Region:Middle East

Author(s):Rebecca

Product Code:KRAB7354

Pages:93

Published On:October 2025

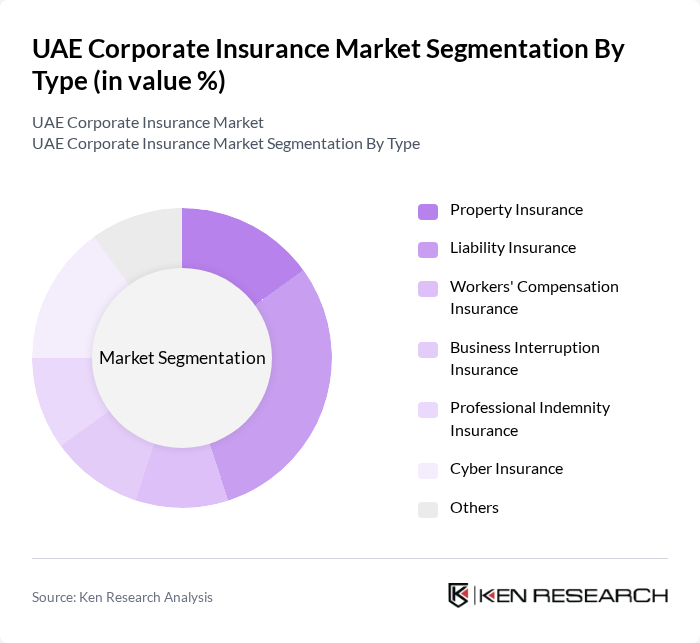

By Type:

The types of insurance in the UAE Corporate Insurance Market include Property Insurance, Liability Insurance, Workers' Compensation Insurance, Business Interruption Insurance, Professional Indemnity Insurance, Cyber Insurance, and Others. Among these, Liability Insurance is the leading sub-segment, driven by the increasing regulatory requirements and the need for businesses to protect themselves against potential claims. The growing awareness of risk management and the necessity for comprehensive coverage have further propelled the demand for Liability Insurance, making it a critical component of corporate risk strategies.

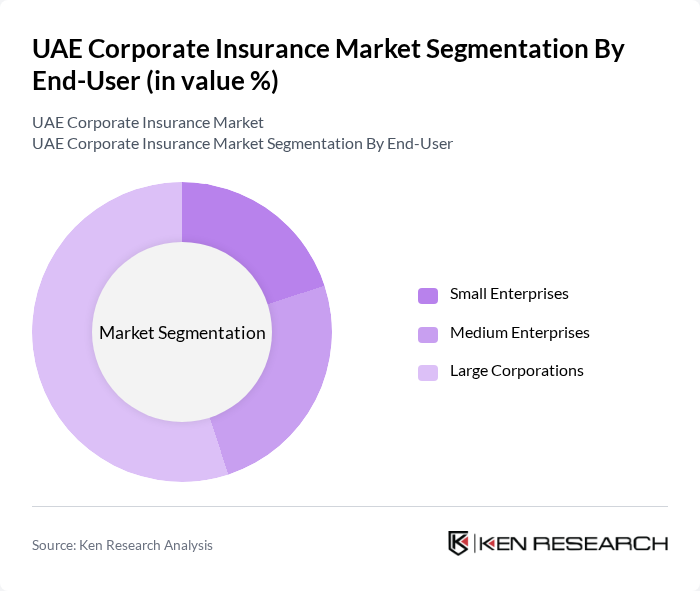

By End-User:

The end-users in the UAE Corporate Insurance Market are categorized into Small Enterprises, Medium Enterprises, and Large Corporations. Large Corporations dominate the market, primarily due to their extensive operations and higher exposure to risks. These entities often require comprehensive insurance solutions to mitigate potential liabilities and protect their assets, leading to a significant demand for tailored insurance products that cater to their complex needs.

The UAE Corporate Insurance Market is characterized by a dynamic mix of regional and international players. Leading participants such as Abu Dhabi National Insurance Company, Dubai Insurance Company, Oman Insurance Company, AXA Gulf, Allianz Insurance, Orient Insurance, Emirates Insurance Company, National General Insurance, Al Fujairah National Insurance Company, Qatar Insurance Company, RSA Insurance, Zurich Insurance, MetLife UAE, Chubb Insurance, AIG UAE contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE corporate insurance market appears promising, driven by technological advancements and a growing emphasis on sustainability. Insurers are increasingly adopting digital platforms to enhance customer engagement and streamline operations. Additionally, the rise of InsurTech solutions is expected to transform traditional insurance models, making them more efficient and customer-centric. As businesses continue to evolve, the demand for innovative insurance products tailored to emerging sectors will likely increase, fostering a dynamic market environment.

| Segment | Sub-Segments |

|---|---|

| By Type | Property Insurance Liability Insurance Workers' Compensation Insurance Business Interruption Insurance Professional Indemnity Insurance Cyber Insurance Others |

| By End-User | Small Enterprises Medium Enterprises Large Corporations |

| By Industry Sector | Construction Healthcare Information Technology Manufacturing Retail Financial Services Others |

| By Distribution Channel | Direct Sales Brokers Online Platforms Agents |

| By Coverage Type | Comprehensive Coverage Basic Coverage |

| By Policy Duration | Short-term Policies Long-term Policies |

| By Premium Range | Low Premium Medium Premium High Premium |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Insurance Needs Assessment | 150 | Risk Managers, CFOs, Insurance Brokers |

| Sector-Specific Insurance Trends | 100 | Industry Analysts, Compliance Officers |

| Claims Management Practices | 80 | Claims Adjusters, Operations Managers |

| Insurance Technology Adoption | 70 | IT Managers, Digital Transformation Leads |

| Market Entry Strategies for New Insurers | 60 | Business Development Managers, Strategy Consultants |

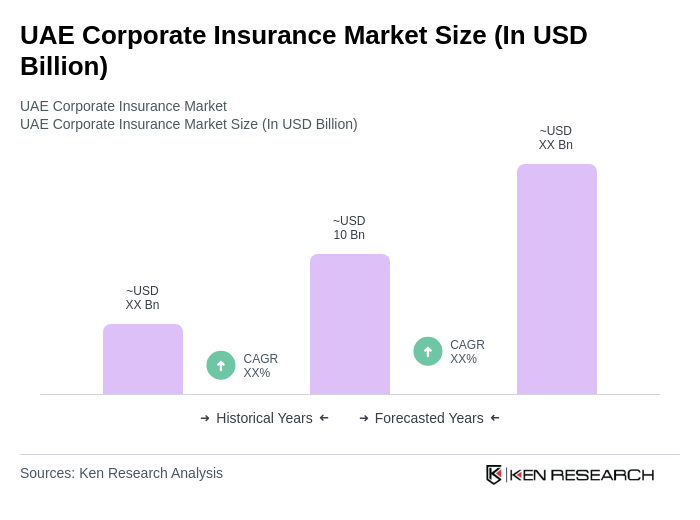

The UAE Corporate Insurance Market is valued at approximately USD 10 billion, reflecting a five-year historical analysis. This growth is driven by increasing demand for risk management solutions across various sectors, including construction, healthcare, and technology.