Region:Middle East

Author(s):Shubham

Product Code:KRAA8608

Pages:89

Published On:November 2025

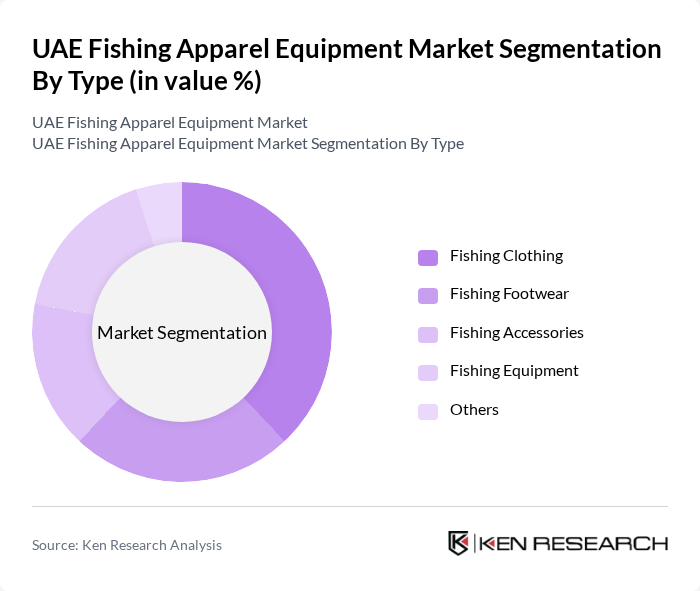

By Type:The market is segmented into various types of fishing apparel and equipment, including fishing clothing, footwear, accessories, and equipment. Fishing clothing, which includes shirts, jackets, trousers, hats, UV-protective wear, and waders, is particularly popular due to its essential role in providing comfort and protection during fishing activities. Fishing footwear, such as boots, sandals, and water shoes, is also in high demand, as it offers safety and convenience for anglers. Accessories like gloves, vests, sunglasses, belts, and bags enhance the overall fishing experience, while fishing equipment, including rods, reels, lines, lures, and tackle boxes, remains a critical component for both recreational and commercial fishermen.

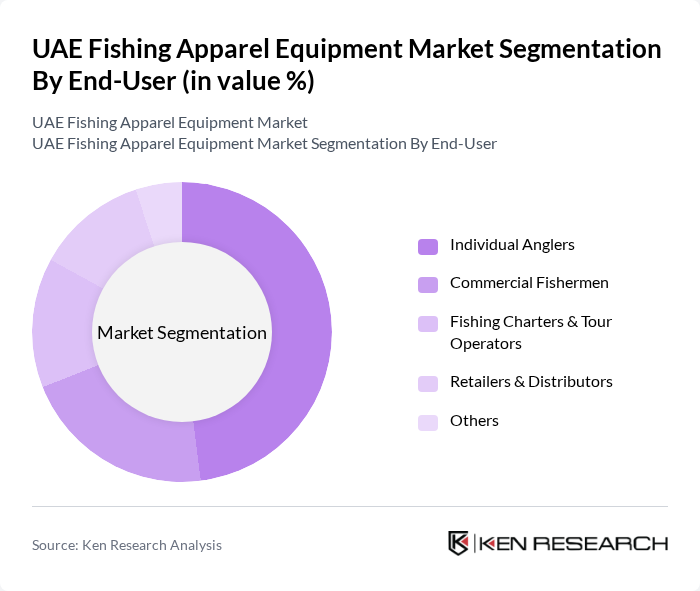

By End-User:The end-user segmentation includes individual anglers, commercial fishermen, fishing charters and tour operators, retailers, and distributors. Individual anglers, comprising recreational and sport fishers, represent a significant portion of the market, driven by the growing interest in fishing as a leisure activity. Commercial fishermen also contribute to market demand, as they require specialized apparel and equipment for their operations. Fishing charters and tour operators play a vital role in promoting fishing tourism, while retailers and distributors ensure that products reach consumers effectively.

The UAE Fishing Apparel Equipment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Adventure HQ (Dubai, UAE), Barracuda Fishing Equipment LLC (Dubai, UAE), Shimano Gulf FZE (JAFZA, Dubai, UAE), Daiwa Middle East (Dubai, UAE), Decathlon UAE (Dubai, UAE), Al Yousuf Sports Equipment LLC (Dubai, UAE), Al Fajer Marine LLC (Dubai, UAE), Al Bawadi Marine (Dubai, UAE), Abu Dhabi Marine Sports Equipment (Abu Dhabi, UAE), Al Marakeb Fishing Equipment (Sharjah, UAE), Columbia Sportswear (UAE distributor presence), AFTCO (UAE distributor presence), Pelagic Gear (UAE distributor presence), Patagonia (UAE distributor presence), Costa Del Mar (UAE distributor presence) contribute to innovation, geographic expansion, and service delivery in this space.

The UAE fishing apparel equipment market is poised for dynamic growth, driven by increasing consumer interest in recreational fishing and government support for fishing tourism. As sustainability becomes a focal point, manufacturers are likely to innovate eco-friendly products, aligning with global trends. Additionally, the rise of e-commerce platforms will facilitate easier access to fishing gear, enhancing market reach. Overall, the combination of these factors suggests a promising trajectory for the market in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Fishing Clothing (e.g., shirts, jackets, trousers, hats, UV-protective wear, waders) Fishing Footwear (e.g., boots, sandals, water shoes) Fishing Accessories (e.g., gloves, vests, sunglasses, belts, bags) Fishing Equipment (e.g., rods, reels, lines, lures, tackle boxes) Others |

| By End-User | Individual Anglers (recreational and sport fishers) Commercial Fishermen Fishing Charters & Tour Operators Retailers & Distributors Others |

| By Distribution Channel | Online Retail (e-commerce platforms, brand websites) Specialty Stores (fishing and outdoor gear shops) Sporting Goods Retailers Supermarkets/Hypermarkets Others |

| By Material | Synthetic Fabrics (polyester, nylon, spandex blends) Natural Fabrics (cotton, wool, bamboo) Waterproof/Breathable Materials (Gore-Tex, PVC, rubberized fabrics) Eco-friendly/Recycled Materials Others |

| By Price Range | Budget Mid-Range Premium Luxury Others |

| By Gender | Male Female Unisex Others |

| By Age Group | Children Adults Seniors Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Fishing Apparel Sales | 80 | Store Managers, Sales Representatives |

| Local Fishermen Insights | 120 | Professional Fishermen, Recreational Anglers |

| Fishing Gear Manufacturers | 60 | Product Development Managers, Marketing Directors |

| Fishing Enthusiast Focus Groups | 40 | Hobbyists, Fishing Club Members |

| Environmental Impact Assessments | 40 | Environmental Scientists, Policy Makers |

The UAE Fishing Apparel Equipment Market is valued at approximately USD 12 million, reflecting the growing demand for fishing apparel and equipment driven by recreational fishing, tourism, and outdoor activities in the region.