Region:Middle East

Author(s):Geetanshi

Product Code:KRAB7311

Pages:100

Published On:October 2025

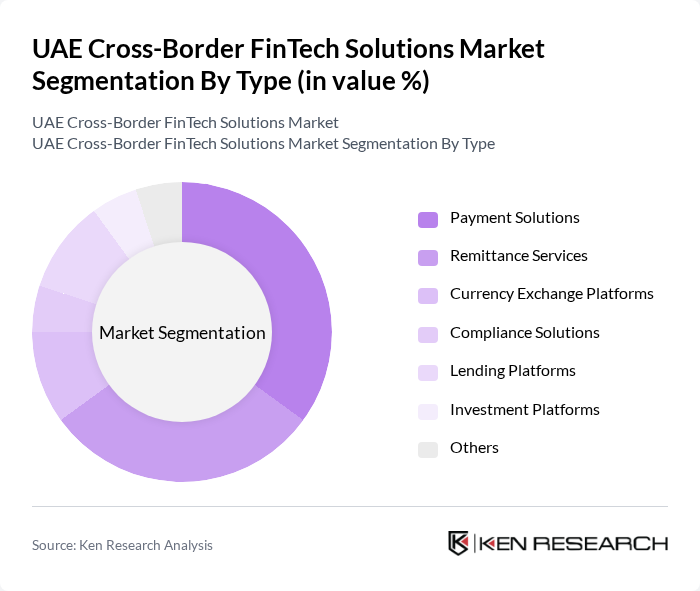

By Type:The market is segmented into various types, including Payment Solutions, Remittance Services, Currency Exchange Platforms, Compliance Solutions, Lending Platforms, Investment Platforms, and Others. Among these, Payment Solutions and Remittance Services are the most prominent, driven by the increasing volume of cross-border transactions and the growing need for efficient payment processing. The demand for these services is fueled by the rise of e-commerce and the global workforce, which necessitates seamless financial transactions across borders.

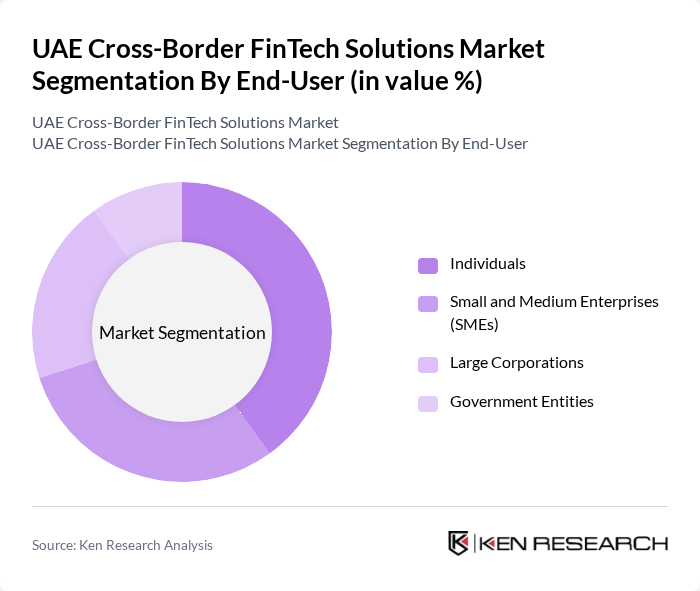

By End-User:The end-user segmentation includes Individuals, Small and Medium Enterprises (SMEs), Large Corporations, and Government Entities. Individuals and SMEs dominate the market, as they increasingly seek accessible and cost-effective financial solutions. The rise of digital banking and mobile payment platforms has made it easier for these segments to engage in cross-border transactions, driving the overall growth of the market.

The UAE Cross-Border FinTech Solutions Market is characterized by a dynamic mix of regional and international players. Leading participants such as Adyen N.V., TransferWise Ltd., PayPal Holdings, Inc., Stripe, Inc., Revolut Ltd., N26 GmbH, Remitly, Inc., Wise Payments Ltd., WorldRemit Ltd., Payoneer Inc., Alipay (Ant Group), WeChat Pay (Tencent), Zelle (Early Warning Services, LLC), Venmo (PayPal Holdings, Inc.), Samsung Pay (Samsung Electronics Co., Ltd.) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE cross-border FinTech solutions market appears promising, driven by technological advancements and increasing consumer demand for seamless payment experiences. As the government continues to support innovation through favorable regulations, the market is likely to witness a surge in new entrants and partnerships. Additionally, the integration of AI and blockchain technologies will enhance operational efficiency and security, positioning the UAE as a leader in the FinTech landscape in future.

| Segment | Sub-Segments |

|---|---|

| By Type | Payment Solutions Remittance Services Currency Exchange Platforms Compliance Solutions Lending Platforms Investment Platforms Others |

| By End-User | Individuals Small and Medium Enterprises (SMEs) Large Corporations Government Entities |

| By Service Model | Business-to-Consumer (B2C) Business-to-Business (B2B) Consumer-to-Consumer (C2C) |

| By Payment Method | Credit/Debit Cards Bank Transfers Mobile Wallets Cryptocurrencies |

| By Geographic Focus | Middle East North Africa South Asia Europe |

| By Customer Segment | Retail Customers Corporate Clients Institutional Investors |

| By Regulatory Compliance Level | Fully Compliant Partially Compliant Non-Compliant |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cross-Border Payment Solutions | 150 | FinTech Executives, Payment Processors |

| Remittance Services | 100 | Banking Professionals, Compliance Officers |

| Digital Lending Platforms | 80 | Product Managers, Risk Analysts |

| Blockchain-Based Solutions | 70 | Technology Officers, Blockchain Developers |

| Regulatory Compliance in FinTech | 90 | Legal Advisors, Regulatory Affairs Managers |

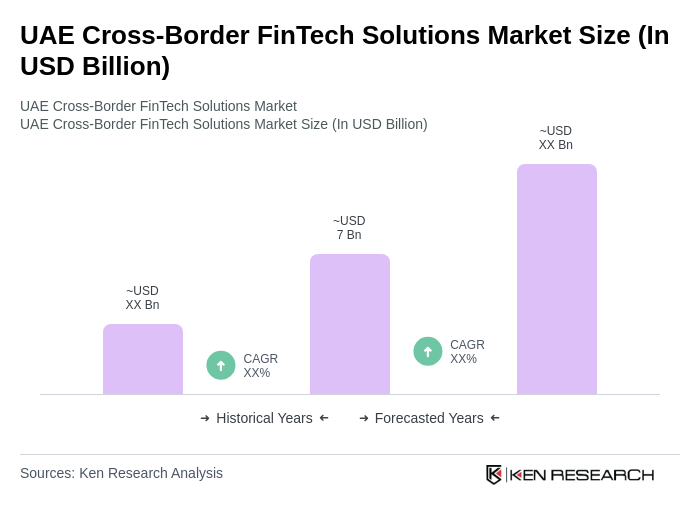

The UAE Cross-Border FinTech Solutions Market is valued at approximately USD 7 billion, reflecting significant growth driven by the demand for digital payment solutions, remittance services, and the expansion of e-commerce in the region.