UAE Handicrafts Market Overview

- The UAE Handicrafts Market is valued at USD 1.1 billion, based on a five-year historical analysis. This growth is primarily driven by a resurgence in cultural heritage appreciation, increased tourism, and government initiatives aimed at promoting local artisans. The market has seen a rise in demand for traditional crafts, reflecting a growing consumer preference for unique, handmade products that embody cultural significance .

- Key cities such as Dubai and Abu Dhabi dominate the UAE Handicrafts Market due to their status as cultural and economic hubs. These cities attract a diverse population and a steady influx of tourists, creating a vibrant marketplace for handicrafts. Additionally, the presence of numerous art galleries, craft fairs, and cultural festivals further enhances the visibility and demand for local handicrafts .

- In 2023, the UAE government implemented the "Crafts and Heritage Development Program" under the Ministry of Culture and Youth, as part of the National Strategy for Cultural and Creative Industries (Cabinet Resolution No. 10 of 2021). This program supports local artisans through funding, training, and marketing initiatives, aiming to preserve traditional crafts while promoting innovation and sustainability in the handicrafts sector .

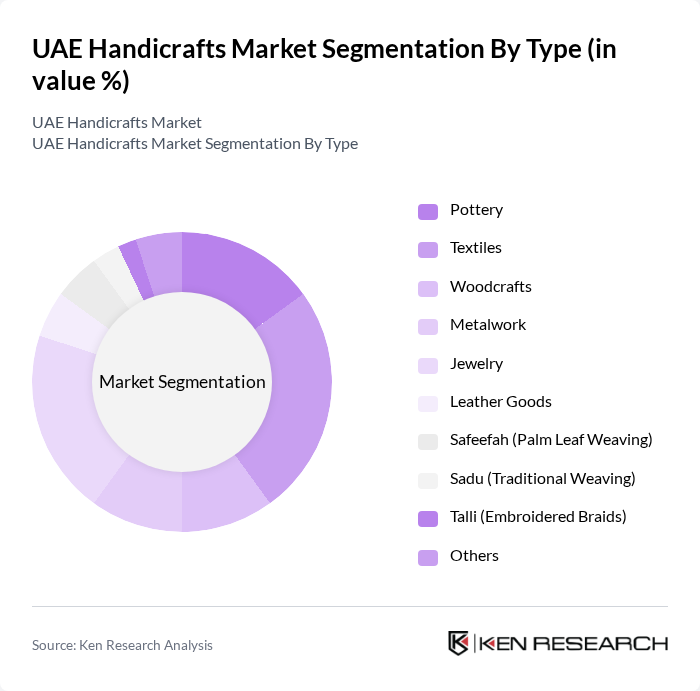

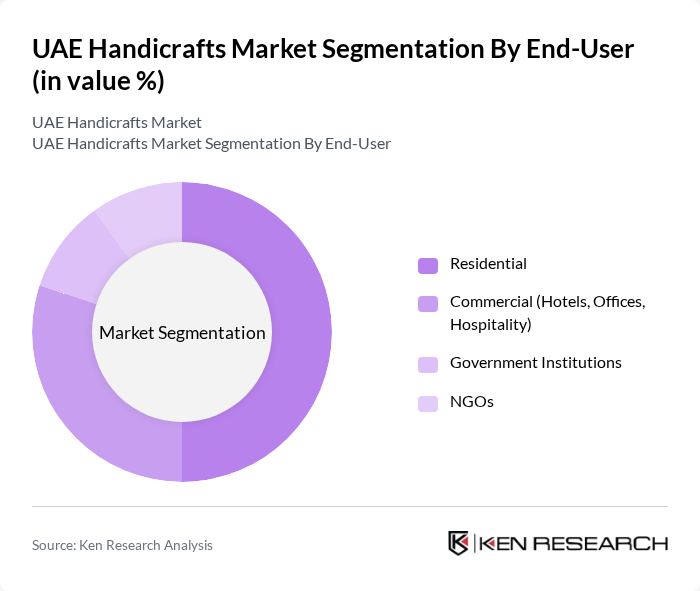

UAE Handicrafts Market Segmentation

By Type:The market is segmented into various types of handicrafts, including pottery, textiles, woodcrafts, metalwork, jewelry, leather goods, Safeefah (palm leaf weaving), Sadu (traditional weaving), Talli (embroidered braids), and others. Among these, textiles and pottery are particularly dominant due to their cultural significance and widespread consumer appeal. The demand for unique, handcrafted textiles has surged, driven by both local and international markets .

