Region:Middle East

Author(s):Shubham

Product Code:KRAD5342

Pages:87

Published On:December 2025

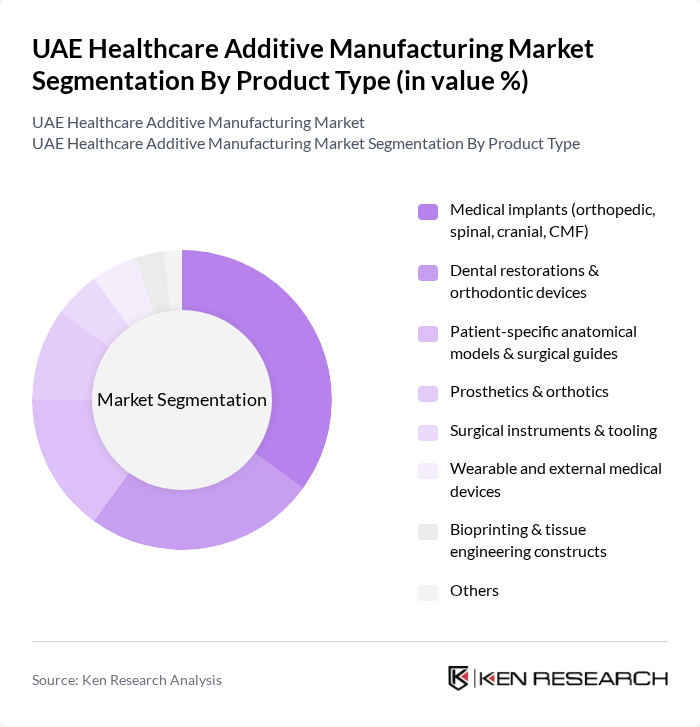

By Product Type:The product type segmentation includes various categories such as medical implants, dental restorations, patient-specific anatomical models, prosthetics, surgical instruments, wearable devices, bioprinting, and others. Among these, dental applications and medical implants together account for the largest share of the UAE market, reflecting strong demand for customized dental prosthetics, orthodontic devices, and patient?specific orthopedic or cranio?maxillofacial implants that improve fit, reduce surgery time, and enhance patient recovery and satisfaction.

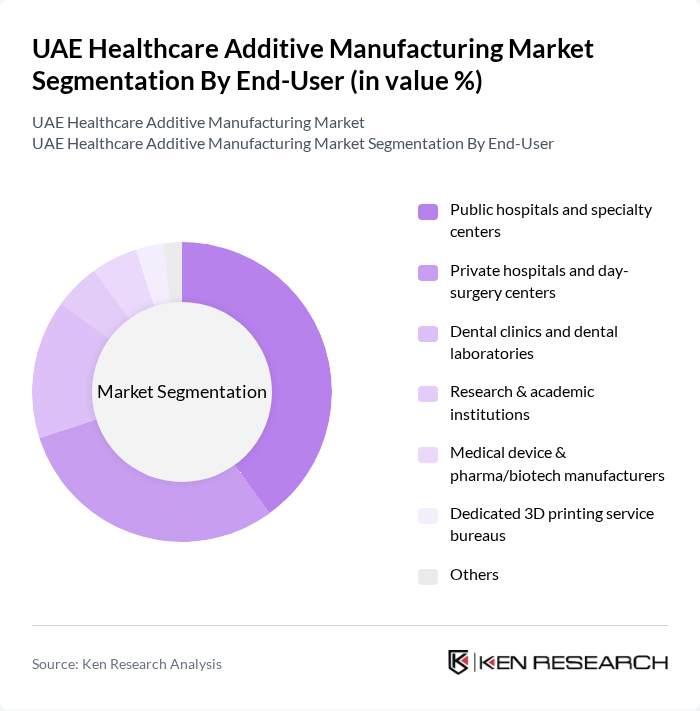

By End-User:The end-user segmentation encompasses public hospitals, private hospitals, dental clinics, research institutions, medical device manufacturers, and dedicated 3D printing service bureaus. Public and large specialty hospitals are increasingly adopting point?of?care 3D printing labs and collaborating with specialized service providers, while private hospitals, dental clinics, and labs are major users of dental and maxillofacial 3D printing, and research and academic institutions play a key role in prototyping, clinical validation, and bioprinting research.

The UAE Healthcare Additive Manufacturing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Stratasys Ltd., 3D Systems Corporation, Materialise NV, Siemens Healthineers, GE Additive, Stryker Corporation, Medtronic plc, Formlabs Inc., HP Inc., EOS GmbH, Renishaw plc, Carbon, Inc., Ultimaker (UltiMaker B.V.), Sinterex FZ?LLC (Dubai), 3DVinci Creations LLC (Dubai) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE healthcare additive manufacturing market appears promising, driven by technological advancements and increasing demand for customized healthcare solutions. As the government continues to invest in healthcare innovation, the integration of AI and machine learning into additive manufacturing processes is expected to enhance efficiency and precision. Furthermore, the growing emphasis on sustainability will likely lead to the development of eco-friendly materials, positioning the UAE as a leader in sustainable healthcare manufacturing practices.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Medical implants (orthopedic, spinal, cranial, CMF) Dental restorations & orthodontic devices Patient-specific anatomical models & surgical guides Prosthetics & orthotics Surgical instruments & tooling Wearable and external medical devices Bioprinting & tissue engineering constructs Others |

| By End-User | Public hospitals and specialty centers Private hospitals and day-surgery centers Dental clinics and dental laboratories Research & academic institutions Medical device & pharma/biotech manufacturers Dedicated 3D printing service bureaus Others |

| By Application | Dental (crowns, bridges, aligners, surgical guides) Orthopedics & trauma Cranio-maxillofacial & neurosurgery Cardiovascular & thoracic Tissue engineering & regenerative medicine Surgical planning & education Others |

| By Material | Metals & alloys (Ti, CoCr, stainless steel) Photopolymer resins (dental, biocompatible, surgical) Thermoplastics & high?performance polymers (PLA, ABS, PEEK, PEKK) Ceramics & bio-ceramics Bio-inks & hydrogels Composites & others |

| By Technology | Powder bed fusion (SLM, DMLS, EBM) Vat photopolymerization (SLA, DLP) Material extrusion (FDM/FFF) Material jetting & binder jetting Bioprinting technologies (inkjet, extrusion, laser?assisted) Others |

| By Distribution / Delivery Model | OEM equipment & materials (direct sales) Local distributors & channel partners In?house point?of?care printing (hospital/clinic?based) Contract manufacturing & service bureaus Online platforms & e?commerce Others |

| By Region | Abu Dhabi Dubai Sharjah & Northern Emirates Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Prosthetics Manufacturing | 60 | Product Managers, R&D Directors |

| Dental 3D Printing | 50 | Dentists, Dental Lab Technicians |

| Bioprinting Applications | 40 | Biomedical Engineers, Research Scientists |

| Medical Device Development | 70 | Regulatory Affairs Specialists, Product Development Managers |

| Healthcare Technology Providers | 50 | Sales Managers, Technical Support Engineers |

The UAE Healthcare Additive Manufacturing Market is valued at approximately USD 70 million, driven by advancements in 3D printing technologies and increasing demand for personalized medical solutions, such as patient-specific implants and dental devices.