Region:Middle East

Author(s):Rebecca

Product Code:KRAB4132

Pages:80

Published On:October 2025

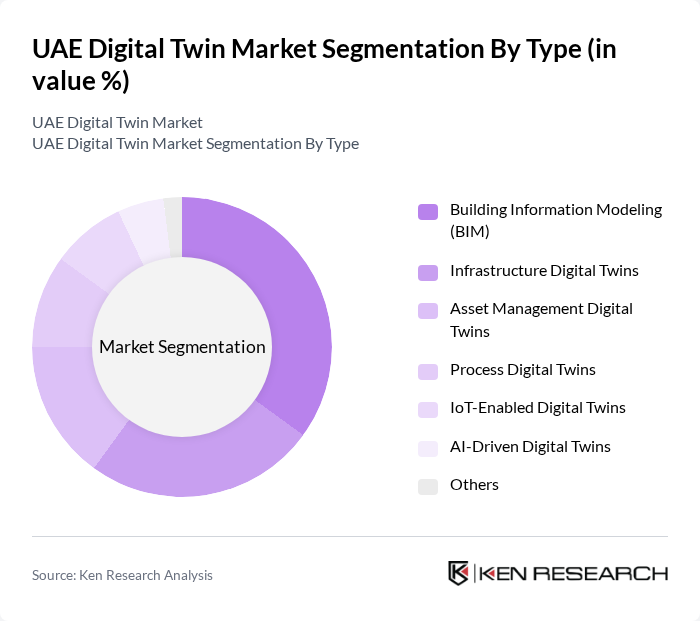

By Type:The market is segmented into various types, including Building Information Modeling (BIM), Infrastructure Digital Twins, Asset Management Digital Twins, Process Digital Twins, IoT-Enabled Digital Twins, AI-Driven Digital Twins, and Others. Among these, Building Information Modeling (BIM) is the leading sub-segment due to its widespread adoption in the construction and real estate sectors, facilitating better collaboration and efficiency in project management. The segmentation reflects the UAE’s focus on smart buildings, infrastructure modernization, and operational optimization across industries.

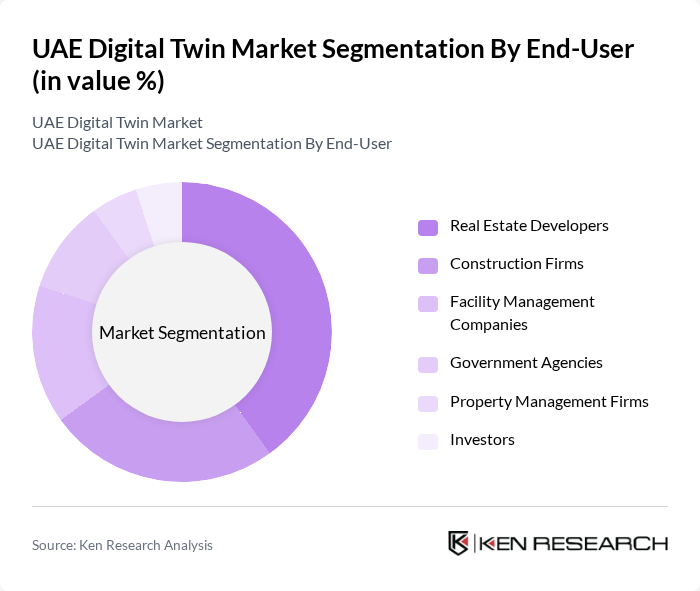

By End-User:The end-user segmentation includes Real Estate Developers, Construction Firms, Facility Management Companies, Government Agencies, Property Management Firms, and Investors. Real Estate Developers are the dominant end-user segment, driven by the need for innovative solutions to enhance property value and streamline project delivery processes. Government agencies are also significant adopters, particularly in smart city and infrastructure projects, while construction firms and facility management companies increasingly leverage digital twins for operational efficiency and lifecycle management.

The UAE Digital Twin Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens AG, Autodesk Inc., Bentley Systems, Incorporated, Dassault Systèmes SE, IBM Corporation, Microsoft Corporation, ANSYS, Inc., PTC Inc., Hexagon AB, Oracle Corporation, GE Digital, SAP SE, Altair Engineering, Inc., AECOM Technology Corporation, Schneider Electric SE, DAMAC Properties, Emaar Properties PJSC, Aldar Properties PJSC, Nakheel PJSC, Majid Al Futtaim Group, Dubai Holding, Noumou Properties contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE digital twin market appears promising, driven by ongoing advancements in technology and increasing government support. As organizations continue to embrace digital transformation, the integration of digital twins into various sectors will likely accelerate. The focus on sustainability and smart city initiatives will further enhance the relevance of digital twins, enabling better resource management and urban planning. Additionally, the collaboration between public and private sectors will foster innovation and drive market growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Building Information Modeling (BIM) Infrastructure Digital Twins Asset Management Digital Twins Process Digital Twins IoT-Enabled Digital Twins AI-Driven Digital Twins Others |

| By End-User | Real Estate Developers Construction Firms Facility Management Companies Government Agencies Property Management Firms Investors |

| By Application | Urban Planning Asset Monitoring Predictive Maintenance Energy Management Virtual Property Showcasing Smart Building Operations |

| By Deployment Model | On-Premises Cloud-Based Hybrid |

| By Industry Vertical | Real Estate Construction Facility Management Infrastructure Hospitality |

| By Geographic Focus | Urban Areas Suburban Areas Free Zones |

| By Investment Source | Private Investments Government Funding Public-Private Partnerships Venture Capital |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Smart City Initiatives | 100 | Urban Planners, City Officials |

| Manufacturing Sector Implementations | 70 | Operations Managers, Production Engineers |

| Healthcare Digital Twin Applications | 60 | Healthcare Administrators, IT Directors |

| Energy Sector Digital Solutions | 50 | Energy Analysts, Project Managers |

| Transportation and Logistics | 80 | Logistics Coordinators, Supply Chain Managers |

The UAE Digital Twin Market is valued at approximately USD 560 million, reflecting significant growth driven by the adoption of advanced technologies in real estate, including IoT, AI, and big data analytics.