Region:Middle East

Author(s):Geetanshi

Product Code:KRAC1040

Pages:96

Published On:October 2025

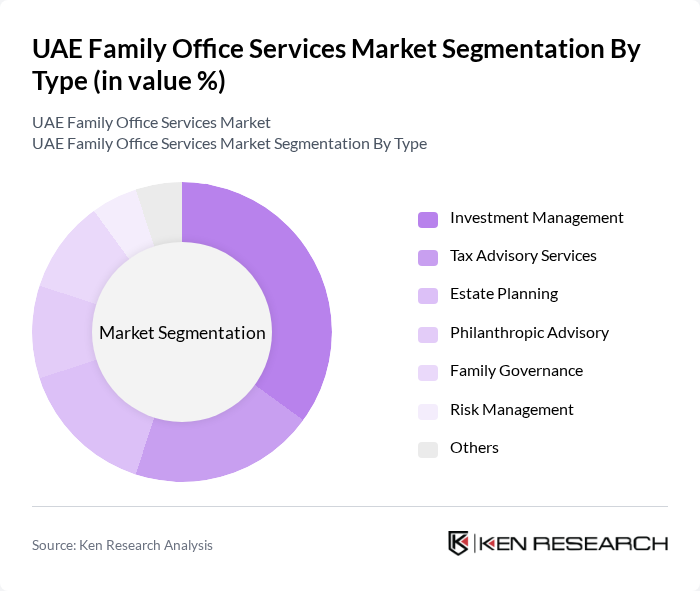

By Type:

The types of services offered in the family office sector include Investment Management, Tax Advisory Services, Estate Planning, Philanthropic Advisory, Family Governance, Risk Management, and Others. Among these, Investment Management is the leading sub-segment, driven by the increasing need for effective asset allocation and portfolio diversification among high-net-worth families. The growing complexity of investment options, including alternative assets such as private equity and real estate, and the desire for tailored financial strategies have made this service essential for family offices, leading to a significant demand for specialized investment management services.

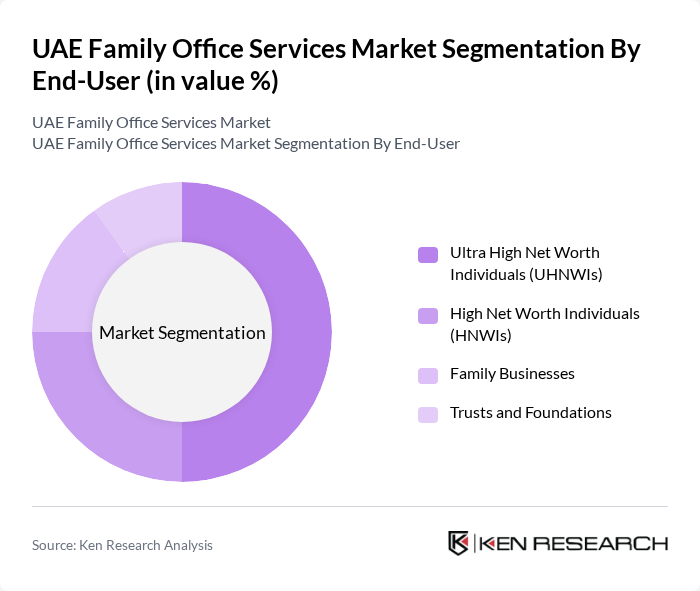

By End-User:

The end-users in the family office services market include Ultra High Net Worth Individuals (UHNWIs), High Net Worth Individuals (HNWIs), Family Businesses, and Trusts and Foundations. The UHNWIs segment dominates the market, as these individuals typically possess substantial wealth and require comprehensive services to manage their complex financial needs. The increasing number of UHNWIs in the UAE, driven by robust economic growth, favorable residency programs, and international investment opportunities, has led to heightened demand for specialized family office services tailored to their unique requirements.

The UAE Family Office Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Abu Dhabi Investment Authority, Dubai Investment Group, Al Habtoor Group, Emirates Investment Authority, Al-Futtaim Group, Majid Al Futtaim Holding, Al Qudra Holding, Al Ghurair Investment, Emaar Properties, Dubai Holding, Abu Dhabi National Oil Company, Sharjah Investment and Development Authority, Gulf Capital, Invest AD, Noor Investment Group contribute to innovation, geographic expansion, and service delivery in this space.

The UAE family office services market is poised for significant growth, driven by increasing wealth concentration and a shift towards personalized financial solutions. As families seek to navigate complex financial landscapes, the demand for specialized services will rise. Additionally, the integration of technology in wealth management will enhance service delivery, making family offices more accessible. The focus on sustainable investments and philanthropy will further shape the market, aligning with global trends towards responsible investing and social impact.

| Segment | Sub-Segments |

|---|---|

| By Type | Investment Management Tax Advisory Services Estate Planning Philanthropic Advisory Family Governance Risk Management Others |

| By End-User | Ultra High Net Worth Individuals (UHNWIs) High Net Worth Individuals (HNWIs) Family Businesses Trusts and Foundations |

| By Service Model | Single Family Office Multi-Family Office Virtual Family Office |

| By Investment Strategy | Direct Investments Fund Investments Alternative Investments (e.g., Private Equity, Real Estate) |

| By Geographic Focus | Domestic Investments International Investments |

| By Client Engagement | Full-Service Engagement Advisory-Only Engagement |

| By Asset Class | Real Estate Equities Fixed Income Private Equity Others (e.g., Art & Collectibles, Cryptocurrencies) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Investment Management Services | 100 | Family Office Executives, Investment Advisors |

| Estate Planning and Trust Services | 70 | Legal Advisors, Estate Planners |

| Tax Advisory Services | 60 | Tax Consultants, Financial Planners |

| Philanthropic Advisory Services | 50 | Philanthropy Advisors, Family Office Directors |

| Family Governance and Succession Planning | 80 | Family Business Consultants, Governance Experts |

The UAE Family Office Services Market is valued at approximately USD 99 million, reflecting a significant growth driven by the increasing wealth of high-net-worth individuals and families, alongside a rising demand for personalized financial management and investment strategies.