Region:Middle East

Author(s):Dev

Product Code:KRAD5113

Pages:99

Published On:December 2025

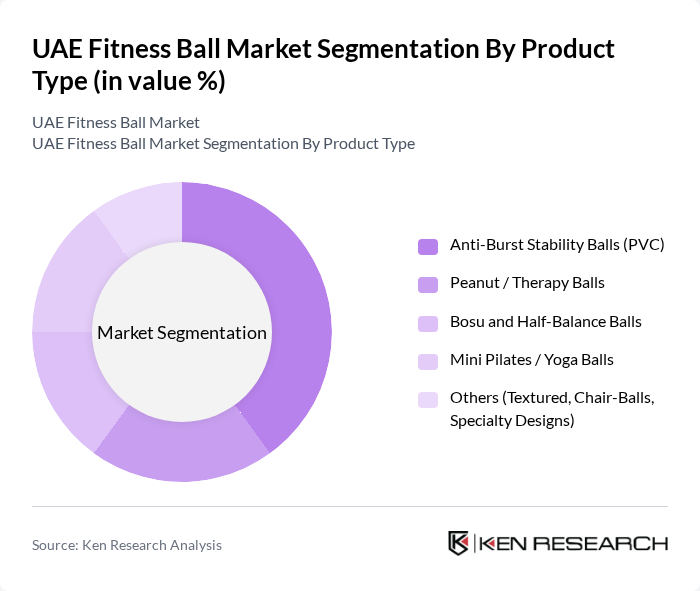

By Product Type:The product type segmentation of the UAE Fitness Ball Market includes various categories that cater to different consumer needs and preferences. The subsegments are Anti-Burst Stability Balls (PVC), Peanut / Therapy Balls, Bosu and Half-Balance Balls, Mini Pilates / Yoga Balls, and Others (Textured, Chair-Balls, Specialty Designs). This structure aligns with global fitness ball segmentation, where PVC-based anti-burst balls, balance trainers, and therapy balls form the core of the category. Among these, Anti-Burst Stability Balls (PVC) dominate the market due to their safety features, affordability, and versatility in strength, core, balance, and flexibility routines for both home users and professional settings. Consumers increasingly prefer these balls for home workouts, virtual training programs, and gym use, while Bosu and half-balance trainers see higher uptake in commercial gyms and studios for functional and athletic training.

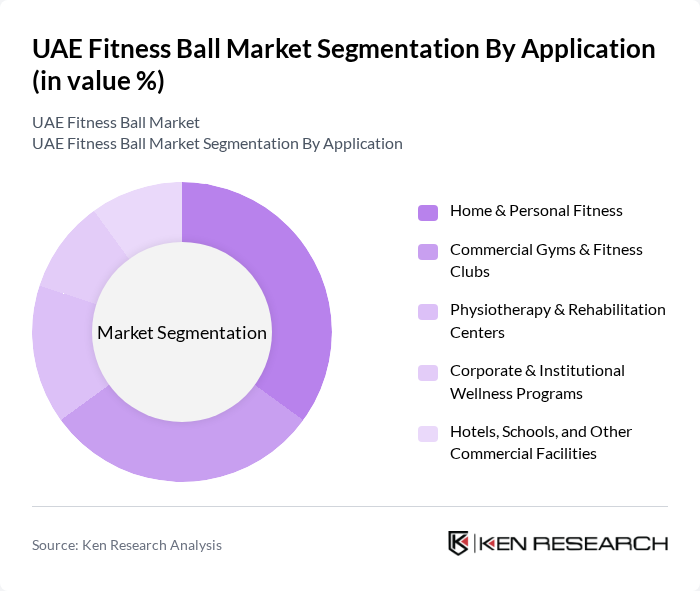

By Application:The application segmentation of the UAE Fitness Ball Market encompasses various sectors where fitness balls are utilized. The subsegments include Home & Personal Fitness, Commercial Gyms & Fitness Clubs, Physiotherapy & Rehabilitation Centers, Corporate & Institutional Wellness Programs, and Hotels, Schools, and Other Commercial Facilities. This mirrors global demand patterns where individual users, gyms, and healthcare settings are the principal end users of fitness balls. The Home & Personal Fitness segment is currently leading the market, driven by the growing trend of hybrid and home-based workouts, the influence of digital fitness content, and the increasing number of individuals investing in compact, multiuse personal fitness equipment for strength, mobility, and posture-focused routines.

The UAE Fitness Ball Market is characterized by a dynamic mix of regional and international players. Leading participants such as Decathlon S.A. (Domyos), Sun & Sand Sports LLC, Adidas AG, Nike, Inc., Reebok International Ltd., Liveup Sports (Livepro / Liveup Sports UAE), Gaiam, ProBody Pilates, DYNAPRO, Black Mountain Products, Inc., SPRI Products, Inc., Sivan Health and Fitness, Gymnic, TheraBand, Valor Fitness contribute to innovation, geographic expansion, and service delivery in this space.

The UAE fitness ball market is poised for growth, driven by increasing health awareness and the popularity of home workouts. As consumers seek innovative and effective fitness solutions, the integration of technology into fitness products is expected to enhance user experience. Additionally, the rise of online fitness communities will likely foster engagement and promote the use of fitness balls, creating a dynamic environment for market expansion and product diversification in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Anti-Burst Stability Balls (PVC) Peanut / Therapy Balls Bosu and Half-Balance Balls Mini Pilates / Yoga Balls Others (Textured, Chair-Balls, Specialty Designs) |

| By Application | Home & Personal Fitness Commercial Gyms & Fitness Clubs Physiotherapy & Rehabilitation Centers Corporate & Institutional Wellness Programs Hotels, Schools, and Other Commercial Facilities |

| By Distribution Channel | E?commerce Marketplaces (Amazon.ae, Noon, etc.) Specialty Sports & Fitness Retailers Hypermarkets & Supermarkets Direct-to-Consumer Brand Stores & Online Platforms Wholesale & Institutional Supply |

| By Material | PVC / Vinyl Rubber / Latex TPE and Other Eco-Friendly Materials Others (Hybrid / Composite Materials) |

| By Size (Diameter) | Up to 55 cm cm cm and Above Mini Balls (Under 45 cm) |

| By Price Range | Budget (Mass Market) Mid-Range (Branded) Premium & Professional-Grade Luxury / Designer Collaborations |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Fitness Enthusiasts | 120 | Regular gym-goers, personal trainers |

| Casual Users | 100 | Individuals using fitness balls at home |

| Health Professionals | 60 | Physiotherapists, nutritionists |

| Retail Sector Insights | 50 | Store managers, sales representatives |

| Fitness Equipment Distributors | 40 | Supply chain managers, product managers |

The UAE Fitness Ball Market is valued at approximately USD 12 million, reflecting a growing trend in health consciousness and fitness activities among residents, supported by the expansion of gyms and fitness facilities across the country.