Region:Middle East

Author(s):Geetanshi

Product Code:KRAB9118

Pages:93

Published On:October 2025

Market.png)

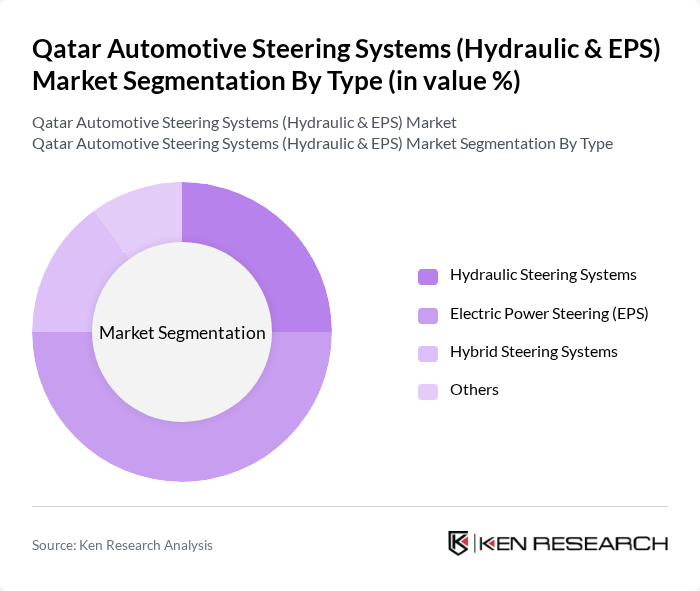

By Type:The market is segmented into various types of steering systems, including Hydraulic Steering Systems, Electric Power Steering (EPS), Hybrid Steering Systems, and Others. Among these, Electric Power Steering (EPS) is gaining significant traction due to its advantages in fuel efficiency and ease of integration with advanced driver-assistance systems (ADAS). The increasing consumer preference for fuel-efficient vehicles is driving the demand for EPS, making it the leading sub-segment in the market.

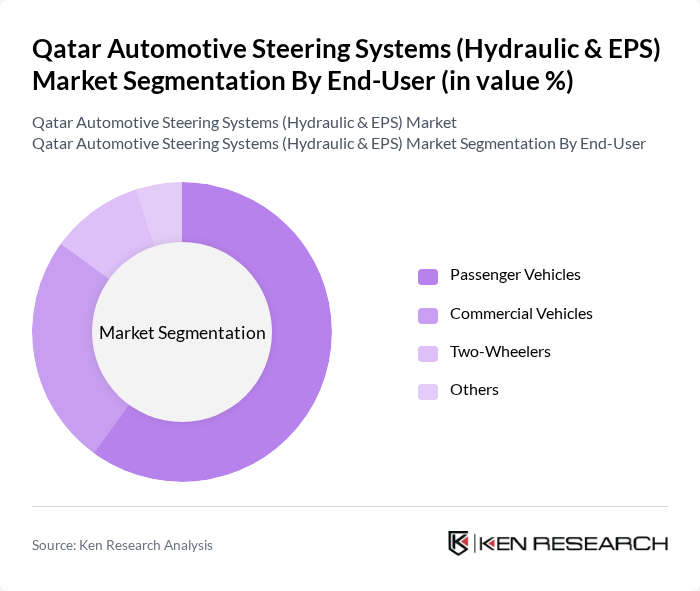

By End-User:The end-user segmentation includes Passenger Vehicles, Commercial Vehicles, Two-Wheelers, and Others. The Passenger Vehicles segment is the most dominant, driven by the increasing consumer demand for personal mobility solutions and the growing trend of urbanization. The rise in disposable income and changing lifestyles are also contributing to the growth of this segment, making it a key focus for manufacturers.

The Qatar Automotive Steering Systems (Hydraulic & EPS) Market is characterized by a dynamic mix of regional and international players. Leading participants such as ZF Friedrichshafen AG, Bosch Automotive Steering, JTEKT Corporation, Nexteer Automotive, Thyssenkrupp AG, Hyundai Mobis, Mando Corporation, Aisin Seiki Co., Ltd., DENSO Corporation, TRW Automotive, AAM (American Axle & Manufacturing), Sona Comstar, Asteer contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Qatar automotive steering systems market appears promising, driven by increasing vehicle production and a shift towards electric vehicles. As the government continues to support the automotive sector through incentives and infrastructure development, the adoption of advanced steering technologies is likely to accelerate. Additionally, the integration of smart technologies and sustainability initiatives will shape the market landscape, fostering innovation and enhancing consumer preferences for modern automotive solutions.

| Segment | Sub-Segments |

|---|---|

| By Type | Hydraulic Steering Systems Electric Power Steering (EPS) Hybrid Steering Systems Others |

| By End-User | Passenger Vehicles Commercial Vehicles Two-Wheelers Others |

| By Component | Steering Gear Steering Column Electronic Control Unit (ECU) Others |

| By Sales Channel | OEMs Aftermarket Online Sales Others |

| By Distribution Mode | Direct Sales Distributors Retail Outlets Others |

| By Price Range | Low Price Range Mid Price Range High Price Range |

| By Application | Personal Use Commercial Use Industrial Use Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hydraulic Steering Systems | 100 | Product Engineers, R&D Managers |

| Electric Power Steering (EPS) Systems | 80 | Technical Directors, Automotive Designers |

| Aftermarket Steering Components | 70 | Procurement Managers, Sales Executives |

| OEM Steering System Suppliers | 90 | Supply Chain Managers, Quality Assurance Officers |

| Automotive Service Centers | 60 | Service Managers, Automotive Technicians |

The Qatar Automotive Steering Systems market is valued at approximately USD 1.2 billion, reflecting a significant growth driven by the demand for advanced steering technologies, particularly Electric Power Steering (EPS), which enhances fuel efficiency and driving comfort.