Region:Middle East

Author(s):Shubham

Product Code:KRAC4257

Pages:89

Published On:October 2025

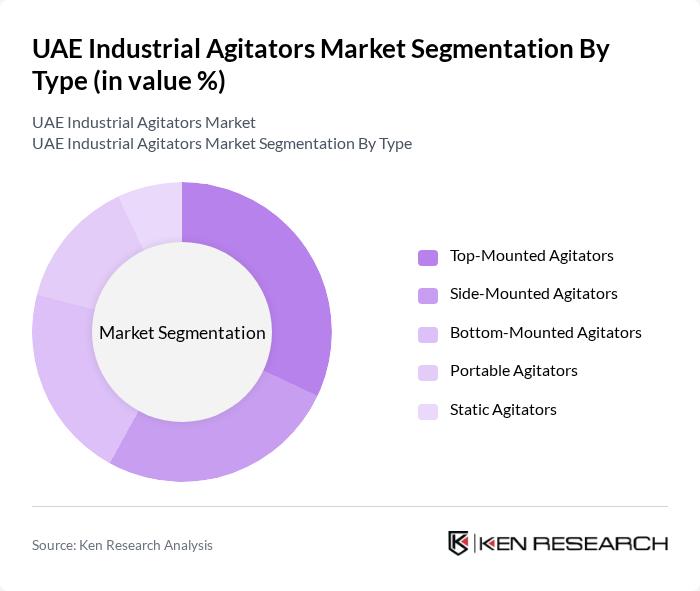

By Type:The market is segmented into various types of agitators, including Top-Mounted Agitators, Side-Mounted Agitators, Bottom-Mounted Agitators, Portable Agitators, and Static Agitators. Each type serves specific applications and industries, catering to diverse mixing and blending needs.

The Top-Mounted Agitators segment is currently leading the market due to their versatility and efficiency in various applications, particularly in the chemical and food industries. Their design allows for effective mixing in large tanks, making them ideal for high-volume production processes. The growing trend towards automation and smart manufacturing is also driving demand for these agitators, as they can be easily integrated into automated systems and equipped with digital controls for real-time monitoring and precise process management.

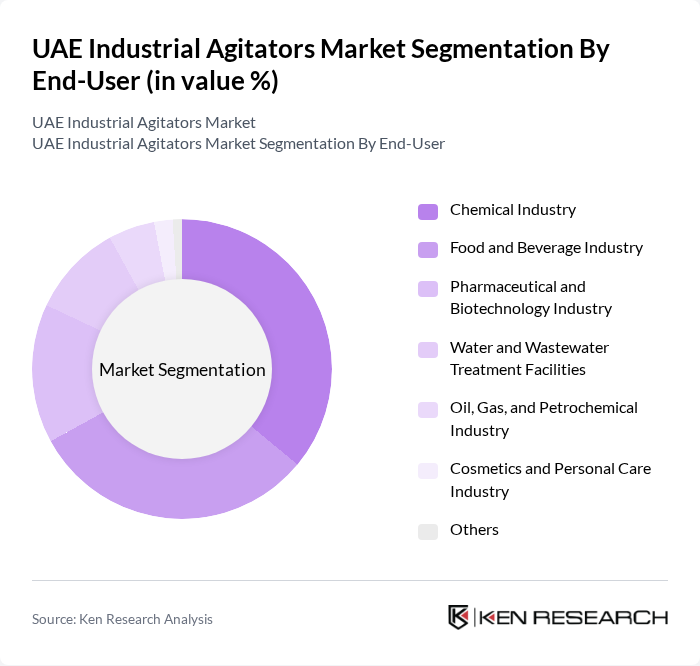

By End-User:The market is segmented based on end-users, including the Chemical Industry, Food and Beverage Industry, Pharmaceutical and Biotechnology Industry, Water and Wastewater Treatment Facilities, Oil, Gas, and Petrochemical Industry, Cosmetics and Personal Care Industry, and Others. Each end-user category has unique requirements and applications for industrial agitators.

