Region:Middle East

Author(s):Geetanshi

Product Code:KRAD4891

Pages:95

Published On:December 2025

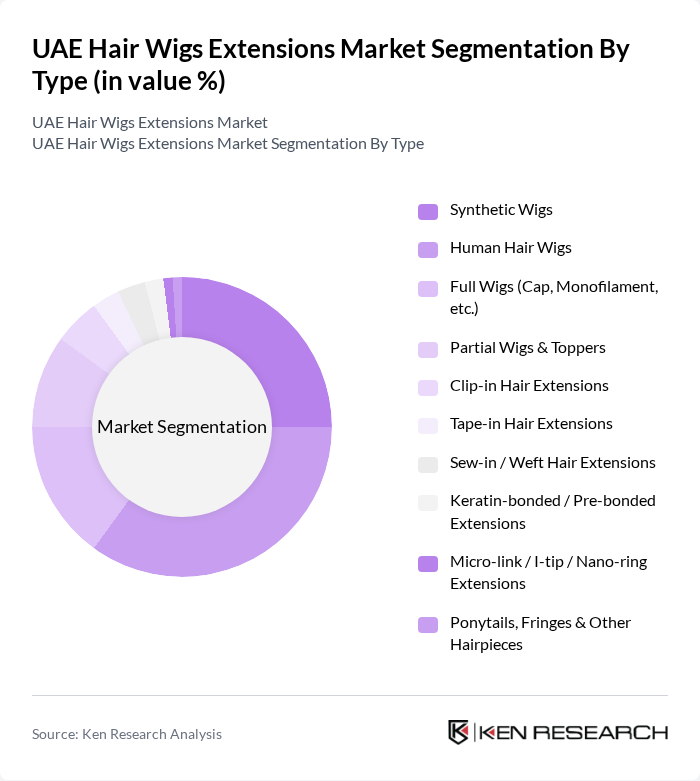

By Type:The market is segmented into various types of wigs and extensions, including synthetic wigs, human hair wigs, full wigs, partial wigs, and different types of hair extensions. Among these, human hair wigs are particularly popular due to their natural appearance, durability, and styling versatility, appealing to consumers seeking high-quality options for everyday wear, medical hair-loss solutions, and special occasions.

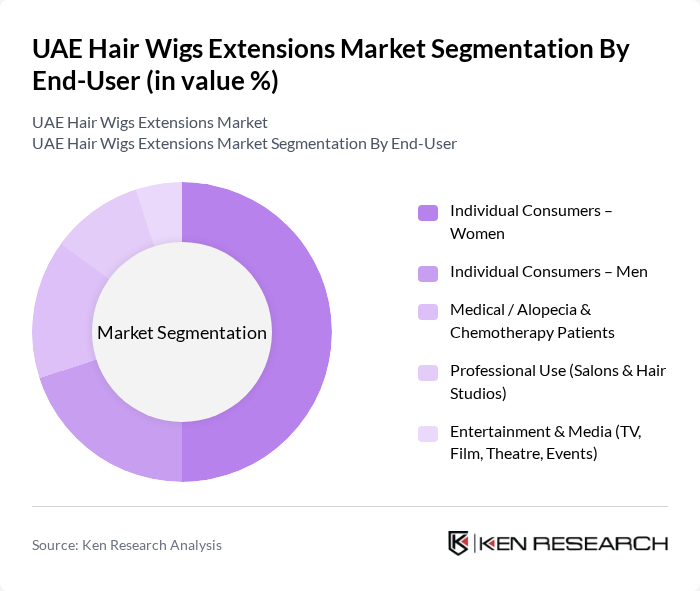

By End-User:The end-user segmentation includes individual consumers, both women and men, medical patients, professional salons, and the entertainment industry. The segment of individual consumers, particularly women, dominates the market as they are the primary purchasers of wigs and extensions for fashion, personal styling, and hair-loss concealment, while professional salons and media production also represent important demand centers in the UAE.

The UAE Hair Wigs Extensions Market is characterized by a dynamic mix of regional and international players. Leading participants such as Diva Divine Hair Extensions and Wigs (UAE), Hair Dreams Hair Extensions LLC (Dubai), Great Lengths (Regional Presence via UAE Salons), Balmain Hair Couture (Middle East / UAE), Hairwash Wigs & Hair Extensions Trading LLC, Diva Plus Hair Extensions Trading LLC, Royal Hair Extensions Dubai, Hair Fusion Bar (Dubai), Extensionist.ae, Virgin Hair Dubai, Ellen Wille (Premium European Brand Distributed in UAE), Indique Hair (Presence via UAE Distributors / Online), India Hair International (UAE Import & Distribution), SalonLabs Exports India Pvt. Ltd. (Supplying UAE Market), Other Organized Wig & Extension Chains and E-commerce Platforms in UAE contribute to innovation, geographic expansion, and service delivery in this space.

The UAE hair wigs extensions market is poised for significant growth, driven by evolving consumer preferences and technological advancements. As the demand for natural and customizable products increases, brands are likely to invest in innovative manufacturing techniques. Additionally, the rise of e-commerce platforms will facilitate wider access to diverse product offerings. With a focus on sustainability, companies are expected to explore eco-friendly materials, aligning with consumer values and enhancing brand loyalty in future.

| Segment | Sub-Segments |

|---|---|

| By Type | Synthetic Wigs Human Hair Wigs Full Wigs (Cap, Monofilament, etc.) Partial Wigs & Toppers Clip-in Hair Extensions Tape-in Hair Extensions Sew-in / Weft Hair Extensions Keratin-bonded / Pre-bonded Extensions Micro-link / I-tip / Nano-ring Extensions Ponytails, Fringes & Other Hairpieces |

| By End-User | Individual Consumers – Women Individual Consumers – Men Medical / Alopecia & Chemotherapy Patients Professional Use (Salons & Hair Studios) Entertainment & Media (TV, Film, Theatre, Events) |

| By Distribution Channel | Offline Retail – Specialized Wig & Extension Stores Offline Retail – Beauty Supply Stores & Pharmacies Salons & Professional Studios Online – Brand-owned E-commerce Online – Marketplaces (Noon, Amazon, Namshi, etc.) Social Commerce & WhatsApp / Instagram Sellers |

| By Price Range | Budget (Mass Market) Mid-Range Premium Luxury / Couture |

| By Material | Synthetic Fibers % Human Hair Remy Human Hair Non-Remy Human Hair Blended (Human Hair + Synthetic) |

| By Occasion / Use Case | Daily Wear & Protective Styling Medical & Hair Loss Restoration Bridal & Special Events Fashion, Editorial & Runway Theatrical, Costume & Cosplay |

| By Region | Abu Dhabi Dubai Sharjah Ajman Ras Al Khaimah Fujairah Umm Al Quwain & Other Emirates |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences for Hair Wigs | 120 | Female Consumers, Age 18-45 |

| Retail Insights from Wig Shops | 80 | Store Managers, Sales Representatives |

| Market Trends in E-commerce | 60 | E-commerce Managers, Digital Marketing Specialists |

| Salon Usage of Hair Extensions | 70 | Salon Owners, Hair Stylists |

| Consumer Satisfaction with Hair Products | 90 | Regular Users of Hair Wigs and Extensions |

The UAE Hair Wigs Extensions Market is valued at approximately USD 160 million, reflecting a significant growth trend driven by increasing consumer demand for hair fashion and the popularity of wigs and extensions among both men and women.