Region:Middle East

Author(s):Geetanshi

Product Code:KRAE0693

Pages:92

Published On:December 2025

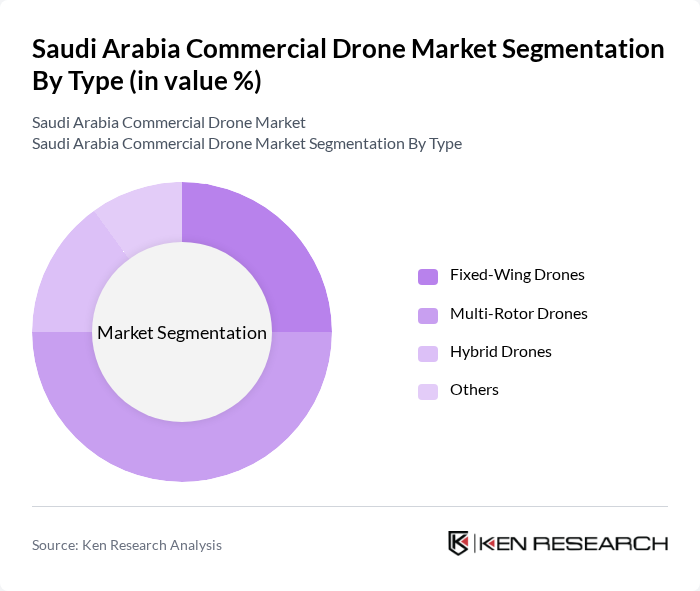

By Type:The commercial drone market in Saudi Arabia is segmented into Fixed-Wing Drones, Multi-Rotor Drones, Hybrid Drones, and Others. Among these, Multi-Rotor Drones dominate the market due to their versatility and ease of use in various applications such as aerial photography and inspections. The growing demand for real-time data collection and surveillance capabilities has further solidified their position as the preferred choice for many industries.

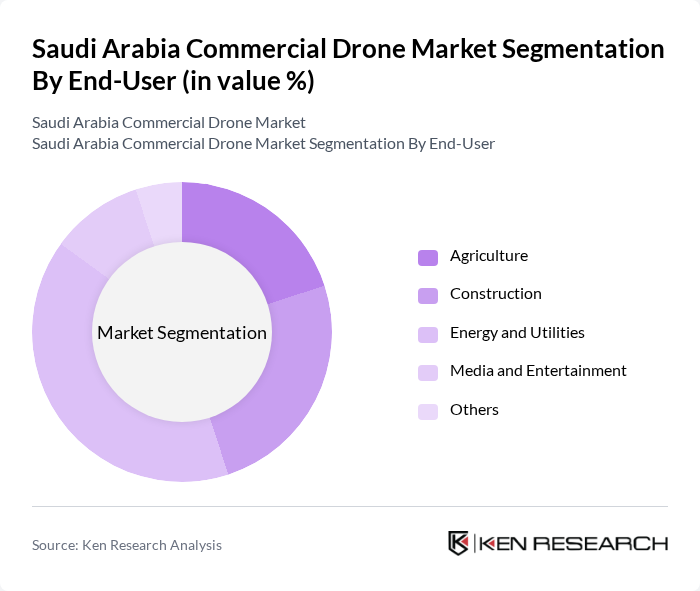

By End-User:The end-user segmentation includes Agriculture, Construction, Energy and Utilities, Media and Entertainment, and Others. The Energy and Utilities sector is currently the leading segment, driven by the need for efficient inspection and monitoring of oil and gas facilities. The increasing adoption of drones for maintenance and safety inspections in this sector is a key factor contributing to its dominance.

The Saudi Arabia Commercial Drone Market is characterized by a dynamic mix of regional and international players. Leading participants such as DJI Technology Co., Ltd., Parrot Drones, Yuneec International, senseFly, 3D Robotics, Skydio, AeroVironment, Inc., Insitu, Inc., Delair, Flyability, Quantum Systems, Wingtra, EHang, Kespry, and Altavian contribute to innovation, geographic expansion, and service delivery in this space.

The future of the commercial drone market in Saudi Arabia appears promising, driven by technological advancements and increasing applications across various sectors. In future, the integration of AI and machine learning into drone operations is expected to enhance efficiency and safety, attracting more investments. Additionally, the growth of smart city initiatives will further stimulate demand for drones, as urban planners seek innovative solutions for infrastructure management and public services, creating a dynamic market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Fixed-Wing Drones Multi-Rotor Drones Hybrid Drones Others |

| By End-User | Agriculture Construction Energy and Utilities Media and Entertainment Others |

| By Application | Aerial Photography Surveying and Mapping Inspection and Monitoring Delivery Services Others |

| By Payload Capacity | Less than 5 kg kg to 10 kg More than 10 kg Others |

| By Technology | GPS Navigation Computer Vision LiDAR Technology Others |

| By Investment Source | Private Investments Government Funding Venture Capital Others |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Agricultural Drone Usage | 100 | Farm Owners, Agricultural Technologists |

| Logistics and Delivery Drones | 80 | Logistics Managers, Supply Chain Executives |

| Surveillance and Security Drones | 70 | Security Managers, Law Enforcement Officials |

| Drone Manufacturing Insights | 60 | Product Development Managers, R&D Heads |

| Regulatory Compliance and Challenges | 50 | Aviation Regulators, Compliance Officers |

The Saudi Arabia Commercial Drone Market is valued at approximately USD 300 million, driven by investments in infrastructure projects and the integration of advanced technologies like AI and autonomy in various applications such as inspection and logistics.