Region:Middle East

Author(s):Rebecca

Product Code:KRAD7416

Pages:89

Published On:December 2025

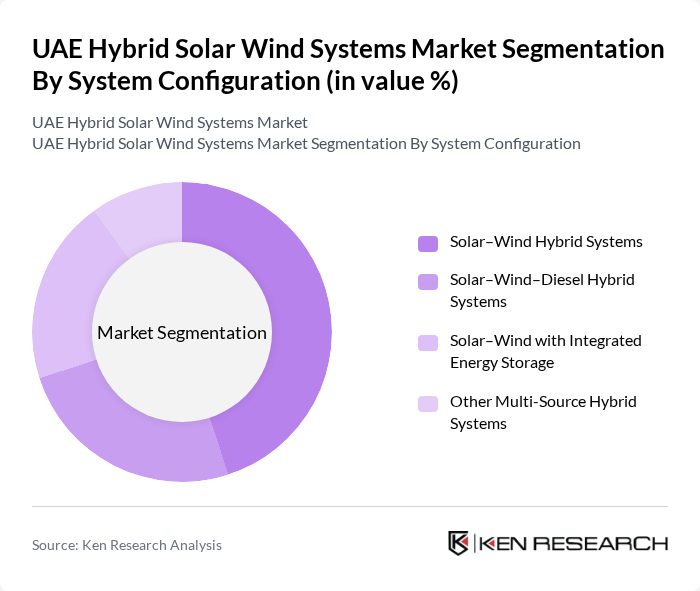

By System Configuration:The market is segmented into various configurations, including Solar–Wind Hybrid Systems, Solar–Wind–Diesel Hybrid Systems, Solar–Wind with Integrated Energy Storage, and Other Multi-Source Hybrid Systems. Each configuration addresses different load profiles and reliability requirements, with diesel-based hybrids used mainly for remote or backup applications, and storage-integrated systems increasingly adopted to provide firm, dispatchable power for both urban and off-grid use cases in line with broader Middle East hybrid trends.

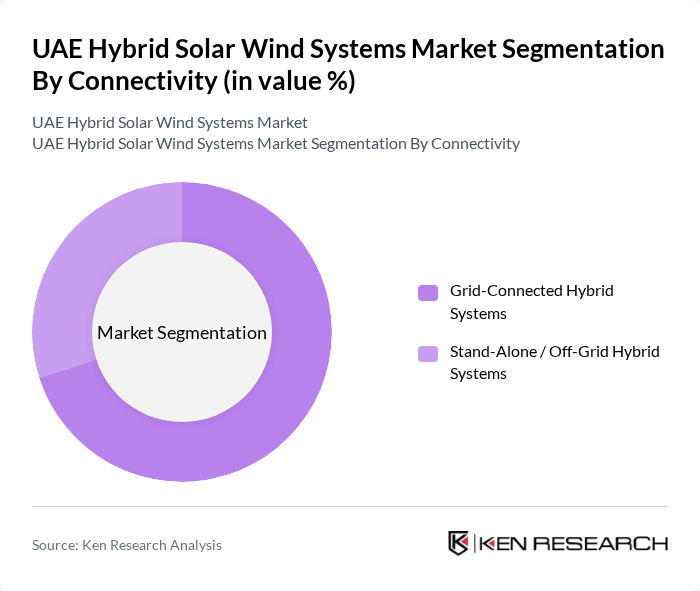

By Connectivity:The connectivity segment includes Grid-Connected Hybrid Systems and Stand-Alone/Off-Grid Hybrid Systems. Grid-connected systems are primarily used in urban and industrial areas to complement conventional generation, benefit from net metering or power purchase agreements, and support grid balancing, whereas off-grid systems are deployed in remote communities, islands, oil and gas sites, and infrastructure corridors to provide reliable power where grid extension is costly or impractical.

The UAE Hybrid Solar Wind Systems Market is characterized by a dynamic mix of regional and international players. Leading participants such as Abu Dhabi Future Energy Company (Masdar), Emirates Water and Electricity Company (EWEC), Dubai Electricity and Water Authority (DEWA), ACWA Power, Engie, TotalEnergies, Siemens Energy, GE Vernova (GE Renewable Energy), EDF Renewables, JinkoSolar, Trina Solar, Canadian Solar, Vestas Wind Systems, Scatec, Yellow Door Energy contribute to innovation, geographic expansion, and service delivery in this space, leveraging their experience in large-scale solar, wind, storage, and integrated renewable portfolios across the Middle East.

