Region:Middle East

Author(s):Rebecca

Product Code:KRAD7484

Pages:91

Published On:December 2025

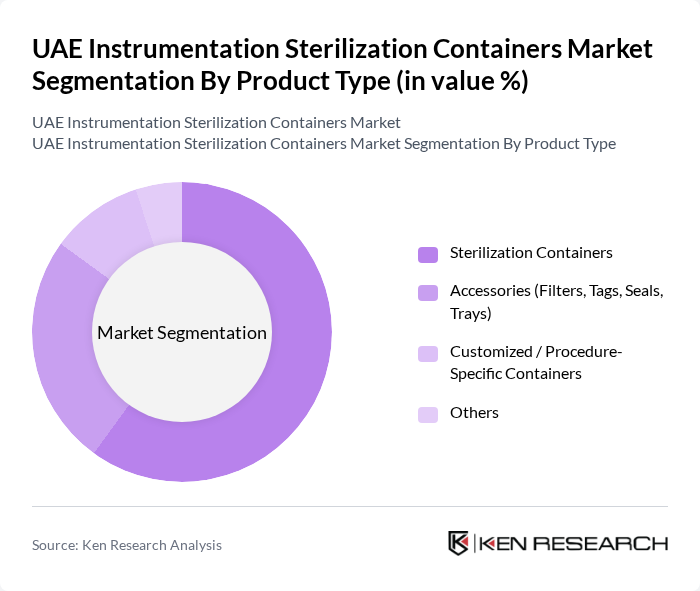

By Product Type:The product type segmentation includes various categories such as sterilization containers, accessories, customized containers, and others. Among these, sterilization containers are the most dominant segment due to their essential role in ensuring the safe storage and transportation of surgical instruments. The increasing focus on infection control and the need for reliable sterilization methods in healthcare facilities have led to a surge in demand for these containers. Accessories, including filters and seals, also play a significant role in enhancing the functionality of sterilization systems.

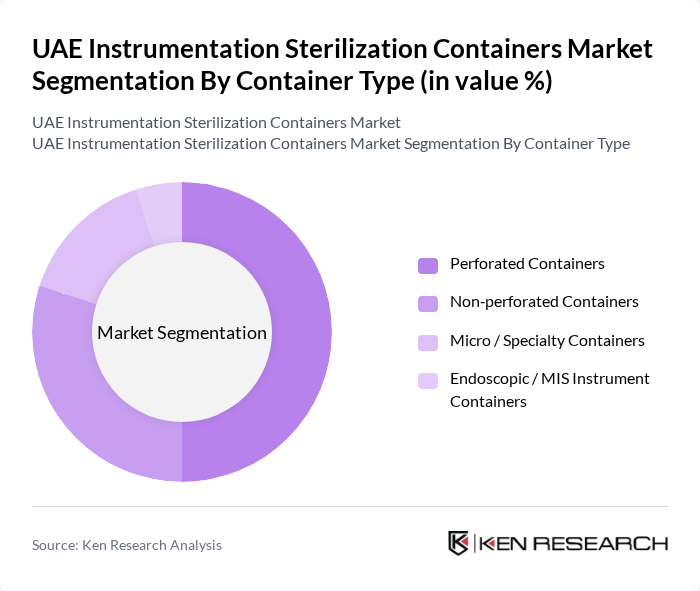

By Container Type:The container type segmentation includes perforated containers, non-perforated containers, micro/specialty containers, and endoscopic/MIS instrument containers. Perforated containers are the leading segment, favored for their ability to allow steam penetration during the sterilization process, ensuring effective sterilization of instruments. Non-perforated containers are also gaining traction due to their durability and ease of use. The demand for micro and specialty containers is rising as healthcare facilities seek tailored solutions for specific surgical instruments.

