Region:Middle East

Author(s):Shubham

Product Code:KRAB7457

Pages:100

Published On:October 2025

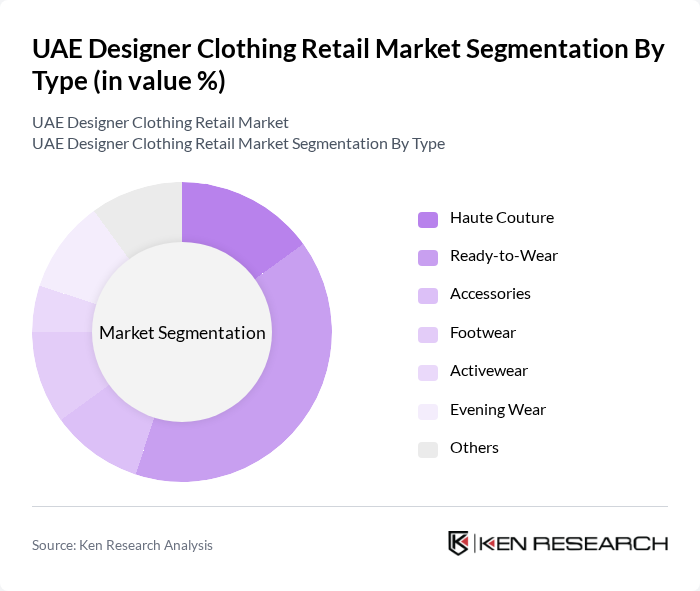

By Type:The designer clothing retail market can be segmented into various types, including Haute Couture, Ready-to-Wear, Accessories, Footwear, Activewear, Evening Wear, and Others. Among these, Ready-to-Wear has emerged as the leading subsegment due to its accessibility and appeal to a broader consumer base. The trend towards casual and versatile fashion has driven demand for ready-to-wear collections, making it a preferred choice for many shoppers.

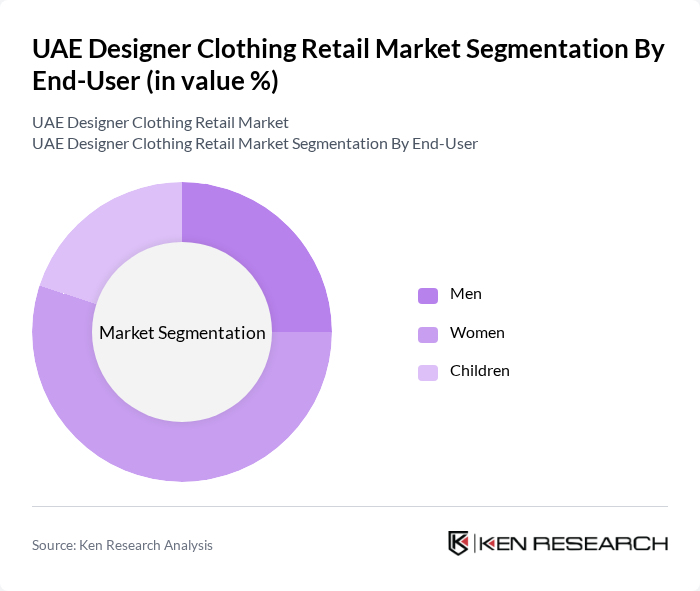

By End-User:The market can also be segmented by end-user categories, which include Men, Women, and Children. The Women’s segment dominates the market, driven by a higher inclination towards fashion and luxury among female consumers. Women are more likely to invest in designer clothing, leading to a significant market share for this segment. The increasing number of women entering the workforce and their growing purchasing power further contribute to this trend.

The UAE Designer Clothing Retail Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Haramain, Ounass, Level Shoes, Boutique 1, The Luxury Closet, Bloomingdale's Dubai, Harvey Nichols Dubai, Galeries Lafayette, Maison de Mode, Damas, Areej, S*uce, Madiyah Al Sharqi, Rami Al Ali, Amato Couture contribute to innovation, geographic expansion, and service delivery in this space.

The UAE designer clothing retail market is poised for significant transformation, driven by evolving consumer preferences and technological advancements. As sustainability becomes a priority, brands that adopt eco-friendly practices are likely to attract a growing segment of environmentally conscious consumers. Additionally, the integration of augmented reality and virtual fitting rooms is expected to enhance the shopping experience, making it more interactive and personalized. These trends will shape the future landscape of the market, fostering innovation and growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Haute Couture Ready-to-Wear Accessories Footwear Activewear Evening Wear Others |

| By End-User | Men Women Children |

| By Sales Channel | Online Retail Brick-and-Mortar Stores Department Stores |

| By Price Range | Luxury Premium Mid-Range |

| By Brand Origin | Local Brands International Brands |

| By Occasion | Casual Wear Formal Wear Sportswear |

| By Distribution Mode | Direct Sales Wholesale Franchise |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Designer Retail | 150 | Store Managers, Brand Executives |

| Contemporary Fashion Brands | 100 | Marketing Managers, Retail Buyers |

| Streetwear Market Insights | 80 | Fashion Influencers, Trend Analysts |

| Consumer Preferences in Online Shopping | 120 | Online Shoppers, E-commerce Managers |

| Market Trends and Future Outlook | 90 | Industry Experts, Fashion Consultants |

The UAE Designer Clothing Retail Market is valued at approximately USD 3.5 billion, reflecting a robust growth driven by increasing disposable income, a preference for luxury brands, and the expansion of e-commerce platforms.