Region:Middle East

Author(s):Shubham

Product Code:KRAB7438

Pages:93

Published On:October 2025

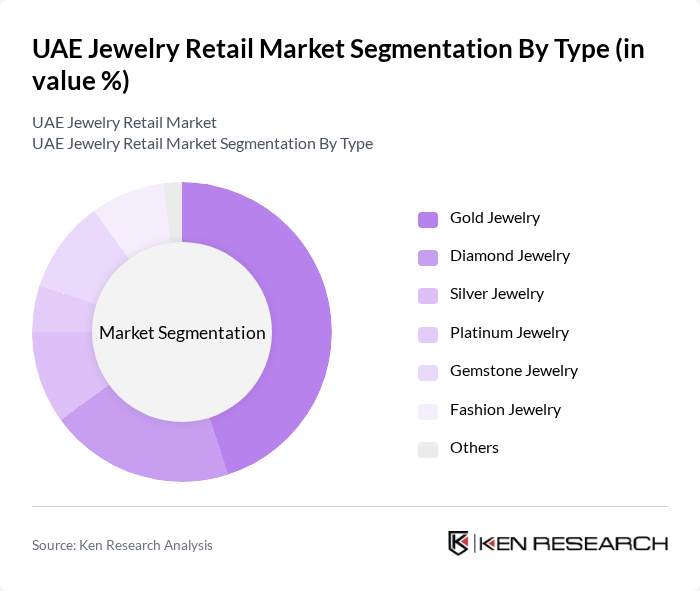

By Type:The jewelry retail market is segmented into various types, including Gold Jewelry, Diamond Jewelry, Silver Jewelry, Platinum Jewelry, Gemstone Jewelry, Fashion Jewelry, and Others. Among these, Gold Jewelry remains the most dominant segment due to its cultural significance and investment value in the UAE. The preference for gold is deeply rooted in local traditions, making it a staple for both everyday wear and special occasions. The rising trend of customization and unique designs in gold jewelry is also contributing to its sustained popularity.

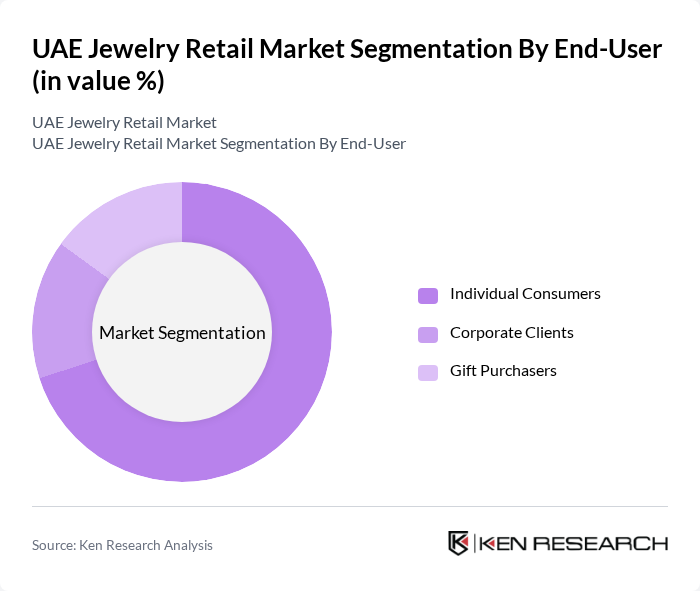

By End-User:The market is segmented by end-user into Individual Consumers, Corporate Clients, and Gift Purchasers. Individual Consumers dominate the market, driven by personal purchases for self-expression and status. The growing trend of gifting jewelry for special occasions, such as weddings and anniversaries, also contributes to the strong demand from this segment. Corporate clients, while significant, represent a smaller portion of the market, primarily focusing on bulk purchases for events and employee rewards.

The UAE Jewelry Retail Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al-Futtaim Group, Damas Jewelry, Joyalukkas, Pure Gold Jewellers, Malabar Gold & Diamonds, Tiffany & Co., Liali Jewelry, Al Zain Jewelry, Al Haramain Jewelry, Kalyan Jewellers, Rivoli Group, Sona Gold & Diamonds, Bafleh Jewelry, Areej Jewelry, Ameen Al Khatib Jewelry contribute to innovation, geographic expansion, and service delivery in this space.

The UAE jewelry retail market is poised for significant transformation, driven by evolving consumer preferences and technological advancements. As sustainability becomes a priority, retailers are expected to adopt eco-friendly practices, appealing to environmentally conscious consumers. Additionally, the integration of augmented reality in online shopping will enhance customer engagement, allowing for immersive experiences. The market will likely see a shift towards personalized jewelry, catering to individual tastes and preferences, thereby fostering brand loyalty and increasing sales opportunities in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Gold Jewelry Diamond Jewelry Silver Jewelry Platinum Jewelry Gemstone Jewelry Fashion Jewelry Others |

| By End-User | Individual Consumers Corporate Clients Gift Purchasers |

| By Sales Channel | Online Retail Brick-and-Mortar Stores Wholesale Distributors |

| By Price Range | Luxury Segment Mid-Range Segment Budget Segment |

| By Occasion | Weddings Festivals Corporate Events Everyday Wear |

| By Material | Gold Silver Platinum Other Metals |

| By Design Complexity | Simple Designs Intricate Designs Custom Designs |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Jewelry Retailers | 150 | Store Managers, Owners, and Franchise Operators |

| Consumer Insights | 200 | Jewelry Buyers, Gift Shoppers, and Online Consumers |

| Jewelry Designers | 50 | Independent Designers, Brand Founders, and Artisans |

| Wholesalers and Distributors | 80 | Wholesale Managers, Supply Chain Coordinators |

| Market Analysts and Experts | 30 | Industry Analysts, Economic Advisors, and Trend Forecasters |

The UAE Jewelry Retail Market is valued at approximately USD 10 billion, driven by increasing disposable income, a robust tourism sector, and a cultural affinity for gold and luxury items. This market reflects a steady rise in demand for both traditional and contemporary jewelry.