The UAE Instrumentation Sterilization Containers Market is characterized by a dynamic mix of regional and international players. Leading participants such as Aesculap AG (B. Braun Group), STERIS plc, Medline Industries, LP, Integra LifeSciences Holdings Corporation, Hu-Friedy Mfg. Co., LLC (Cantel Medical / STERIS Group), KLS Martin Group, GKE-GmbH, Case Medical, Inc., Solvay Specialty Polymers, 3M Company, B. Braun SE, Symmetry Surgical Inc. (Aspen Surgical), Tekno-Medical Optik-Chirurgie GmbH, InstruSafe by Summit Medical, Inc., Key Regional Distributors in UAE (e.g., Gulf Drug LLC, Leader Healthcare Group, Al Zahrawi Medical Supplies LLC) contribute to innovation, geographic expansion, and service delivery in this space.

The UAE Instrumentation Sterilization Containers Market is poised for significant growth, driven by increasing healthcare investments and a focus on infection control. As healthcare facilities expand, particularly in rural areas, the demand for effective sterilization solutions will rise. Additionally, the integration of smart technologies and eco-friendly practices will shape the future landscape, enhancing operational efficiency and sustainability. The market is expected to adapt to evolving healthcare needs, ensuring patient safety and compliance with stringent regulations.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Sterilization Containers Accessories (Filters, Tags, Seals, Trays) Customized / Procedure-Specific Containers Others |

| By Container Type | Perforated Containers Non?perforated Containers Micro / Specialty Containers Endoscopic / MIS Instrument Containers |

| By Material | Anodized Aluminum Stainless Steel High?temperature Polymer / Plastic Composite / Hybrid Materials |

| By Sterilization Method Compatibility | Steam / Autoclave Sterilization Low?temperature Plasma / Hydrogen Peroxide Sterilization Ethylene Oxide (EtO) Sterilization Others |

| By End?User | Public Hospitals Private Hospitals Day Surgery Centers Dental Clinics Specialty Clinics & Diagnostic / Research Laboratories Others |

| By Distribution Channel | Direct Sales to Healthcare Facilities Local Medical Device Distributors / Importers Group Purchasing Organizations (GPOs) & Tender-Based Procurement Online / E?procurement Platforms Others |

| By Emirate | Abu Dhabi Dubai Sharjah & Northern Emirates Others |

| By Regulatory & Quality Compliance | UAE Ministry of Health and Prevention (MOHAP) / Local Regulator Registration CE Marking U.S. FDA 510(k) / Approval ISO 13485 / ISO 17665 and Related Standards Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Sterilization Departments | 100 | Head of Sterilization, Infection Control Officers |

| Healthcare Equipment Manufacturers | 60 | Product Managers, Sales Directors |

| Clinical Laboratories | 50 | Laboratory Managers, Quality Assurance Officers |

| Regulatory Bodies | 40 | Policy Makers, Compliance Officers |

| Healthcare Consultants | 40 | Healthcare Analysts, Market Researchers |

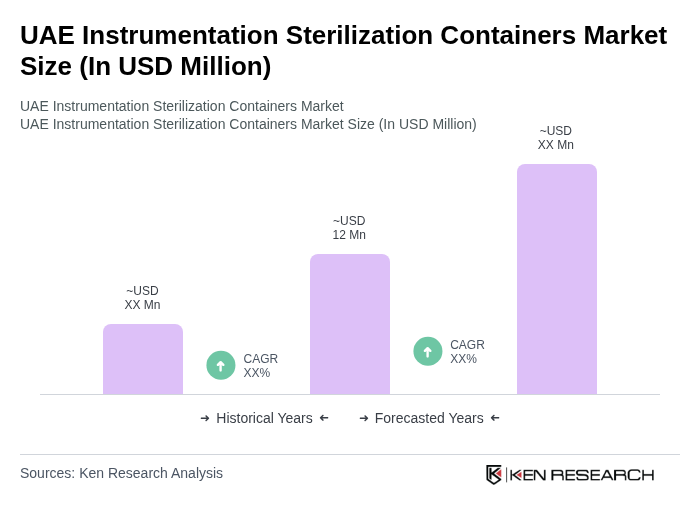

The UAE Instrumentation Sterilization Containers Market is valued at approximately USD 12 million, reflecting a growing demand for effective sterilization solutions in healthcare facilities, driven by increased awareness of infection control practices and advancements in sterilization technologies.