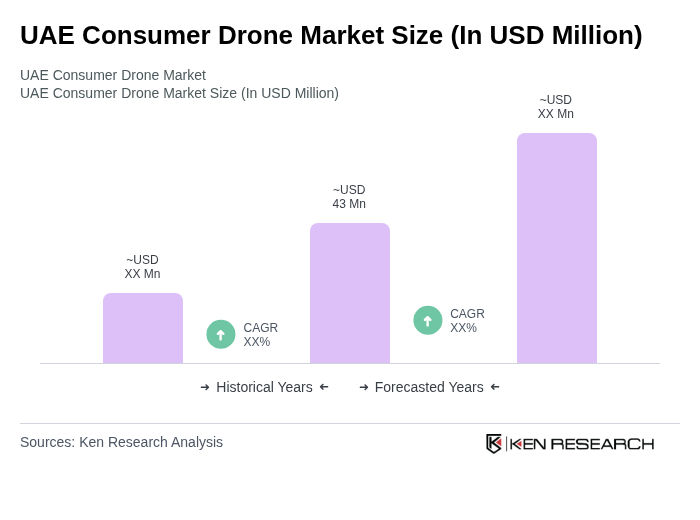

The UAE Consumer Drone Market is valued at approximately USD 43 million, reflecting significant growth driven by advancements in drone technology and increasing consumer interest in aerial photography and recreational applications.