Region:Middle East

Author(s):Shubham

Product Code:KRAB6176

Pages:99

Published On:October 2025

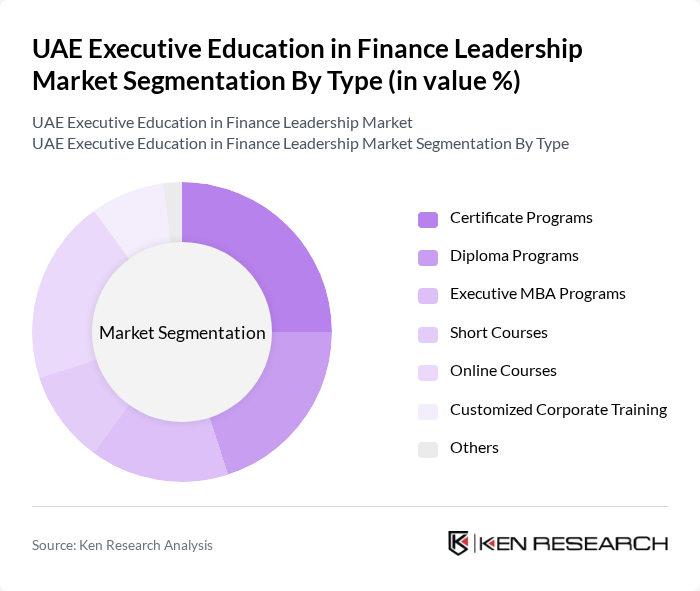

By Type:The market is segmented into various types of educational offerings, including Certificate Programs, Diploma Programs, Executive MBA Programs, Short Courses, Online Courses, Customized Corporate Training, and Others. Each of these subsegments caters to different professional needs and preferences, with a growing trend towards online and customized training solutions.

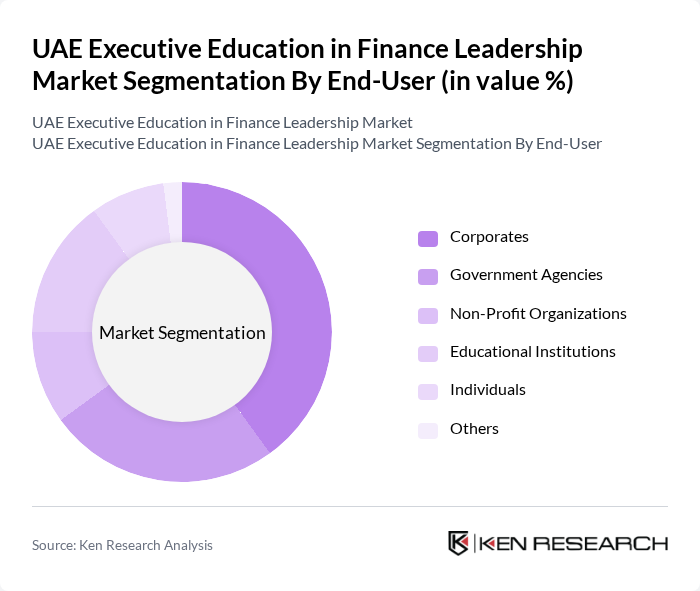

By End-User:The end-users of executive education in finance leadership include Corporates, Government Agencies, Non-Profit Organizations, Educational Institutions, Individuals, and Others. Corporates are the largest segment, driven by the need for skilled financial leaders to navigate complex business environments and enhance organizational performance.

The UAE Executive Education in Finance Leadership Market is characterized by a dynamic mix of regional and international players. Leading participants such as INSEAD, London Business School, Hult International Business School, University of Dubai, American University in Dubai, ESCP Business School, University of Sharjah, Abu Dhabi University, University of Wollongong in Dubai, SP Jain School of Global Management, ESMT Berlin, IMD Business School, Wharton School of the University of Pennsylvania, Harvard Business School, Stanford Graduate School of Business contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE executive education market in finance leadership appears promising, driven by the increasing integration of technology and a focus on personalized learning experiences. As organizations prioritize continuous professional development, educational institutions are likely to enhance their offerings with innovative, technology-driven solutions. Furthermore, the emphasis on sustainability in finance education will shape program development, ensuring that future leaders are equipped to address emerging challenges in the financial landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Certificate Programs Diploma Programs Executive MBA Programs Short Courses Online Courses Customized Corporate Training Others |

| By End-User | Corporates Government Agencies Non-Profit Organizations Educational Institutions Individuals Others |

| By Delivery Mode | In-Person Training Online Learning Hybrid Learning Workshops and Seminars Others |

| By Duration | Short-Term (Less than 3 months) Medium-Term (3 to 6 months) Long-Term (More than 6 months) Others |

| By Certification Type | Accredited Programs Non-Accredited Programs Industry-Specific Certifications Others |

| By Target Audience | Senior Executives Mid-Level Managers Aspiring Leaders Entrepreneurs Others |

| By Price Range | Low-End (Under AED 5,000) Mid-Range (AED 5,000 - AED 15,000) High-End (Above AED 15,000) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Finance Executives in Corporates | 150 | CFOs, Finance Directors, Senior Financial Analysts |

| Participants in Executive Education Programs | 100 | Current Students, Alumni, Program Coordinators |

| HR Professionals in Financial Services | 80 | HR Managers, Talent Development Specialists |

| Industry Experts and Consultants | 60 | Finance Consultants, Education Advisors, Industry Analysts |

| Government Officials in Education Sector | 50 | Policy Makers, Education Regulators, Workforce Development Officers |

The UAE Executive Education in Finance Leadership Market is valued at approximately USD 1.2 billion, reflecting a significant demand for skilled financial leaders in the region's evolving economic landscape.