By End-User:The end-user segmentation includes residential, commercial (hotels, offices, hospitality), government institutions, and NGOs. The residential segment is the largest, driven by a growing trend of incorporating traditional handicrafts into home decor. Commercial establishments are also significant consumers, utilizing handicrafts to enhance their aesthetic appeal and cultural authenticity .

UAE Handicrafts Market Competitive Landscape

The UAE Handicrafts Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Qattara Arts Centre, Irthi Contemporary Crafts Council, House of Artisans (Abu Dhabi), Sharjah Heritage Institute, Fakih Group of Companies, Al Saqee Handicraft LLC, Tribe Dubai, Amal Star Antiques LLC, Lucky's Furniture & Handicraft, The Craft House, Souk Al Marfa, Ramniwas Hastkala Niryat Pvt. Ltd., UAE Heritage Crafts, Craft Culture UAE, D Decor Home Fabrics Pvt. Ltd. contribute to innovation, geographic expansion, and service delivery in this space .

UAE Handicrafts Market Industry Analysis

Growth Drivers

- Increasing Demand for Traditional Crafts:The UAE's handicrafts market is experiencing a surge in demand, driven by a cultural renaissance that values traditional craftsmanship. In future, the UAE's population is projected to reach approximately 10 million, with a significant portion showing interest in local arts. The Ministry of Culture and Knowledge Development reported a 30% increase in participation in handicraft exhibitions, indicating a growing appreciation for traditional crafts among residents and tourists alike.

- Government Support for Local Artisans:The UAE government has implemented various initiatives to support local artisans, including funding programs and training workshops. In future, the government allocated AED 60 million to promote handicraft skills among youth. This support is crucial as it not only enhances artisans' skills but also fosters a sustainable ecosystem for traditional crafts, ensuring their survival and growth in a competitive market.

- Rising Tourism Boosting Handicraft Sales:The UAE's tourism sector is projected to attract over 25 million visitors in future, significantly boosting sales of handicrafts. Tourists are increasingly seeking authentic local experiences, with 65% expressing interest in purchasing traditional crafts as souvenirs. This trend is supported by the UAE's strategic initiatives to promote cultural tourism, which directly benefits local artisans and enhances the visibility of handicraft products.

Market Challenges

- Competition from Mass-Produced Goods:The UAE handicrafts market faces significant challenges from mass-produced items, which are often cheaper and more accessible. In future, it is estimated that 75% of retail sales in the home decor segment will be dominated by mass-produced goods. This competition undermines the pricing power of local artisans, making it difficult for them to sustain their businesses and maintain traditional craftsmanship.

- High Production Costs for Artisans:Artisans in the UAE are grappling with high production costs, which can reach up to AED 250,000 annually for small-scale operations. Factors such as sourcing quality materials and labor contribute to these costs. As a result, many artisans struggle to price their products competitively, limiting their market reach and profitability, especially in a landscape dominated by lower-cost alternatives.

UAE Handicrafts Market Future Outlook

The future of the UAE handicrafts market appears promising, driven by a combination of cultural appreciation and technological advancements. As e-commerce continues to expand, artisans are likely to leverage online platforms to reach broader audiences. Additionally, the integration of sustainable practices in production will resonate with environmentally conscious consumers, further enhancing market appeal. The revival of traditional techniques, coupled with modern design elements, will likely create unique offerings that attract both local and international buyers.

Market Opportunities

- Expansion of E-commerce Platforms:The growth of e-commerce in the UAE presents a significant opportunity for artisans. With online sales projected to reach AED 30 billion in future, artisans can tap into this market by showcasing their products on digital platforms, increasing visibility and sales potential. This shift allows for direct consumer engagement, fostering brand loyalty and expanding market reach.

- Collaborations with International Designers:Collaborating with international designers can open new avenues for UAE artisans. Such partnerships can enhance product appeal and introduce innovative designs that blend traditional craftsmanship with contemporary aesthetics. This strategy not only elevates the artisans' profiles but also attracts a global customer base, potentially increasing sales and market presence significantly.