Region:Middle East

Author(s):Rebecca

Product Code:KRAD4314

Pages:93

Published On:December 2025

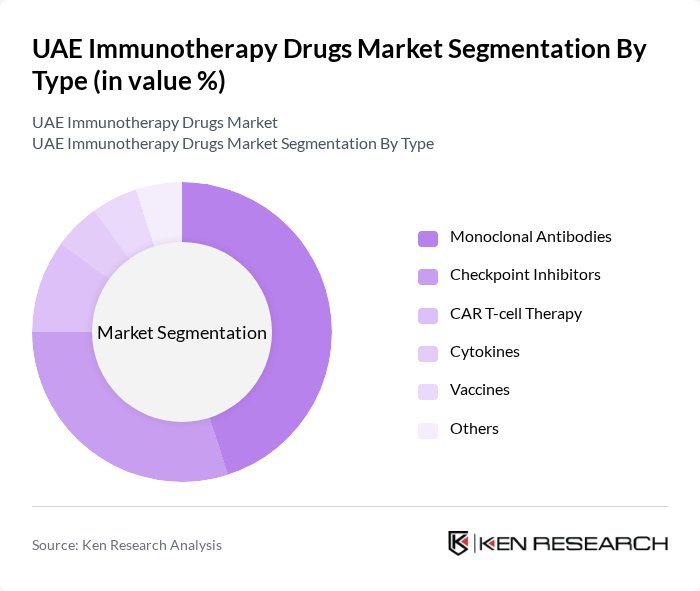

By Type:The market is segmented into various types of immunotherapy drugs, including Monoclonal Antibodies, Checkpoint Inhibitors, CAR T-cell Therapy, Cytokines, Vaccines, and Others. Among these, Monoclonal Antibodies are leading the market due to their effectiveness in targeting specific cancer cells and their widespread use in various cancer treatments. The increasing number of approvals for new monoclonal antibody therapies is also driving their dominance.

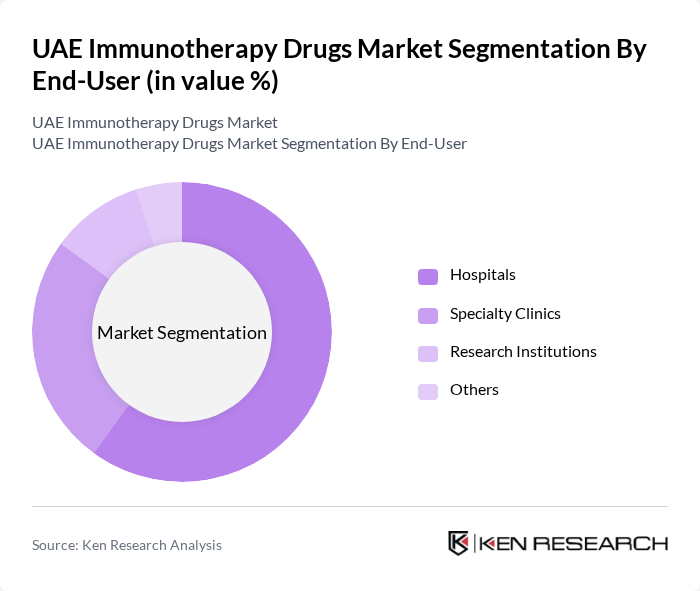

By End-User:The end-user segmentation includes Hospitals, Specialty Clinics, Research Institutions, and Others. Hospitals are the leading end-user segment, primarily due to their capacity to provide comprehensive cancer care and access to advanced treatment options. The increasing number of cancer patients seeking treatment in hospitals further solidifies their position as the dominant end-user in the immunotherapy drugs market.

The UAE Immunotherapy Drugs Market is characterized by a dynamic mix of regional and international players. Leading participants such as Roche, Merck & Co., Bristol-Myers Squibb, Novartis, AstraZeneca, Pfizer, GSK, Amgen, Eli Lilly, Sanofi, AbbVie, Takeda, Celgene, Regeneron Pharmaceuticals, Juno Therapeutics, Hikma Pharmaceuticals, Dr. Reddy’s Laboratories, Emcure Pharmaceuticals, Exelixis, Hims & Hers Health Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE immunotherapy drugs market appears promising, driven by ongoing advancements in treatment modalities and increasing public awareness. As healthcare providers continue to embrace innovative therapies, the integration of personalized medicine and combination therapies is expected to gain traction. Furthermore, the government's commitment to enhancing healthcare infrastructure will likely facilitate broader access to immunotherapy, ultimately improving patient outcomes and fostering market growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Monoclonal Antibodies Checkpoint Inhibitors CAR T-cell Therapy Cytokines Vaccines Others |

| By End-User | Hospitals Specialty Clinics Research Institutions Others |

| By Cancer Type | Lung Cancer Melanoma Breast Cancer Prostate Cancer Others |

| By Administration Route | Intravenous Subcutaneous Oral Others |

| By Distribution Channel | Hospital Pharmacies Retail Pharmacies Online Pharmacies Others |

| By Region | Abu Dhabi Dubai Sharjah Others |

| By Patient Demographics | Age Group Gender Socioeconomic Status Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oncology Clinics and Hospitals | 120 | Oncologists, Clinical Researchers |

| Pharmaceutical Companies | 90 | Product Managers, Business Development Executives |

| Patient Advocacy Groups | 60 | Patient Representatives, Healthcare Advocates |

| Health Insurance Providers | 60 | Policy Analysts, Claims Managers |

| Regulatory Bodies | 40 | Regulatory Affairs Specialists, Compliance Officers |

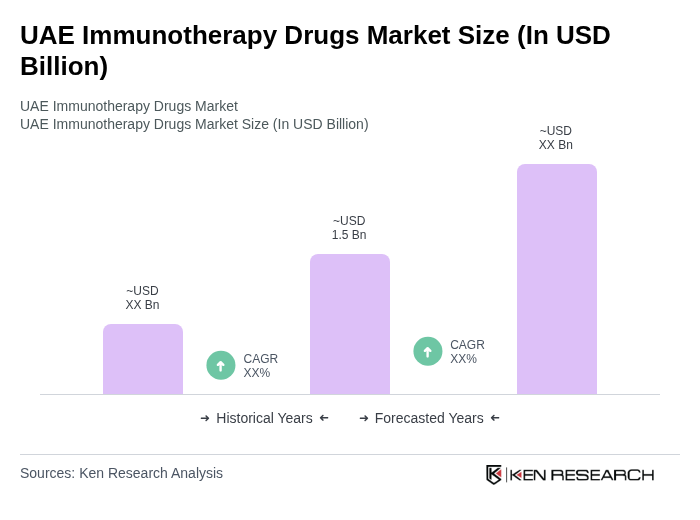

The UAE Immunotherapy Drugs Market is valued at approximately USD 1.5 billion, reflecting significant growth driven by increasing cancer prevalence, advancements in research and development, and rising healthcare expenditure.