Region:Middle East

Author(s):Rebecca

Product Code:KRAB7209

Pages:95

Published On:October 2025

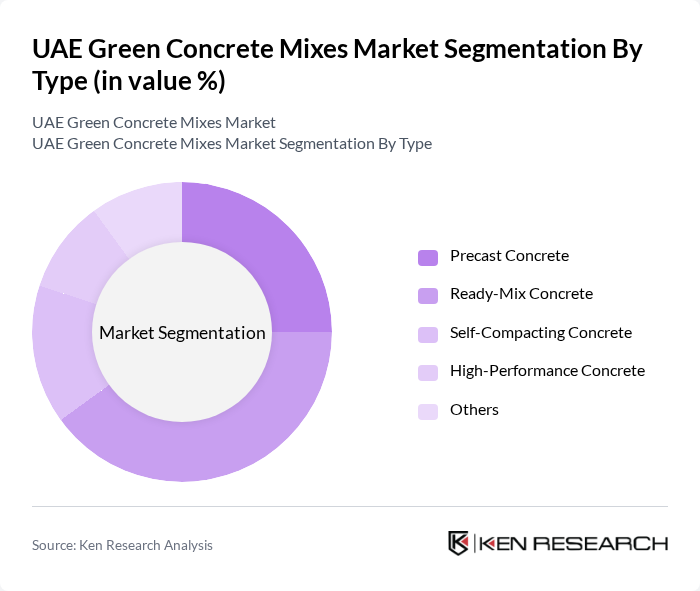

By Type:The market is segmented into various types of green concrete mixes, including Precast Concrete, Ready-Mix Concrete, Self-Compacting Concrete, High-Performance Concrete, and Others. Each type serves different construction needs and preferences, with specific advantages in terms of sustainability and performance.

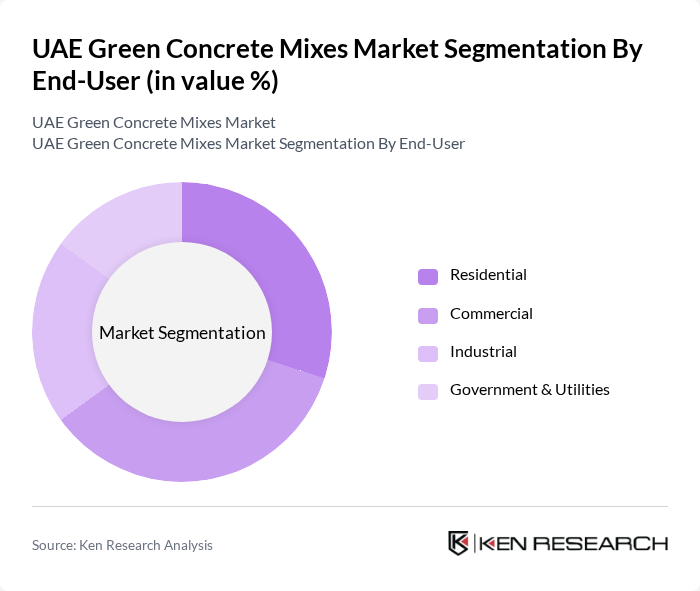

By End-User:The end-user segmentation includes Residential, Commercial, Industrial, and Government & Utilities. Each segment has unique requirements and contributes differently to the overall demand for green concrete mixes.

The UAE Green Concrete Mixes Market is characterized by a dynamic mix of regional and international players. Leading participants such as Lafarge Emirates Cement, Holcim UAE, CEMEX UAE, Al Ain Cement Factory, RAK Mix, Emirates Cement Factory, Union Cement Company, Gulf Concrete and Blocks, Abu Dhabi Commercial Bank (ADCB), National Cement Company, Al Falah Ready Mix, Al Jazeera Ready Mix, Al Maktoum Ready Mix, Al Mufeed Ready Mix, Al Qusais Ready Mix contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE green concrete mixes market appears promising, driven by increasing regulatory support and a growing emphasis on sustainability. As the construction industry evolves, the integration of innovative technologies and materials will likely enhance the performance and affordability of green concrete. Additionally, the rising demand for eco-friendly building solutions will encourage collaboration among stakeholders, fostering a more sustainable construction ecosystem. This shift is expected to create a dynamic market landscape, with significant opportunities for growth and development in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Precast Concrete Ready-Mix Concrete Self-Compacting Concrete High-Performance Concrete Others |

| By End-User | Residential Commercial Industrial Government & Utilities |

| By Application | Infrastructure Projects Residential Buildings Commercial Buildings Road Construction Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Outlets |

| By Price Range | Low Price Mid Price High Price |

| By Region | Abu Dhabi Dubai Sharjah Ajman Others |

| By Sustainability Certification | LEED Certified BREEAM Certified Green Star Certified Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Construction Projects | 100 | Project Managers, Site Engineers |

| Commercial Building Developments | 80 | Construction Executives, Architects |

| Infrastructure Projects (Roads, Bridges) | 70 | Civil Engineers, Project Directors |

| Green Material Suppliers | 60 | Sales Managers, Product Development Leads |

| Sustainability Consultants | 50 | Environmental Analysts, Policy Advisors |

The UAE Green Concrete Mixes Market is valued at approximately USD 1.2 billion, driven by increasing construction activities, government initiatives for sustainable building practices, and a growing demand for eco-friendly materials.