The Chemical Industry is the leading end-user segment, driven by the need for efficient mixing processes in the production of various chemicals and the requirement for high-performance agitators to handle high-viscosity fluids. The increasing focus on process optimization and the demand for high-quality products are pushing manufacturers to invest in advanced agitation technologies. Additionally, the Food and Beverage Industry is also witnessing significant growth, as companies seek to enhance product consistency and quality through effective mixing solutions while maintaining strict hygiene compliance and food safety standards.

The UAE Industrial Agitators Market is characterized by a dynamic mix of regional and international players. Leading participants such as Alfa Laval, SPX FLOW, Sulzer Ltd., KSB SE & Co. KGaA, Xylem Inc., Schenck Process, Chemineer, GEA Group, Flottweg SE, Ebara Corporation, Ecolab Inc., Tetra Pak, Siemens AG, Emerson Electric Co., Honeywell International Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE industrial agitators market appears promising, driven by technological advancements and increasing industrial automation. As companies prioritize energy efficiency and sustainability, the demand for innovative agitators that integrate IoT capabilities is expected to rise. Additionally, the ongoing digital transformation in manufacturing will likely lead to customized solutions tailored to specific applications, enhancing operational efficiency and product quality across various sectors.

| Segment | Sub-Segments |

|---|---|

| By Type | Top-Mounted Agitators Side-Mounted Agitators Bottom-Mounted Agitators Portable Agitators Static Agitators |

| By End-User | Chemical Industry Food and Beverage Industry Pharmaceutical and Biotechnology Industry Water and Wastewater Treatment Facilities Oil, Gas, and Petrochemical Industry Cosmetics and Personal Care Industry Others |

| By Application | Mixing and Blending Emulsification Suspension Heat Transfer Homogenization Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Outlets Others |

| By Region | Abu Dhabi Dubai Sharjah Ajman Ras Al Khaimah Fujairah Umm Al Quwain Others |

| By Price Range | Low Price Mid Price High Price |

| By Technology | Conventional Agitation Advanced Agitation Technologies (e.g., Magnetic, Seal-less) Automated & Smart Agitation Systems (IoT, AI-enabled) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Chemical Processing Industry | 100 | Plant Managers, Process Engineers |

| Pharmaceutical Manufacturing | 60 | Quality Control Managers, Production Supervisors |

| Food and Beverage Sector | 50 | Operations Managers, R&D Directors |

| Oil and Gas Sector | 80 | Procurement Managers, Engineering Leads |

| Water Treatment Facilities | 40 | Facility Managers, Environmental Engineers |

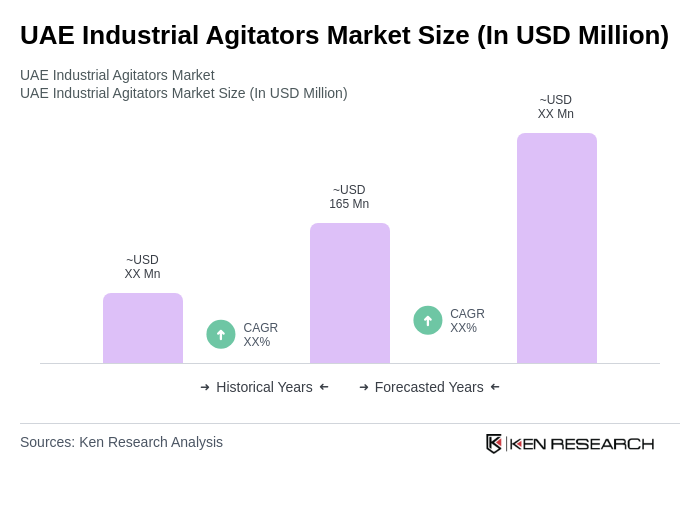

The UAE Industrial Agitators Market is valued at approximately USD 165 million, driven by rapid industrialization and the expansion of sectors such as chemicals, food and beverage, and pharmaceuticals, which require efficient mixing and blending processes.