Region:Middle East

Author(s):Geetanshi

Product Code:KRAB7320

Pages:92

Published On:October 2025

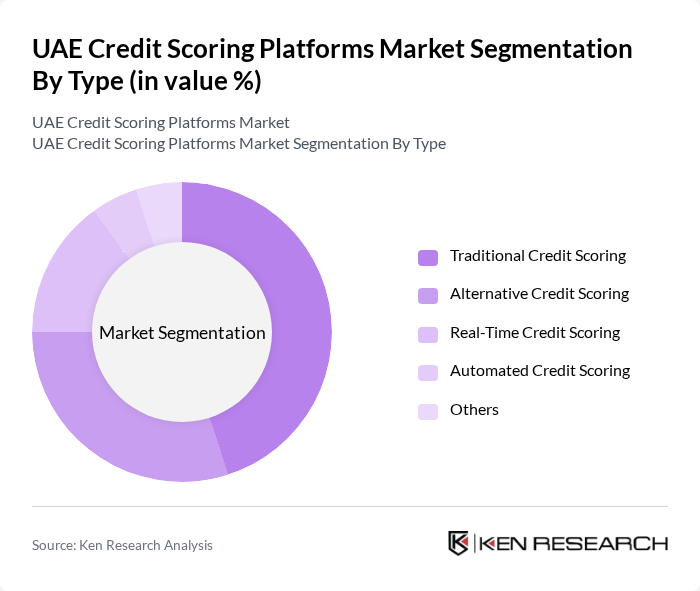

By Type:The market is segmented into various types of credit scoring methodologies, including Traditional Credit Scoring, Alternative Credit Scoring, Real-Time Credit Scoring, Automated Credit Scoring, and Others. Traditional Credit Scoring remains the most widely used method, as it relies on established credit histories and is favored by banks and financial institutions for its reliability. However, Alternative Credit Scoring is gaining traction due to the rise of fintech companies that leverage non-traditional data sources to assess creditworthiness, appealing to a broader range of consumers.

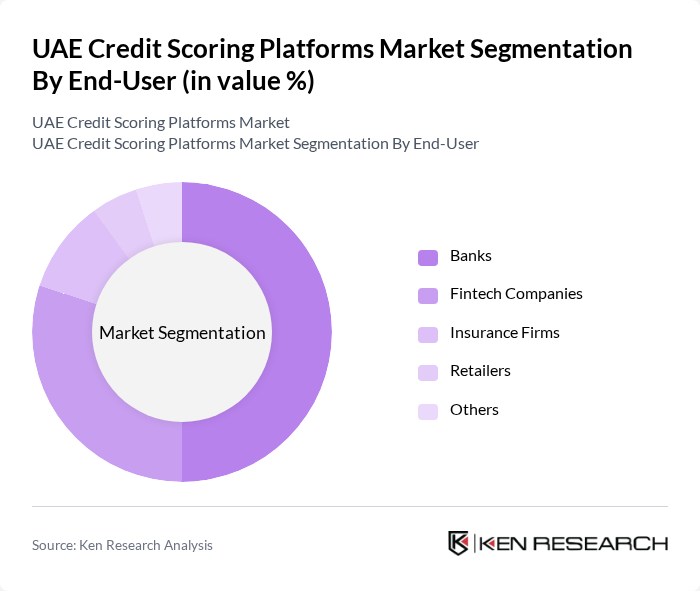

By End-User:The end-user segmentation includes Banks, Fintech Companies, Insurance Firms, Retailers, and Others. Banks dominate the market as they are the primary users of credit scoring platforms for assessing loan applications and managing credit risk. Fintech companies are rapidly emerging as significant players, utilizing innovative technologies to provide alternative scoring solutions that cater to underserved segments of the population, thus driving competition and innovation in the market.

The UAE Credit Scoring Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Experian, TransUnion, Equifax, Creditinfo, FICO, Dun & Bradstreet, CRIF, ZestFinance, CredoLab, FinScore, YAPILI, Acreditus, CIBIL, ScoreSense, Credit Karma contribute to innovation, geographic expansion, and service delivery in this space.

The UAE credit scoring platforms market is poised for significant evolution, driven by technological advancements and regulatory support. As financial institutions increasingly adopt AI-driven solutions, the accuracy and speed of credit assessments will improve. Furthermore, the focus on real-time data processing will enhance consumer experiences. The integration of alternative data sources will also play a crucial role in expanding credit access, particularly for underserved populations, fostering a more inclusive financial ecosystem in the UAE.

| Segment | Sub-Segments |

|---|---|

| By Type | Traditional Credit Scoring Alternative Credit Scoring Real-Time Credit Scoring Automated Credit Scoring Others |

| By End-User | Banks Fintech Companies Insurance Firms Retailers Others |

| By Application | Personal Loans Mortgages Credit Cards Business Loans Others |

| By Distribution Channel | Direct Sales Online Platforms Partnerships with Financial Institutions Others |

| By Customer Segment | Individual Consumers Small and Medium Enterprises (SMEs) Large Corporations Others |

| By Geographic Coverage | Urban Areas Rural Areas Free Zones Others |

| By Pricing Model | Subscription-Based Pay-Per-Use Freemium Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Credit Scoring Awareness | 150 | General Consumers, Young Professionals |

| Banking Sector Insights | 100 | Credit Risk Managers, Loan Officers |

| Fintech Adoption Trends | 80 | Fintech Executives, Product Managers |

| Regulatory Impact Assessment | 70 | Regulatory Affairs Specialists, Compliance Officers |

| Market Entry Strategies | 60 | Business Development Managers, Strategy Analysts |

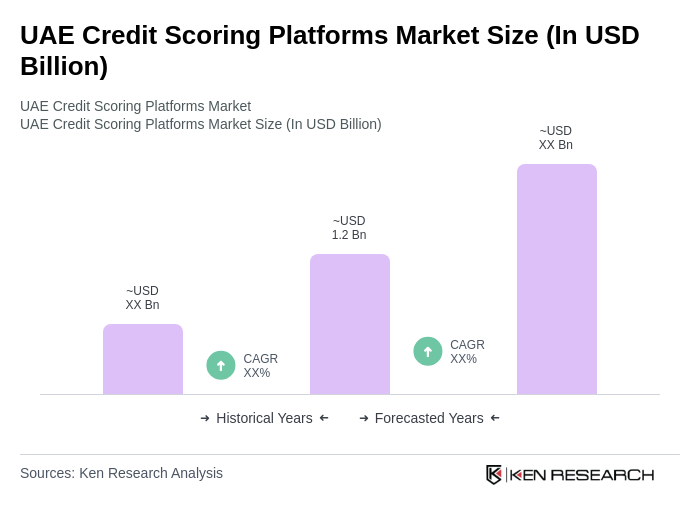

The UAE Credit Scoring Platforms Market is valued at approximately USD 1.2 billion, reflecting a robust growth driven by increasing consumer and business credit demand, alongside the rise of fintech solutions enhancing credit assessment processes.