Region:Middle East

Author(s):Rebecca

Product Code:KRAB7781

Pages:95

Published On:October 2025

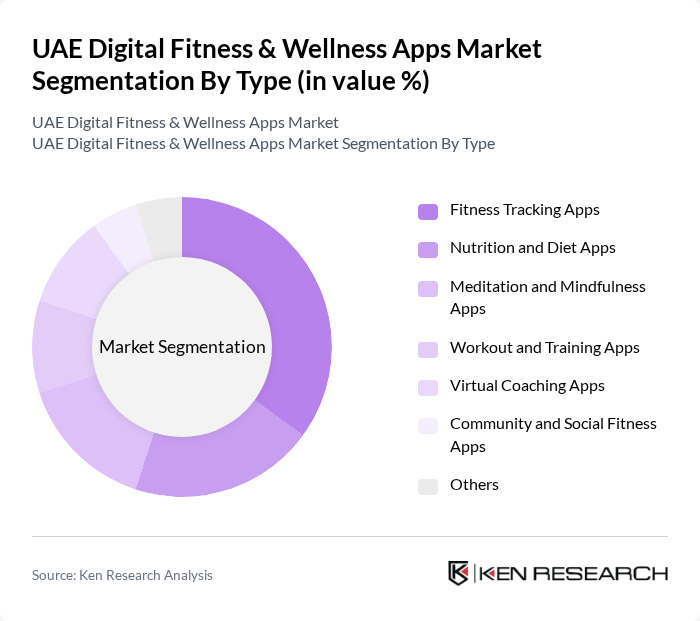

By Type:The market is segmented into various types of applications that cater to different aspects of fitness and wellness. The primary subsegments include Fitness Tracking Apps, Nutrition and Diet Apps, Meditation and Mindfulness Apps, Workout and Training Apps, Virtual Coaching Apps, Community and Social Fitness Apps, and Others. Among these, Fitness Tracking Apps are currently leading the market due to their popularity and the increasing demand for health monitoring solutions.

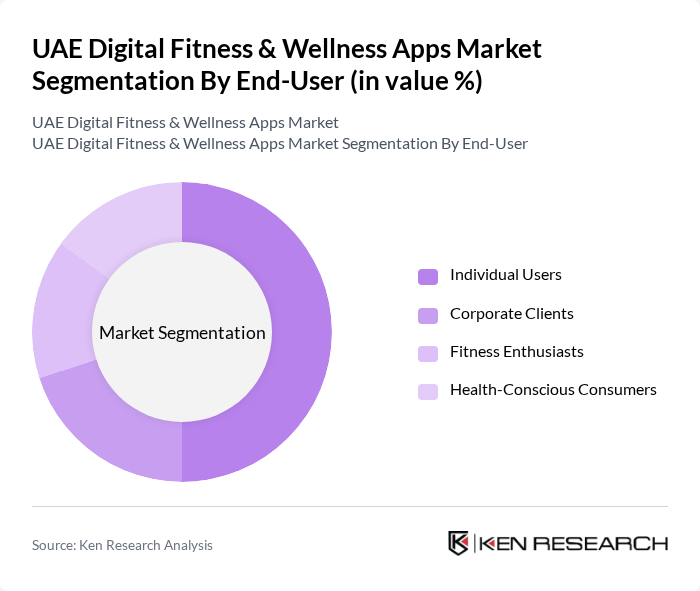

By End-User:The end-user segmentation includes Individual Users, Corporate Clients, Fitness Enthusiasts, and Health-Conscious Consumers. Individual Users dominate the market as they seek personalized fitness solutions that cater to their specific health goals. The rise in health awareness and the convenience of accessing fitness resources through mobile applications have significantly contributed to this trend.

The UAE Digital Fitness & Wellness Apps Market is characterized by a dynamic mix of regional and international players. Leading participants such as MyFitnessPal, Fitbit, Noom, Strava, Headspace, Calm, Nike Training Club, Peloton, 8fit, JEFIT, Sworkit, Aaptiv, Fitbod, Freeletics, Lifesum contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE digital fitness and wellness apps market appears promising, driven by technological advancements and evolving consumer preferences. As users increasingly seek integrated health solutions, apps that combine fitness tracking with nutrition and mental wellness features are likely to gain traction. Additionally, the growing trend of remote work will continue to fuel demand for home-based fitness solutions, creating opportunities for innovative app development and partnerships with health professionals.

| Segment | Sub-Segments |

|---|---|

| By Type | Fitness Tracking Apps Nutrition and Diet Apps Meditation and Mindfulness Apps Workout and Training Apps Virtual Coaching Apps Community and Social Fitness Apps Others |

| By End-User | Individual Users Corporate Clients Fitness Enthusiasts Health-Conscious Consumers |

| By Subscription Model | Freemium Monthly Subscription Annual Subscription One-Time Purchase |

| By Demographics | Age Group (18-24, 25-34, 35-44, 45+) Gender Income Level |

| By Device Type | Smartphone Tablet Wearable Devices |

| By Geographic Distribution | Urban Areas Rural Areas |

| By User Engagement Level | Casual Users Regular Users Power Users |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Fitness App Users | 150 | Active Users, Fitness Enthusiasts |

| Wellness App Users | 100 | Health-Conscious Individuals, Wellness Coaches |

| Healthcare Professionals | 80 | Doctors, Nutritionists, Fitness Trainers |

| App Developers | 60 | Product Managers, UX Designers |

| Industry Experts | 50 | Market Analysts, Health Tech Consultants |

The UAE Digital Fitness & Wellness Apps Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by increased smartphone adoption and rising health consciousness among consumers, particularly during the pandemic.