The future of the UAE hybrid solar-wind systems market appears promising, driven by increasing investments in renewable energy infrastructure and technological innovations. By future, the integration of smart grid technologies is expected to enhance energy management, while the focus on energy storage solutions will address intermittency issues. As community solar projects gain traction, they will further democratize energy access, fostering a sustainable energy landscape in the UAE.

| Segment | Sub-Segments |

|---|---|

| By System Configuration (Solar–Wind, Solar–Wind–Diesel, Solar–Wind–Storage, Others) | Solar–Wind Hybrid Systems Solar–Wind–Diesel Hybrid Systems Solar–Wind with Integrated Energy Storage Other Multi-Source Hybrid Systems |

| By Connectivity (Grid-Connected, Stand-Alone/Off-Grid) | Grid-Connected Hybrid Systems Stand-Alone / Off-Grid Hybrid Systems |

| By End-User (Residential, Commercial, Industrial, Government & Utilities, Telecom & Remote Infrastructure) | Residential Users Commercial & Commercial Buildings Industrial Facilities Government & Utilities Telecom Towers & Remote / Off-Grid Sites |

| By Component (Solar PV, Wind Turbine, Power Conditioning Unit/Controller, Energy Storage, Balance of System) | Solar PV Modules Wind Turbines Power Conditioning Units, Inverters & Controllers Energy Storage Systems (Batteries & Others) Balance of System (BoS) & Mounting Structures |

| By Power Rating (Up to 10 kW, 11–100 kW, Above 100 kW) | Up to 10 kW –100 kW Above 100 kW |

| By Application (Rural Electrification & Islands, Commercial & Industrial Facilities, Utility-Scale Hybrid Plants, Microgrids & Backup Power) | Rural Electrification & Islanded Communities Commercial & Industrial Power Supply Utility-Scale Hybrid Power Plants Microgrids, Backup & Ancillary Power |

| By Region (Emirates of Abu Dhabi, Dubai, Sharjah, Ajman, Umm Al-Quwain, Fujairah, Ras Al Khaimah) | Abu Dhabi Dubai Sharjah Ajman Umm Al-Quwain Fujairah Ras Al Khaimah |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Government Renewable Energy Initiatives | 100 | Policy Makers, Energy Regulators |

| Hybrid Solar-Wind Project Developers | 80 | Project Managers, Technical Directors |

| Energy Consultants and Analysts | 60 | Market Analysts, Energy Consultants |

| Utility Companies and Energy Providers | 70 | Operations Managers, Business Development Heads |

| Academic and Research Institutions | 50 | Researchers, Professors in Renewable Energy |

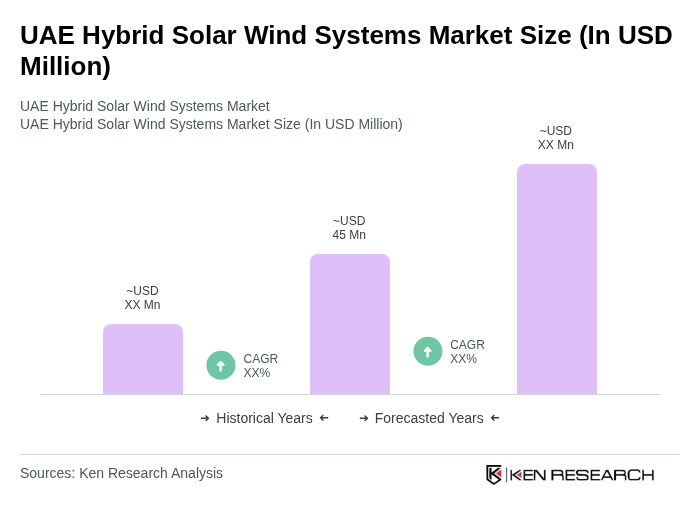

The UAE Hybrid Solar Wind Systems Market is valued at approximately USD 45 million, reflecting a growing trend towards renewable energy sources and advancements in hybrid technology and energy storage solutions.